Blockchain Bliss: Navigating the Cryptocurrency Landscape

Bitcoin (BTC), the renowned digital currency, is expected to close out 2023 in a manner akin to how it embarked upon the year, as suggested by insights from the well-regarded on-chain analytics firm Glassnode. As we navigate through the month of October, Bitcoin's price appears to be on the verge of achieving a notable gain of nearly 30%.

In their most recent weekly newsletter, titled "The Week On-Chain" and released on October 24th, the astute researchers at Glassnode put forth the intriguing idea that the past week has not merely shaped the present but also laid down a solid foundation for an upward trajectory in BTC's price. This upward movement, they posit, has been significantly reinforced by Bitcoin's remarkable conquest of resistance levels.

The BTC price has decisively surpassed resistance levels

Throughout the course of this week, Bitcoin surged to an impressive $35,200, effectively eclipsing various significant trendlines that had hitherto acted as dependable support over the preceding months. Among these noteworthy trendlines was the 200-week simple moving average, residing at $28,400, a metric often regarded as the quintessential "bear market" support line.

Glassnode astutely noted, "A cluster of long-term simple moving averages of price are situated around the $28k mark, and these have steadfastly played the role of market resistance throughout the months of September and October."

"After a month of the market grinding higher, the bulls mustered enough strength this week to convincingly breach through the 111-day, 200-day, and 200-week moving averages."

BTC/USD annotated chart with moving average data (screenshot). Source: Glassnode

BTC/USD annotated chart with moving average data (screenshot). Source: Glassnode

This decisive breakthrough significantly bolstered the profitability of various groups of investors. Even the cost basis for speculators and newcomers to the market currently lingers in the vicinity of $28,000.

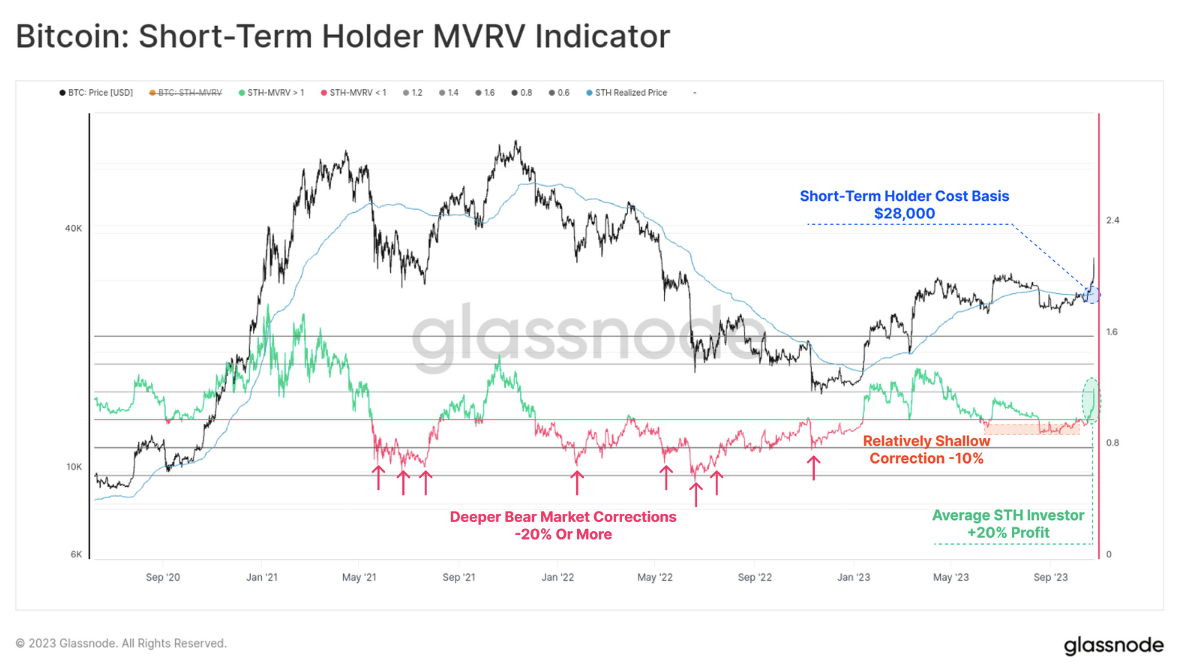

"The Short-Term Holder (STH) cost basis now lies in the rearview mirror at $28k, consequently positioning the average recent investor with an impressive average profit margin of +20%," "The Week On-Chain" report continued.

The researchers thoughtfully included a chart illustrating the short-term holder market-value-to-realized-value (STH-MVRV) ratio, a metric meticulously gauging the profitability of STH coins. They astutely emphasized that even before the October surge, there was no discernible sign of significant capitulation within the market.

"We can observe instances in 2021-22 where STH-MVRV experienced relatively deep corrections of -20% or more," they elucidated.

"While the August sell-off did dip as low as -10%, it is worth noting how shallow this MVRV decline is in comparison, implying that the recent correction found robust support, setting the stage for this week's rally."

Bitcoin STH-MVRV annotated chart (screenshot). Source: Glassnode

Bitcoin STH-MVRV annotated chart (screenshot). Source: Glassnode

Bitcoin is laying the groundwork for a promising year ahead

Furthermore, the current historical data reveals that the presence of Short-Term Holder (STH) entities, in contrast to their seasoned counterparts, the Long-Term Holders (LTHs), is currently at an all-time low. Despite grappling with their own profitability challenges, LTHs now lay claim to more than three-quarters of the available BTC supply for the very first time.

Their cost basis is somewhat lower, closer to the $20,000 mark. While some may entertain the possibility of Bitcoin revisiting this price range, Glassnode remains cautiously optimistic regarding the year's conclusion.

"A significant portion of both the supply and the investors now find themselves positioned above the average break-even price, which is situated around $28k," they concluded.

"This dynamic serves as the bedrock upon which a potential resurgence of the 2023 uptrend can be built. At the very least, the market has successfully crossed several pivotal thresholds that are likely to anchor collective investor sentiment. Therefore, the weeks that lie ahead are of paramount importance for close observation."

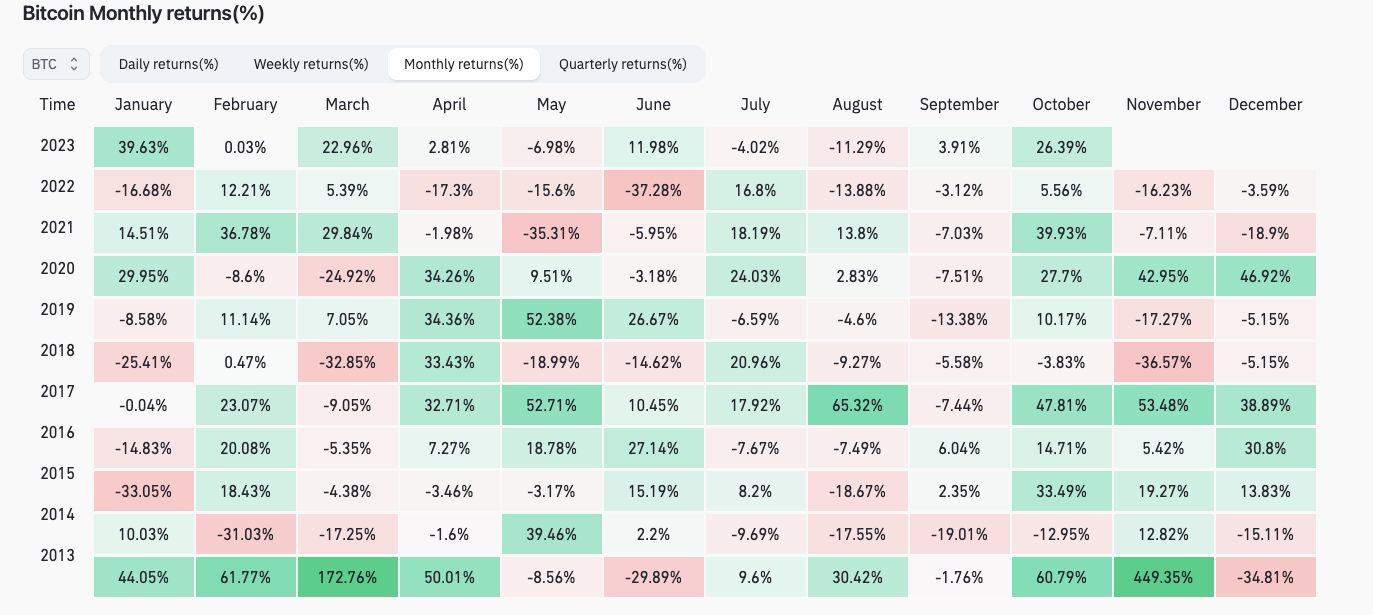

BTC/USD monthly returns (screenshot). Source: CoinGlass

BTC/USD monthly returns (screenshot). Source: CoinGlass

According to data provided by the on-chain monitoring resource CoinGlass, BTC/USD has experienced a commendable 26% increase in value during this month. In the context of October, this growth may be considered somewhat modest.

Read more: Guardians of the Crypto Realm: Defending Your Digital Treasure

Trending

Press Releases

Deep Dives