Intelligent Capital: Anticipated Bitcoin ETF Drives Unprecedented Long Positions

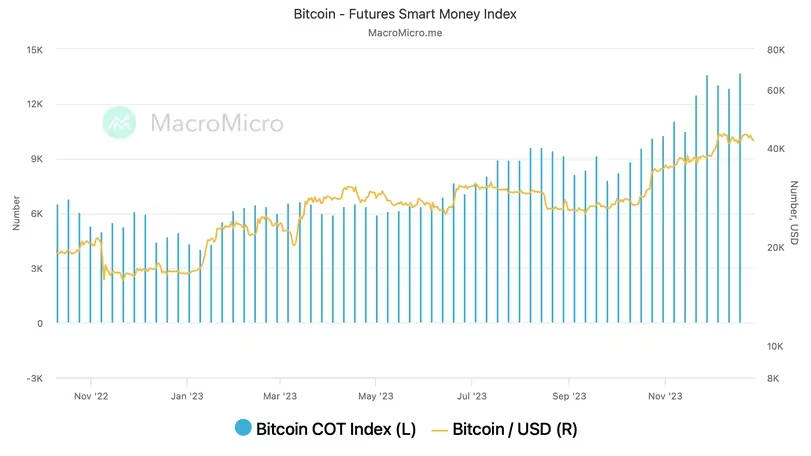

In recent developments on the Chicago Mercantile Exchange (CME), institutional investors and well-informed market participants are showcasing a remarkable surge in optimism, reaching an unprecedented pinnacle, as disclosed by data tracking from MacroMicro. The smart money index for bitcoin futures on MacroMicro's platform experienced an extraordinary ascent to an all-time high of 13,711 last week.

This upswing in bullish sentiment is strategically timed, coinciding with the impending decision by the U.S. Securities and Exchange Commission (SEC) regarding spot ETF applications. The heightened anticipation surrounding the ETF launch has prompted some industry observers to speculate on the likelihood of a conventional "sell the news" market response.

In preparation for the SEC's imminent decision on a spot BTC exchange-traded fund (ETF), significant capital investments from institutional players and astute market participants are finding their way into bitcoin (BTC). MacroMicro's bitcoin futures smart money index, meticulously analyzing the spread between long and short positions of major investors on the CME, communicates this trend. The index, extracted from the weekly Commitment of Traders report by the Commodity Futures Trading Commission (CFTC), saw an extraordinary climb to 13,711 last week, surpassing the previous peak of 13,603. This surge signals a historic level of bullish positioning by asset managers and other influential market players.

Considered a key gauge for institutional activity, CME's cash-settled standard bitcoin futures contracts, each representing 5 BTC, provide market participants with a regulated avenue to gain exposure to the cryptocurrency without direct ownership. In the realm of derivative contracts, futures necessitate a commitment from the buyer to acquire an asset and from the seller to sell an asset at a predetermined price on a future date. Opting for a long position implies a commitment to buy the underlying asset, indicating a bullish outlook, while going short suggests the opposite.

Breaking Records: MacroMicro's Smart Money Index Reaches Unprecedented Highs

Breaking Records: MacroMicro's Smart Money Index Reaches Unprecedented Highs

The smart money index has witnessed a substantial upturn this quarter, propelled by the narrative surrounding the spot ETF and the escalating expectations of a Federal Reserve rate cut in 2024. The U.S. SEC has reportedly set a January 10 deadline to decide on the approval or rejection of an ETF directly investing in bitcoin rather than BTC futures. Analysts are foreseeing a potential influx of capital into the asset class if one or more spot ETFs are given the green light.

This optimistic outlook has catapulted bitcoin's value by nearly 60% this quarter, setting the stage for a possible "sell the news" scenario post-ETF launch. The market insights team at QCP Capital in Singapore underscores that as the launch date draws near, the actual demand for the BTC Spot ETF may initially fall short of market expectations. This situation lays the groundwork for a classic 'sell the news' dynamic in the second week of January. QCP anticipates resistance in the $45,000-$48,500 range for BTC, with a potential retracement to $36,000 levels before the resumption of the bullish trend, emphasizing that the upward momentum is likely to intensify in anticipation of April's mining reward halving.

Read More: Regulatory Ambiguity Surrounds Former FTX Unit LedgerX's Customer Funds: CFTC Commissioner

Trending

Press Releases

Deep Dives