Cryptocurrency Revolution: Riding the Digital Wave of Financial Transformation

The price of Bitcoin (BTC) has soared to unprecedented heights when measured against the backdrop of several inflation-stricken fiat currencies worldwide. During a remarkable 30-hour window from October 23rd to 24th, the cost of acquiring a single Bitcoin reached astonishing all-time highs when juxtaposed with the Argentine peso, Nigerian naira, Turkish lira, Laotian kip, and the Egyptian pound.

#Bitcoin just hit an all-time high in Argentina, Turkey and Nigeria. ???? pic.twitter.com/sKRNUaBMX8

— Miles Deutscher (@milesdeutscher) October 26, 2023

It is essential to bear in mind that this impressive feat is a direct consequence of the ongoing depreciation of these currencies, which has been further compounded by Bitcoin's recent meteoric price surge, tallying a substantial 16% increase.

Both the naira and lira experienced significant depreciation in their exchange rates against the United States dollar on the dates of October 24th and 25th, respectively. Simultaneously, the peso currently teeters at a mere 0.85% above its historical nadir when compared to the U.S. dollar.

In line with data compiled by the International Monetary Fund (IMF), the Venezuelan bolivar has attained the unenviable title of having the world's highest annual inflation rate at a staggering 360%. It is followed closely by the Zimbabwean dollar at 314%, the Sudanese pound at 256%, and the Argentine oesi at 122%.

Meanwhile, the Turkish lira and Nigerian naira find themselves in the sixth and fifteenth positions on the list, respectively, with annual inflation rates of 51% and 25%, as per the IMF's dataset.

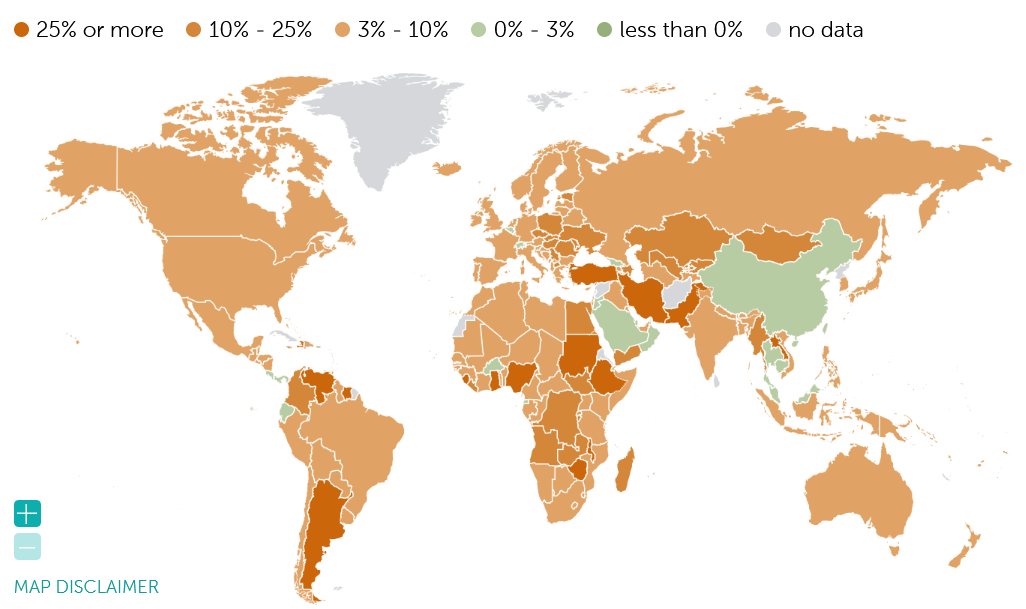

Heat map of countries in the world with corresponding annual inflation rates. Source: IMF

Heat map of countries in the world with corresponding annual inflation rates. Source: IMF

Obsevers within the cryptocurrency sphere have long regarded digital assets such as Bitcoin and stablecoins as a refuge from the relentless rise in inflation, and the latest data appears to lend credence to this perspective.

Nigeria, Turkey, and Argentina feature prominently as the second, twelfth, and fifteenth nations in terms of cryptocurrency adoption on a global scale, as attested by a report from Chainalysis dated September 12th. Nevertheless, the governments of these countries have not always seen eye to eye with the cryptocurrency industry.

With inflation at 99% in #Argentina, it’s 99% likely that the citizens of that beautiful country would benefit from #Bitcoin.

— Michael Saylor⚡️ (@saylor) February 15, 2023

In the case of Nigeria, the nation has incrementally warmed up to cryptocurrencies, following the central bank's initial prohibition on local banks providing services to cryptocurrency exchanges in February 2021. Notably, December 2022 saw Nigeria signaling its intent to enact legislation recognizing cryptocurrencies as "investment capital," citing the imperative to align with "globally accepted standards" as the prime rationale for this policy shift.

While Turkey counts a sizable population with a burgeoning interest in cryptocurrencies, the central bank imposed a blanket ban on cryptocurrency payments for goods and services in April 2021. Additionally, Turkey has actively pursued the development of a central bank digital currency (CBDC) to digitize the Turkish lira in recent years.

#Bitcoin fixes this????????????

— Gülben Gözü (@gulbengozu) August 28, 2023

I'm back in my beautiful country, Turkey, after 6 months. Shocked to witness the same goods costing 3–4 times more already. Rents, food, public transport, and more costs skyrocket regularly. High inflation's devastation is real and alarming. pic.twitter.com/X4N4Axuh1n

Concurrently, the inflation crisis plaguing Argentina may be significantly impacted by the outcome of the impending presidential election in November. The presidential contender, Javier Milei, is poised to contend with his adversary, Sergi Massa, in a final run-off vote scheduled for November 19th. Massa, the incumbent Minister of Economy, is an advocate for expeditiously launching an Argentine CBDC to tackle the persistent inflation challenges. He underscores the importance of Argentinians championing the Argentine peso over the U.S. dollar.

Argentina's present provides a glimpse into America's future, where the central bank raised interest rates 15 percentage points to 133% on Oct. 12. But with #inflation running at 138% and budget deficits and debt rising, the rate hikes will have no effect on reducing inflation.

— Peter Schiff (@PeterSchiff) October 26, 2023

On the contrary, Milei champions the adoption of the U.S. dollar in conjunction with the abolition of Argentina's central bank.

Read more about: Blockchain Bliss: Navigating the Cryptocurrency Landscape

Trending

Press Releases

Deep Dives