Ether's Potential Surge: Network Activity Spurs Deflationary Outlook Toward $3,000

Last week, the Ethereum blockchain processed an impressive $250 billion worth of transactions, marking its highest activity level since mid-March. This surge in transaction volume has injected a renewed sense of optimism into the Ethereum ecosystem, particularly concerning the price of Ether (ETH).

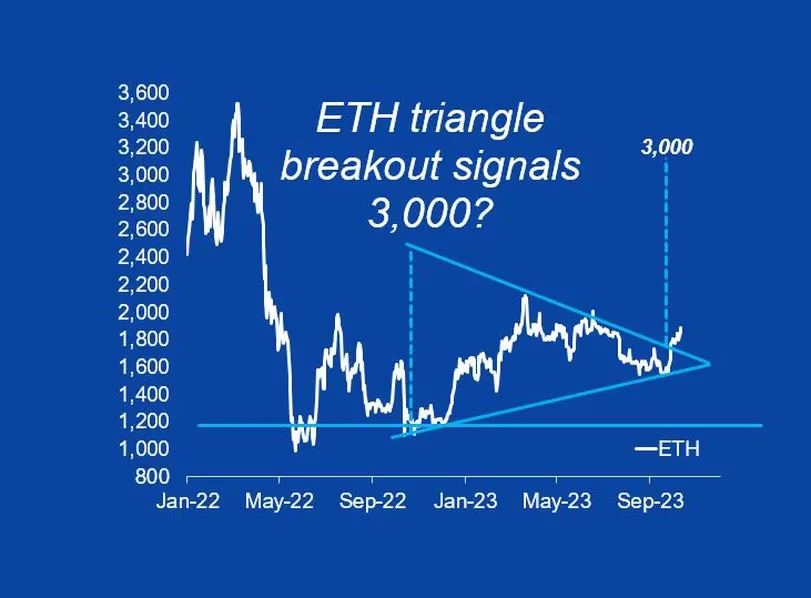

Markus Thielen, the head of research at Matrixport, has indicated that Ether has broken free from its previous downtrend and could be poised to reach the $3,000 mark. Thielen noted in a recent report that the recent surge of interest in altcoins has revitalized network activity, making Ethereum's outlook appear increasingly bullish.

Thielen emphasized that the revenues generated within the Ethereum ecosystem are rebounding from previously depressed levels, potentially signaling a tradeable bottom for ETH. A key indicator of this recovery is Ethereum's weekly revenue, which is derived from transaction fees (known as gas fees). This metric recently surged, surpassing $30 million for two consecutive weeks. This is a substantial improvement from the yearly low of $12 million recorded in early October, as indicated by data from Token Terminal.

Thielen also offered a tactical bullish trade perspective, suggesting that as long as weekly Ethereum fees remain above $30 million, there is a strong case for the price of ETH to reach $3,000, based on technical chart patterns.

Analyzing ETH Price Trends: Insights from Markus Thielen and Defi Trends

Analyzing ETH Price Trends: Insights from Markus Thielen and Defi Trends

This optimistic outlook represents a significant shift from Thielen's bearish stance on ETH back in September. At that time, he expressed concerns about deteriorating network revenues and user activity. Consequently, ETH's value plummeted to a seven-month low in early October, and its relative valuation against Bitcoin (BTC) reached a 15-month low.

However, the landscape has evolved with a substantial rally in Bitcoin and the broader cryptocurrency market. ETH has rebounded by approximately 20%, recently trading at around $1,870. This resurgence can be attributed in part to capital rotation from Bitcoin to various altcoins, which has sparked increased user activity on the Ethereum network.

Ether (ETH) Shifts to Deflationary Mode: Implications and Outlook

Ethereum serves as the foundational platform for many decentralized finance (DeFi) protocols and decentralized exchanges (DEXs), which have garnered significant attention in the crypto space. The network witnessed a remarkable $250 billion in asset transfers last week, a level not seen since the mid-March regional banking crisis. This figure represents a substantial increase from the $105 billion recorded in late August, according to data from IntoTheBlock.

Furthermore, the surge in Ethereum's on-chain activity has resulted in more ETH being burned than added to its supply over the past week. This shift from inflationary to deflationary is a noteworthy development for the token.

According to Lucas Outumuro, the head of research at IntoTheBlock, the increasing on-chain activity is a clear sign that the fundamentals of the crypto market are improving. He highlighted that growing spot-driven inflows, combined with the enhanced on-chain activity, indicate strong demand driving the cryptocurrency market's rally.

Read More: Microcap Surge: Bitcoin Surges to $35.5K, Igniting 'Mini Altcoin Season' and Boosting Crypto Market Cap to $1.3 Trillion

Trending

Press Releases

Deep Dives