The Enigma Behind Bitcoin's Recent Price Surge: Exploring the Elusiveness of Famed Bull-Market Pullbacks

The ongoing bullish trend in Bitcoin (BTC) is primarily influenced by spot trading, marking a significant deviation from previous market upswings. Analysts note that major derivatives data has shown little fluctuation, and the current surge seems to have minimal downside. This surge, led by spot trading, is characterized by a distinctive pattern of incremental price increases followed by periods of horizontal consolidation.

In contrast to earlier rallies, particularly the one in late 2020 to early 2021, where frequent pullbacks of 20% or more were common, the present market experiences infrequent pullbacks. The scarcity of substantial downturns is attributed to spot market buyers taking the forefront in propelling the bull market. Observers stress that the bull market is robust, with limited downside, indicating an enduring sentiment.

BTC's Unprecedented Bull Run: A Departure from Traditional Market Patterns (TradingView)

BTC's Unprecedented Bull Run: A Departure from Traditional Market Patterns (TradingView)

A crucial factor contributing to the resilience of the current bull run is the prevalence of spot trading. In spot markets, assets are traded for immediate delivery, differing from derivatives that involve futures and options settled in the future. Data reveals that trading volume for spot and derivatives on centralized exchanges hit an eight-month peak of $3.61 trillion in November, with the proportion of derivatives declining for the third consecutive month to 73%.

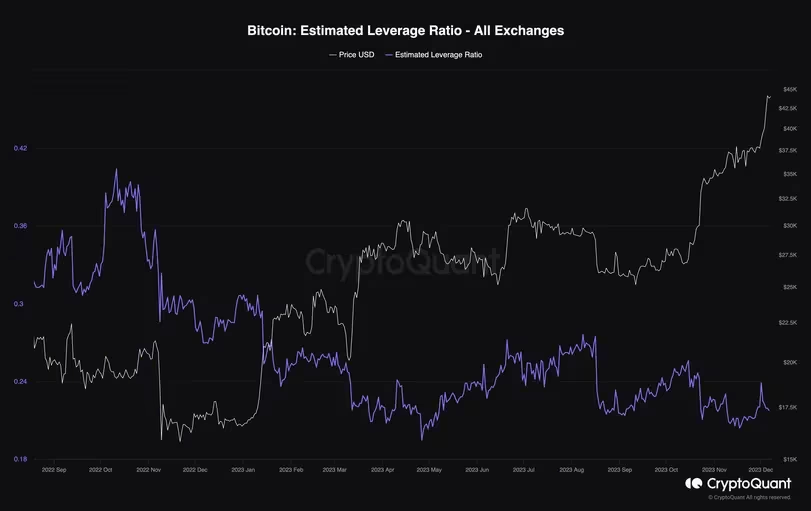

Despite derivatives still constituting the majority of market volume, the leverage within the system remains relatively low, supporting the gradual rise in prices. Leverage, which involves using borrowed funds to amplify a trading position's size, significantly influences market dynamics. In the current context, the leverage ratio remains low, calculated by dividing the dollar value locked in active open perpetual futures contracts by the total value of coins held by derivatives exchanges.

Analyzing Bitcoin's Leverage Ratio: Insights from CryptoQuant

Analyzing Bitcoin's Leverage Ratio: Insights from CryptoQuant

Unlike previous bullish periods where exchanges offered high leverage, sometimes up to 100x, most leading exchanges, such as Binance, now limit leverage to 20x or lower. This reduction in leverage mitigates the risk of mass liquidations, a phenomenon often leading to exaggerated market movements. The market's attention has shifted towards standard futures on the regulated Chicago Mercantile Exchange (CME), where institutional and sophisticated traders operate with lower leverage compared to unregulated platforms.

Furthermore, the composition of margin for trading has evolved. The use of coins as margin, prevalent in the 2021-22 period, has decreased. Instead, cash or stablecoin-margined contracts now dominate the open interest in BTC futures. Cash-margined contracts offer a more predictable payoff, reducing the risk of liquidation associated with coin-margined contracts, where collateral is as volatile as the trading position.

In summary, the current dynamics in the Bitcoin market depict a robust and sustainable bull market driven by spot trading, low leverage, and a shift towards more regulated and less leveraged trading platforms. This departure from previous market patterns signifies a maturing market with a more cautious and stable approach to trading.

Read More: AI Horizons: Meta and Gemini Unveil Future

Trending

Press Releases

Deep Dives