NFT Market Struggles to Keep Pace with Ether's Soaring Success

In the dynamic landscape of the cryptocurrency market, a noticeable contrast has emerged between the remarkable success of Ether and the sluggish performance of Non-Fungible Tokens (NFTs). Despite Ether's impressive 70% surge year-to-date, NFT indexes are facing challenges, experiencing a 16% decline in dollar terms and a substantial 50% decrease when denominated in Ether.

While the broader cryptocurrency sphere has enjoyed gains surpassing 10% since the beginning of the year, NFT prices have failed to keep pace. Analysts and industry stakeholders are emphasizing the imperative need for utility and technological advancements to revitalize growth within the NFT sector.

As the cryptocurrency market approaches potential bull-market territory, NFTs, renowned for their association with innovative digital assets, appear to have missed the prevailing wave of market euphoria. The Nansen's NFT-500 index, which assesses the valuation of the top 500 NFTs, has observed a significant 50% decline when denominated in Ether and a 16% decrease in dollar terms.

Source: Nansen.ai

Source: Nansen.ai

The Blue-Chip 10 index, concentrating on prominent NFTs like CryptoPunks and the Bored Ape Yacht Club, reflects a notable decline of 44% in Ether terms and a marginal 1.7% in dollars.

Source: Nansen.ai

Source: Nansen.ai

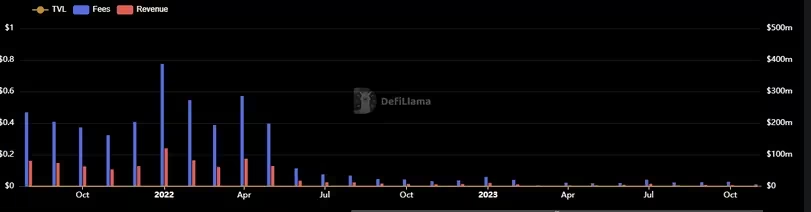

Even OpenSea, the leading NFT marketplace, has not evaded the market downturn. In January 2022, during the peak of NFT mania, the platform generated monthly fees and revenue of $387.48 million and $120.45 million, according to data from DeFiLlama. However, it now faces a considerable decline, with fees plummeting to $6 million and revenue to $1.39 million.

Source: DeFiLlama

Source: DeFiLlama

Nick Ruck, COO of ContentFi, highlights that NFTs are yet to find a technological catalyst similar to DeFi's Uniswap's AMM, which catalyzed the decentralized finance sector. Despite ongoing efforts to expand NFT use cases, their prices appear to be closely linked to the USD value of Ether, contributing to the current challenges.

Nevertheless, signs of optimism emerge with a burgeoning trend towards utility-based NFTs, moving away from traditional speculative monkey JPEGs. The application of NFT technology in areas such as ticketing and loyalty programs suggests a potential avenue for growth.

Bitcoin ordinals, gaining popularity, are considered a breakthrough for Bitcoin utility, fostering collaboration among diverse communities. Jason Fang from Sora Ventures attributes their success to being a hub for the development of a layer-2 for the Bitcoin blockchain, bringing different communities together.

David Mirzadeh, Ecosystem Finance Lead of Taiko, anticipates a resurgence for NFTs as they evolve from speculative JPEGs to assets with utility in games, music, and social contexts. Until then, the performance of NFT prices is expected to rely on speculative hype and mania, prompting the cryptocurrency community to closely monitor any signs of a transformative shift in the NFT landscape.

Read More: Near Foundation Partners with Polygon Labs for Innovative ZK Solution

Trending

Press Releases

Deep Dives