Riot's Hash Rate Surge: Bitcoin's Dynamic Growth Unveiled

Bitcoin (BTC) experiences a fluctuation in value, recently ticking down to $41,663. In a strategic move signaling anticipation of the upcoming Bitcoin halving in April 2024, Riot Platforms, a prominent mining entity, embarks on an ambitious expansion plan. This involves the acquisition of a staggering 66,560 mining rigs from the reputable manufacturer MicroBT, amounting to a substantial $290.5 million investment. Noteworthy is the average cost per machine, standing at $4,360, as disclosed in Riot's statement on Dec. 4.

$Riot Exercises Purchase Option on 18 EH/s of Latest Generation Immersion Miners from MicroBT, and Secures Additional Purchase Options Providing a Path to Exceed 100 EH/s.

— Riot Platforms, Inc. (@RiotPlatforms) December 4, 2023

- Riot places order for 18 EH/s of latest generation MicroBT Bitcoin miners, primarily consisting of the… pic.twitter.com/tEEudV6Z8n

Adding a layer of complexity to this deal, the right-to-purchase option, initially woven into Riot's agreement with MicroBT during the acquisition of 33,280 machines in June, has undergone a transformative update. This revision grants Riot the strategic option to procure an additional 265,000 miners from MicroBT, all under the same favorable terms as the latest order. Jason Les, the forward-thinking CEO of Riot, emphasizes the magnitude of this purchase order, hailing it as "the largest order of hash rate" in the company's illustrious history. His optimism is grounded in the belief that this updated agreement will fortify Riot's mining performance in the ever-evolving cryptocurrency landscape.

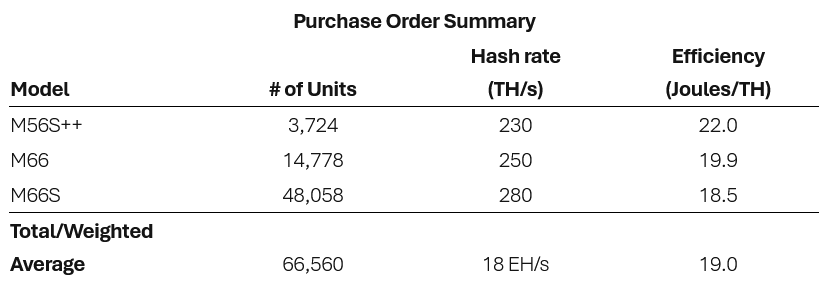

Diving into the technicalities, a noteworthy 72% of the acquired machines will be MicroBT's latest model, the M66S, boasting an impressive hash rate of 250 terahashes per second (TH/s). Complementing these, the remaining machines include the M66 (14,770) and M56S++ (3,720) models. Cumulatively, this fleet of 66,560 miners is projected to inject an additional 18 exahashes per second (EH/s) into Riot's mining operations.

Purchase summary of Riot’s latest deal with MicroBT. Source: Riot Platforms

Purchase summary of Riot’s latest deal with MicroBT. Source: Riot Platforms

Looking ahead, Riot discloses deployment timelines: the initial batch of 33,280 miners from June is set to commence operations in the first quarter of 2024, while the latest cohort of 66,560 miners is slated for deployment in the second half of 2024. In a forward-looking estimate, Riot envisions its self-mining hash rate capacity reaching an impressive 38 EH/s by the second half of 2025, once the full fleet of 99,840 rigs is seamlessly integrated and operational.

The surge in these strategic acquisitions is intricately linked to the imminent Bitcoin halving event scheduled for April 2024. Market observers note a commendable uptick in Riot's stock, with a nearly 9% increase on Dec. 4 alone, marking an outstanding 345% growth throughout the dynamic year of 2023.

Bitcoin miners boost output as Hut 8 Corp commences trading

Shifting focus to the broader Bitcoin mining landscape, CleanSpark, another notable player, showcases an uptrend in production. Having produced 666 BTC in November, a notable 5.2% increase from October, CleanSpark's CEO, Zach Bradford, attributes this surge to a substantial rise in production fees.

In November, $CLSK achieved our second-highest monthly #bitcoin production despite increased difficulty and without using more energy.

— CleanSpark Inc. (@CleanSpark_Inc) December 1, 2023

*Monthly production: 666 (24% increase over same period last year)

*Total #BTC holdings: 2,575

*Month-end fleet #efficiency: 26.4 J/TH

*Daily… pic.twitter.com/i65AY2pskk

Bradford speculates that this trend indicates the potential for fees to become a more significant revenue source as Bitcoin's use cases proliferate and adoption continues to expand. Simultaneously, Nasdaq-listed TeraWulf reports a production increase of 3%, mining 323 BTC in November, primarily driven by higher network transaction fees, though the impact of Ordinals remains unmentioned.

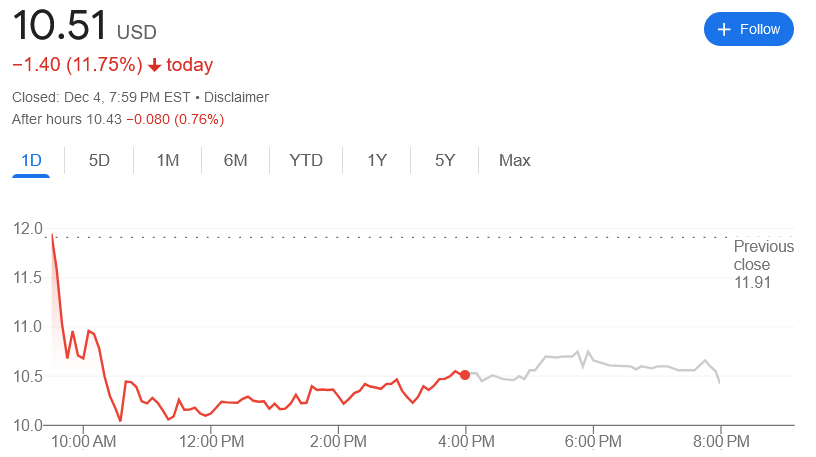

In a noteworthy industry development, Hut 8 Corp finalizes its merger with the United States-based mining firm Bitcoin Corp on Nov. 30, forming the newly traded entity, Hut 8 Corp. Despite facing initial challenges with an 11.75% and 7.44% fall on its debut, as reported by Google Finance, Hut 8 Corp is poised for further developments on both the Nasdaq and the Toronto Stock Exchange. The market will keenly watch as this newly formed entity navigates the dynamic landscape of cryptocurrency trading and mining.

Change in Hut’s share price on the Nasdaq on Dec. 4. Source: Google Finance

Change in Hut’s share price on the Nasdaq on Dec. 4. Source: Google Finance

You might also like: Crypto Surge: Robinhood's Adaptive Odyssey

Trending

Press Releases

Deep Dives