Resilience: Bitcoin's 70% Surge Post FTX Debacle and the Lingering 'Alameda Gap

Roughly a year in the past, the realm of digital currencies experienced a notable and turbulent shift as the FTX conglomerate and its associated entity, Alameda Research, confronted a swift and sensational decline, giving rise to what is now identified as the "Alameda gap." The consequences of this occurrence persistently resonate throughout the cryptocurrency sphere, leading to a decrease in available funds and a contraction in market scope, ultimately impacting the market's capability to manage substantial orders without triggering notable fluctuations in pricing.

FTX, previously acclaimed as the third-largest cryptocurrency exchange on a global scale, and Alameda Research, a prominent player in market facilitation within the crypto sector, held pivotal roles during this chaotic stretch. The catalyst for this turbulent sequence of events stemmed from an investigative exposé published by Bitsday. This exposé divulged pivotal information, setting off a chain of reactions that ultimately culminated in the downfall of these entities. Concurrently, Bitcoin (BTC), the predominant cryptocurrency in terms of market capitalization, plummeted to its lowest point within the same timeframe. Nevertheless, it subsequently staged an impressive recovery, surging by 70% and attaining a value of $34,300.

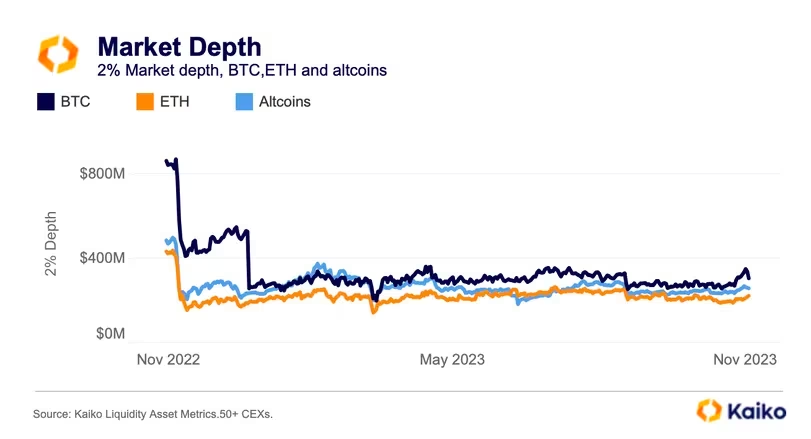

Despite the resurgence in Bitcoin's valuation, the residual effects of the FTX and Alameda collapse persist, manifesting through a discernible decrease in financial assets and market breadth. The collective financial reserve for Bitcoin, Ether (ETH), and the leading 30 alternative cryptocurrencies based on market capitalization presently tallies up to $800 million, marking a 55% drop compared to the corresponding period a year prior. To offer some perspective, a mere year ago, it necessitated an order of no less than $1.8 billion to sway pricing by 2% in either direction. Currently, an order amounting to $800 million holds adequate influence to exert a substantial impact on pricing.

This reduction in financial reserves, as denoted by Kaiko under the moniker of the Alameda Gap, carries significant consequences for traders. It results in elevated slippage expenses, signifying the disparity between the anticipated cost of a transaction and the actual expenses incurred during execution. Anemic financial reserves also entail that a select number of considerable orders can disproportionately affect pricing, potentially magnifying the levels of price volatility. The market's 2% depth continues to grapple with the aftermath of the collapse witnessed a year ago, following the downfall of FTX and Alameda Research. This impact is a persistent challenge, as noted by Kaiko.

The market's 2% depth continues to grapple with the aftermath of the collapse witnessed a year ago, following the downfall of FTX and Alameda Research. This impact is a persistent challenge, as noted by Kaiko.

The repercussions of the Alameda Gap are particularly pronounced for Ether and alternative cryptocurrencies. Preceding the collapse, Alameda furnished a substantial financial reserve for Bitcoin, Ether, and various alternative cryptocurrencies, amassing a total valuation in the billions. FTX, identified as the third-largest perpetual futures exchange in terms of open interest and trading volumes, played a pivotal role in upholding market stability.

Despite Bitcoin showcasing some signs of improvement in financial reserves, surging from $250 million in the third quarter to $350 million in October, this progress has not extended to the enhanced financial liquidity conditions for Ether and alternative cryptocurrencies. The cryptocurrency sector remains entangled in grappling with the aftermath of the FTX and Alameda downturn, particularly in terms of its ability to absorb substantial orders without incurring significant pricing swings.

Read More: Financial Fusion: Tether's Strategic Surge in Bitcoin Mining

Trending

Press Releases

Deep Dives