Crypto Triumph: A Tale of Soaring Stocks and Market Waves

Publicly traded cryptocurrency companies have witnessed an astounding surge in triple-digit percentage returns throughout 2023, basking in the green on December 4th. Bitcoin (BTC) indicators experienced a slight dip to $41,743 but quickly rebounded, reaching a dazzling new year-high of over $42,000.

Coinbase, a key player in the crypto exchange realm, gracefully concluded the day slightly above $141, flaunting a 5.5% increase and an impressive 320% surge from its humble beginnings in 2023, as per the insightful data provided by Google Finance.

In the realm of Bitcoin mining, Marathon Digital and Riot Platforms both reveled in over 8% gains, showcasing remarkable year-to-date (YTD) increases of 337% and 345%, respectively.

A visual map of the one-day price of S&P 500 stocks shows mixed results on Dec. 4 Source: Finviz

A visual map of the one-day price of S&P 500 stocks shows mixed results on Dec. 4 Source: Finviz

Turning our attention to the financial virtuosos, Galaxy Digital Holdings, the crypto investment maestro, recorded a daily gain of nearly 12% and a YTD rise of 155%. Meanwhile, MicroStrategy, boasting the grand title of holding the largest Bitcoin stash among public companies with a valuation soaring above $6.6 billion, observed a daily gain of over 6.5% and a YTD increase of 288%.

This prosperous panorama sharply contrasts with the broader North American stock market on December 4th, where a mixed bag of winners and losers unfolded. Behemoth tech stocks like Microsoft saw a modest decline of 1.43%, Apple dipped by 0.95%, Google descended by 2.02%, and Nvidia, the chip manufacturer, experienced a 2.68% drop.

Nevertheless, amid these financial ebbs and flows, crypto-related stocks find themselves anchored considerably below their all-time highs, setting the stage for potential upward trajectories.

Enter the stage left, IG Australia market analyst Tony Sycamore, attributing the surge in crypto-related stocks to Bitcoin's meteoric rise in recent months, achieving a YTD increase of nearly 152% and nearing the coveted $42,000 mark, already marking a triumphant 19-month zenith.

Sycamore, with a discerning gaze into market dynamics, articulated that investors view crypto stocks as a strategic vehicle for gaining exposure to the crypto universe, a prelude to the eagerly awaited approval of spot Bitcoin exchange-traded funds (ETFs). The ascending trajectory of Bitcoin's price becomes a catalyst, generating a ripple effect of excitement, propelling trading volumes, and encouraging widespread participation in the crypto ecosystem.

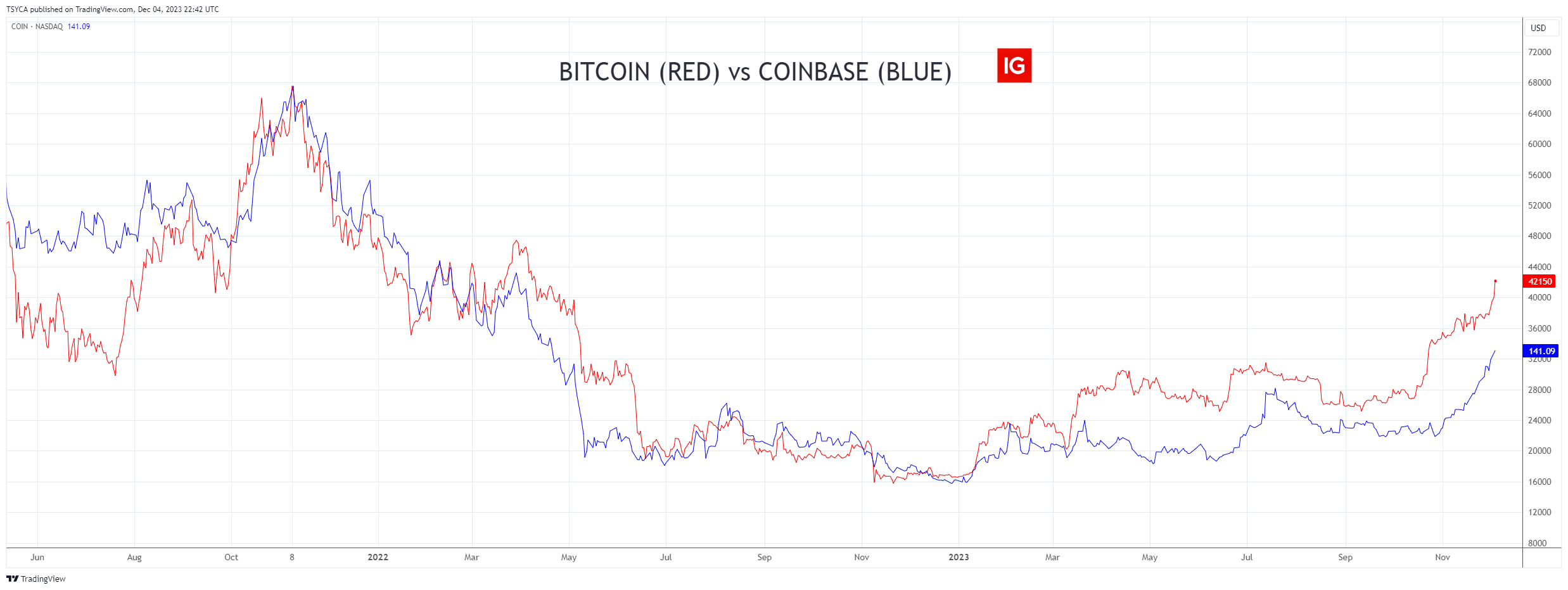

A chart showing the price correlation between Bitcoin (red) and Coinbase (blue) since June 2022. Source: IG

A chart showing the price correlation between Bitcoin (red) and Coinbase (blue) since June 2022. Source: IG

Zooming out to the broader picture, Sycamore painted a canvas of factors fortifying Bitcoin's position. These include the optimistic anticipation surrounding spot ETF approvals, the prospect of U.S. Federal Reserve rate cuts in the coming year, and the eagerly awaited Bitcoin halving scheduled for April.

In a harmonious chorus of insights, Jon de Wet, the investment chief of the crypto platform Zerocap, chimed in, expressing that potential ETF approvals and the impending halving inject a potent dose of momentum into the cauldron of the crypto space. De Wet, joined by the analytical prowess of CMC Markets analyst Tina Teng, emphasized the role of crypto stocks as "exchange-listed proxies," providing investors with a sophisticated ballet of indirect exposure to the market. Teng highlighted the lingering influence of pending spot ETFs as a "micro-bullish factor," gently guiding Bitcoin's rally since August.

De Wet underscored the ETF's pivotal role as a driving force in market sentiment, offering a glimpse into the maturation of the cryptocurrency market. Participants, he noted, are gradually recognizing the intrinsic value nestled within scarce assets.

As the narrative unfolds, Sycamore foresaw the current wave of excitement acting as a siren's call, beckoning a new cohort of crypto investors to the scene. This heightened interest, coupled with the inevitable dance of volatility and amplified volume, promises a crescendo of earnings and profits for crypto exchanges and their kindred businesses.

You might also like: Riot's Hash Rate Surge: Bitcoin's Dynamic Growth Unveiled

Trending

Press Releases

Deep Dives