Crypto Surge: Robinhood's Adaptive Odyssey

The Robinhood trading platform, celebrated for its crypto-friendly approach, has disclosed a remarkable surge of 75% in the trading volume of digital assets from October to November, marking a pivotal moment for the platform. This noteworthy development was meticulously highlighted in a Form 8-K submission to the United States Securities and Exchange Commission (SEC) on December 4, where the document explicitly pointed out that the "November Crypto Notional Trading Volumes were approximately 75% higher than those recorded in October 2023."

In the ever-evolving landscape of digital finance, this surge in trading activity stands out as a testament to Robinhood's adaptability and responsiveness to market dynamics. The platform, often seen as a barometer for retail investor sentiment, has navigated the turbulent waters of the crypto market, seizing opportunities and recalibrating its strategies in response to the ebb and flow of market trends.

Interestingly, this heightened activity did not extend its reach to equity and options contract trading volumes, maintaining a sense of equilibrium and emphasizing the unique dynamics of the market during this period. The interplay of various asset classes adds a layer of complexity to Robinhood's performance, inviting analysts and enthusiasts alike to decipher the intricate dance of financial instruments on the platform.

This robust performance in November represents a substantial turnaround for Robinhood, especially considering its Q3 results, where the platform reported a significant 55% decrease in cryptocurrency notional volumes over the year. The Q3 revenue shortfall and the subsequent reevaluation of strategies serve as a reminder of the ever-shifting landscape of digital assets, where adaptability is key to sustained success.

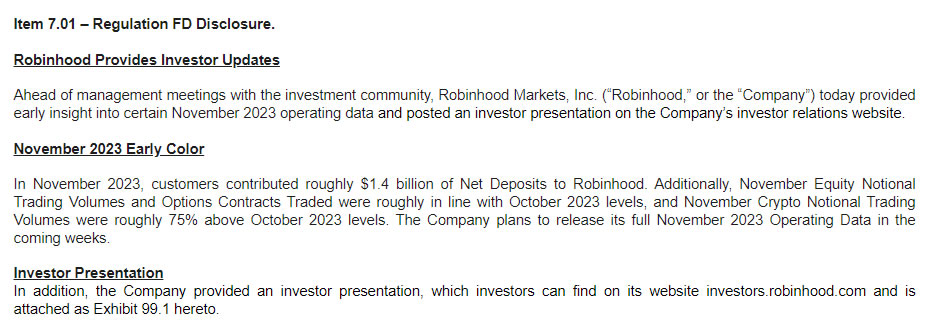

Robinhood’s 8-K report showing preliminary operating data for November 2023. Source: SEC

Robinhood’s 8-K report showing preliminary operating data for November 2023. Source: SEC

Looking ahead, Robinhood appears poised for a potentially lucrative fourth quarter, fueled by the recent rally in the crypto market, which has witnessed a remarkable 40% increase in total capitalization, reaching $1.6 trillion in the past two months. The euphoria surrounding this surge is palpable, and investors are closely watching Robinhood's trajectory as it navigates the volatile waters of the crypto market. This heightened interest adds an element of anticipation to the platform's performance, with stakeholders eagerly awaiting the next chapter in Robinhood's journey.

During a November earnings call, Vlad Tenev, the co-founder, and CEO of Robinhood, expressed a sense of optimism, hinting at the platform's potential to generate "nine figures" in annual revenue. This optimistic outlook, coupled with Tenev's insights on retail investors' renewed interest in the crypto space, further fuels the narrative of Robinhood as a dynamic player in the financial landscape. Tenev's commentary provides a glimpse into the intersection of market dynamics and investor psychology, shaping the narrative around Robinhood's performance.

Despite a challenging period since mid-July, where Robinhood stock experienced a decline after reaching a 2023 peak of just over $13, there has been an 18% increase in stock prices since the beginning of the year. This price trajectory adds an element of unpredictability to the narrative, with investors navigating the metaphorical waves of market fluctuations. The stock's performance serves as a reflection of broader market trends, contributing to the ongoing dialogue about the intersection of traditional and digital finance.

As of the latest update, Robinhood stock was trading at $9.95 in after-hours trading, reflecting a 2.5% daily gain. The after-hours trading scene, often a realm of heightened anticipation, introduces an additional layer of complexity to the stock's journey, adding an element of intrigue for market observers. The after-hours dynamics offer a glimpse into the market sentiment beyond regular trading hours, where nuances and rapid movements shape the narrative in real-time.

Looking ahead, in addition to launching equities in the United Kingdom markets, Robinhood has outlined ambitious plans to introduce futures trading in 2024, pending regulatory approval. This forward-looking approach injects a sense of anticipation into the market, with stakeholders eagerly awaiting regulatory developments that could shape the platform's future trajectory. The regulatory landscape, a sea of complexities, introduces an element of uncertainty, contributing to the ongoing saga of Robinhood's evolution.

It's worth noting that in August, Robinhood had amassed 118,000 BTC valued at around $3 billion at that time. This significant crypto accumulation, at the intersection of traditional finance and the crypto realm, underscores the platform's multifaceted presence in the ever-evolving financial landscape. The strategic accumulation of digital assets adds a layer of intrigue, sparking discussions about the role of crypto in traditional investment portfolios and the potential implications for the broader financial ecosystem.

Read more: Crypto Ballet: Harmonizing the ETF Cosmos

Trending

Press Releases

Deep Dives