- Home

- Cryptocurrency

- Coinbase and MicroStrategy Soar Amidst Bitcoin's Rally: Market Reactions and Momentum Boosts

Coinbase and MicroStrategy Soar Amidst Bitcoin's Rally: Market Reactions and Momentum Boosts

Bitcoin, overcoming challenges and regulatory scrutiny, has surged to levels unseen since April 2022, boasting an impressive year-to-date gain of over 150% and briefly touching the $42,000 mark. This upward momentum has reverberated in the stock performance of Coinbase (COIN) and MicroStrategy (MSTR), both witnessing a more than 4% increase on Monday.

Regarded as indicative plays for the cryptocurrency markets, these companies closely correlate with the largest cryptocurrency by market capitalization. Coinbase, a prominent figure in crypto exchanges with a commitment to regulation, stands out as one of the few publicly traded crypto firms in the United States. Its shares on Nasdaq experienced a 4.34% rise, reaching $139.45, marking their highest point since April 2022. Notably, the company is recognized for its regulatory stance and serves as a custodian for several proposed bitcoin spot exchange-traded fund (ETF) products in the U.S.

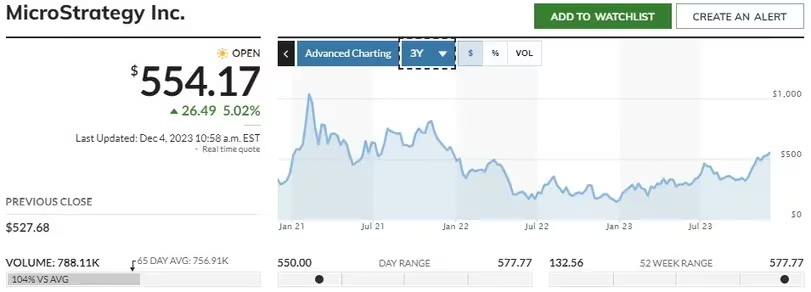

MicroStrategy, a business software company, holds the distinction of being the largest public holder of bitcoin, accumulating 174,000 BTC over three years through corporate fund investments and bond sales. The current valuation of these holdings accounts for over 88% of MicroStrategy’s $8.2 billion market capitalization. MSTR shares traded at $554.17, reflecting a 5% increase and reaching a level last observed in April 2022.

MicroStrategy's (MSTR) Stock Performance on December 5, 2023: A MarketWatch Overview

MicroStrategy's (MSTR) Stock Performance on December 5, 2023: A MarketWatch Overview

Bitcoin's recent surge is underpinned by optimism surrounding the potential approval of exchange-traded funds (ETFs) holding BTC by U.S. regulators. Analysts foresee this development as a catalyst for a substantial influx of investments into the leading cryptocurrency.

Positive market dynamics also extended to other participants in the crypto sphere. Marathon Digital (MARA) observed a 5% gain, Riot Platforms (RIOT) witnessed a 6.7% increase, and Hut 8 (HUT), post-merger with U.S. Data Mining Group, recorded an impressive 380% surge. However, it's crucial to acknowledge that Hut 8's substantial leap is linked to stock consolidation resulting from the merger. Adjusting for the 5:1 ratio, the shares exhibit a decline of around 11%.

Read More: NFT Market Struggles to Keep Pace with Ether's Soaring Success

Trending

Press Releases

Deep Dives