Crypto Odyssey: A $4.3 Billion Settlement Saga

On the turbulent seas of cryptocurrency markets, a storm surged on November 21, unleashing considerable waves of volatility. This tempest was triggered by a momentous event: a collaborative announcement from the United States Department of Justice (DOJ), Commodity Futures Trading Commission (CFTC), and U.S. Treasury. In a grand narrative, they unveiled a colossal $4.3 billion settlement with Binance. Adding a dramatic twist to the plot, the former helmsman of Binance, Changpeng Zhao (CZ), found himself in the role of a protagonist pleading guilty to a single felony charge. This settlement, a fusion of legal sagas, sought to bring closure to the criminal and civil cases entwined with the cryptocurrency exchange.

The orchestration of this legal symphony reached a crescendo when the maestro, United States Attorney General Merrick Garland, disclosed the $4.3 billion resolution. In a somber tone, he emphasized CZ's guilty plea for willfully transgressing the Bank Secrecy Act. As the legal drama unfolded, Garland highlighted the operatic requirement for Binance to compose and submit suspicious activity reports, turning the exchange into a vigilant informant. This, he declared, was essential to advancing the criminal investigations delving into the realms of malicious cyber activity and terrorism fundraising, with a particular focus on the intricate dance of cryptocurrency exchanges supporting groups like Hamas.

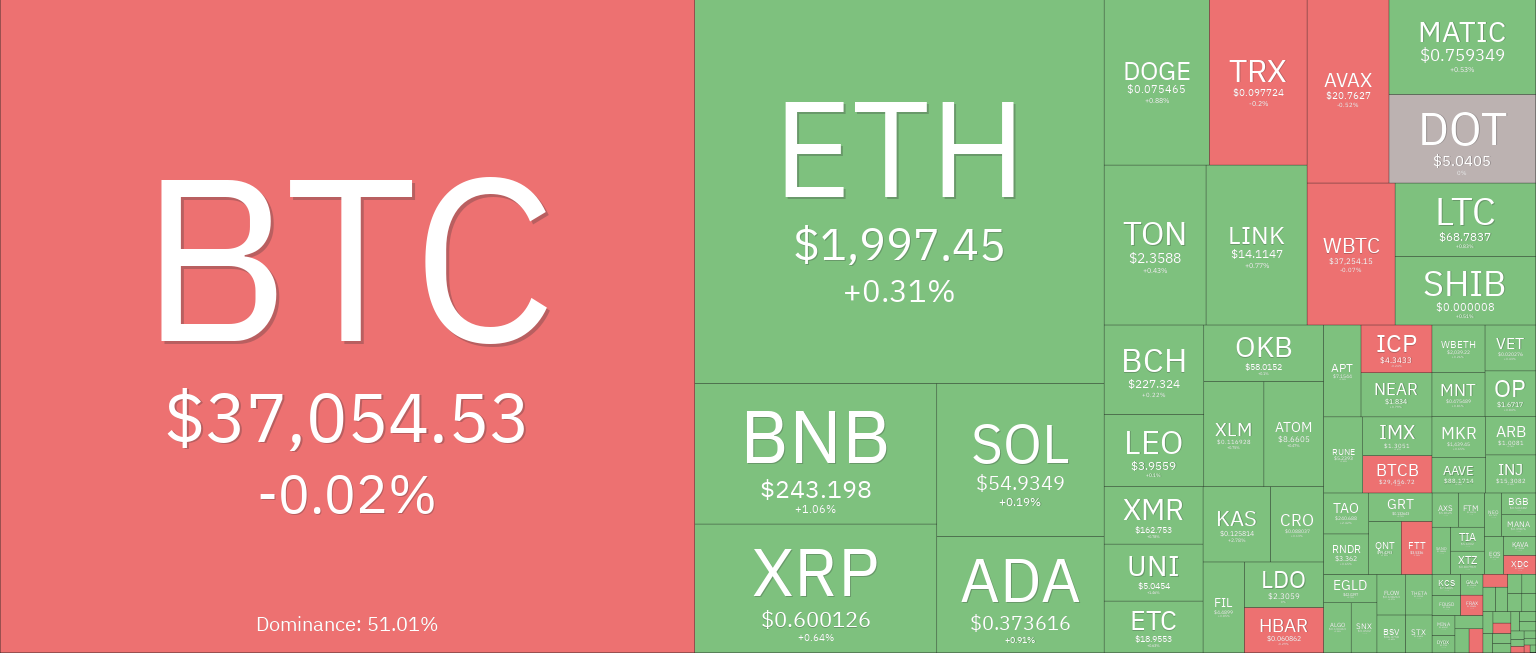

While the tale unfolded, the crypto market, devoid of the traditional opening bell like Wall Street, experienced a choreography of price movements. Bitcoin (BTC), the lead actor in this performance, grappled with a 1.79% loss, trading near $36,700, as altcoins pirouetted in a delicate recovery from their earlier intraday losses.

Crypto market prices 1-hour timeframe. Source: Coin360

Crypto market prices 1-hour timeframe. Source: Coin360

The market's undulating price actions seemed to mirror the participants' attempts to digest the intricacies of the November 21 U.S. enforcement action against the cryptocurrency industry. Like a ship navigating through tumultuous waters, market players and traders were well aware of the impending storm. Prices had already set sail on a course of reaction before the grand announcement by Garland. Binance Coin (BNB), a key character in this unfolding drama, embarked on a journey to a 5-month high, only to navigate back, retracing the majority of its gains, all before the curtain rose on Garland's press conference.

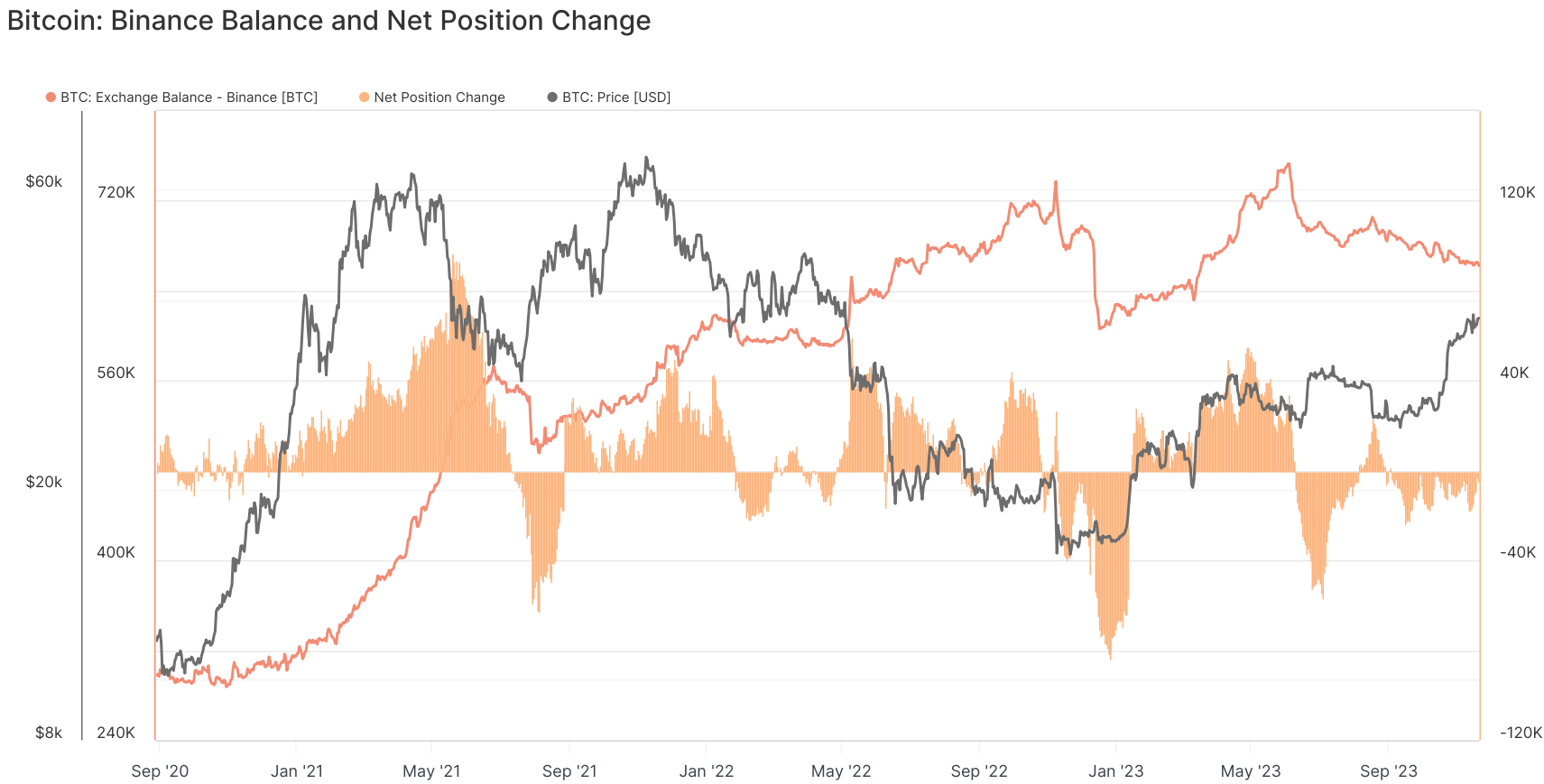

Despite the stormy clouds looming over Binance, its users exhibited an intriguing reluctance to abandon ship or flee from the shores of centralized exchanges. In this sea of uncertainty, Glassnode served as a lighthouse, revealing that the net change in Bitcoin positions on Binance was a mere ripple compared to the roaring waves witnessed in January and July.

Binance Bitcoin net flow. Source: Glassnode

Binance Bitcoin net flow. Source: Glassnode

Contrary to the ominous tones of negative news, the crypto community stood as a resilient chorus, cheering on the decision as the closing notes of a tumultuous chapter.

Hope, like a gentle breeze, wafted through the community, fostering the belief that the entire industry could set sail into calmer waters.

Binance derisking is one of the biggest catalysts we could have in crypto.

— Ryan Selkis (d/acc)???? (@twobitidiot) November 21, 2023

+ Crypto is a "real" industry post $4 billion settlement

+ CZ takes a long-needed Miami vacation a la Arthur

+ Market rips higher, ETFs approved in Jan

+ GOP wins 2024 election, crypto laws passed

???? CZ

Binance, now under the stewardship of Richard Teng, the newly anointed captain post-CZ's resignation, echoed this sentiment. Their words, like a ship's horn in the distance, resonated with the collective resolve to navigate the unpredictable seas of the crypto world.

We’re pleased to share we’ve reached resolution with several US agencies related to their investigations.

— Binance (@binance) November 21, 2023

This allows us to turn the page on a challenging yet transformative chapter of learning that has helped us become stronger, safer, and an even more secure platform.

You might also like: Crypto Crossroads: Navigating the ETF Seas

Trending

Press Releases

Deep Dives