Crypto Market Woes

This week has witnessed a downturn in the cryptocurrency market, with the overall market capitalization experiencing a 4.4% drop, marking its lowest point since June 14, now standing at $1.02 trillion. This downward movement has resulted in an increase in Bitcoin's market dominance, as uncertainty surrounding regulatory measures casts a shadow over alternative cryptocurrencies.

Aggregate cryptocurrency market capitalization data from TradingView

Aggregate cryptocurrency market capitalization data from TradingView

Amidst the buzz surrounding the recently submitted Ether (ETH) and Bitcoin (BTC) exchange-traded fund (ETF) applications, the United States Securities and Exchange Commission (SEC) has chosen to repeatedly postpone its verdict on these financial instruments.

Let's delve into the three key factors contributing to the crypto market's current decline.

ETF Delays Prompt Crypto Investors to Play It Safe

Anticipation was running high among investors for the approval of a spot BTC ETF, especially considering the endorsements and applications from heavyweights like BlackRock and Fidelity. However, these hopes were dashed as the SEC continued to defer its decision, citing concerns about inadequate safeguards against manipulation.

Despite these delays, VanEck and ARK Invest have officially submitted applications for spot Ether ETFs on September 6, initiating the countdown for the SEC to reach a verdict. The estimated deadline for this decision falls on May 23, 2024.

While Grayscale managed to secure a win against the SEC in a U.S. appeals court, the Grayscale Bitcoin Trust (GBTC) still faces a 20% discount, with the SEC contemplating appealing the court's ruling. Although ETFs are perceived as a positive long-term development, the market is struggling to maintain short-term momentum.

Regulatory Uncertainty and Legal Battles Weigh Heavily on Crypto

Financial woes within the Digital Currency Group (DCG), the entity behind GBTC, have significantly dampened investor sentiment. A DCG subsidiary grapples with a debt exceeding $1.2 billion owed to the Gemini exchange.

Furthermore, Genesis Global Trading, driven to bankruptcy by losses tied to Terra and FTX, is now taking legal action against DCG, led by Barry Silbert. This precarious situation could potentially force the Grayscale Bitcoin Trust to liquidate positions if DCG fails to meet its obligations.

Adding to the market's challenges are impending regulations. The SEC has leveled a series of accusations against Binance, the largest cryptocurrency exchange, and its CEO, Changpeng Zhao, alleging misleading practices and operating an unregistered exchange.

Ether, the second-largest cryptocurrency by market cap, also grapples with uncertainty regarding its legal classification. Although the Commodity Futures Trading Commission chair views Ether as a commodity rather than a security, the SEC has yet to provide definitive clarity on the matter.

As regulatory ambiguity continues to cast a shadow over the cryptocurrency market, the chief technology officer of Ripple believes that the tide may be turning in favor of a more favorable U.S. regulatory landscape.

Liquidations and Dwindling Volume Drive Cryptocurrency Prices Lower

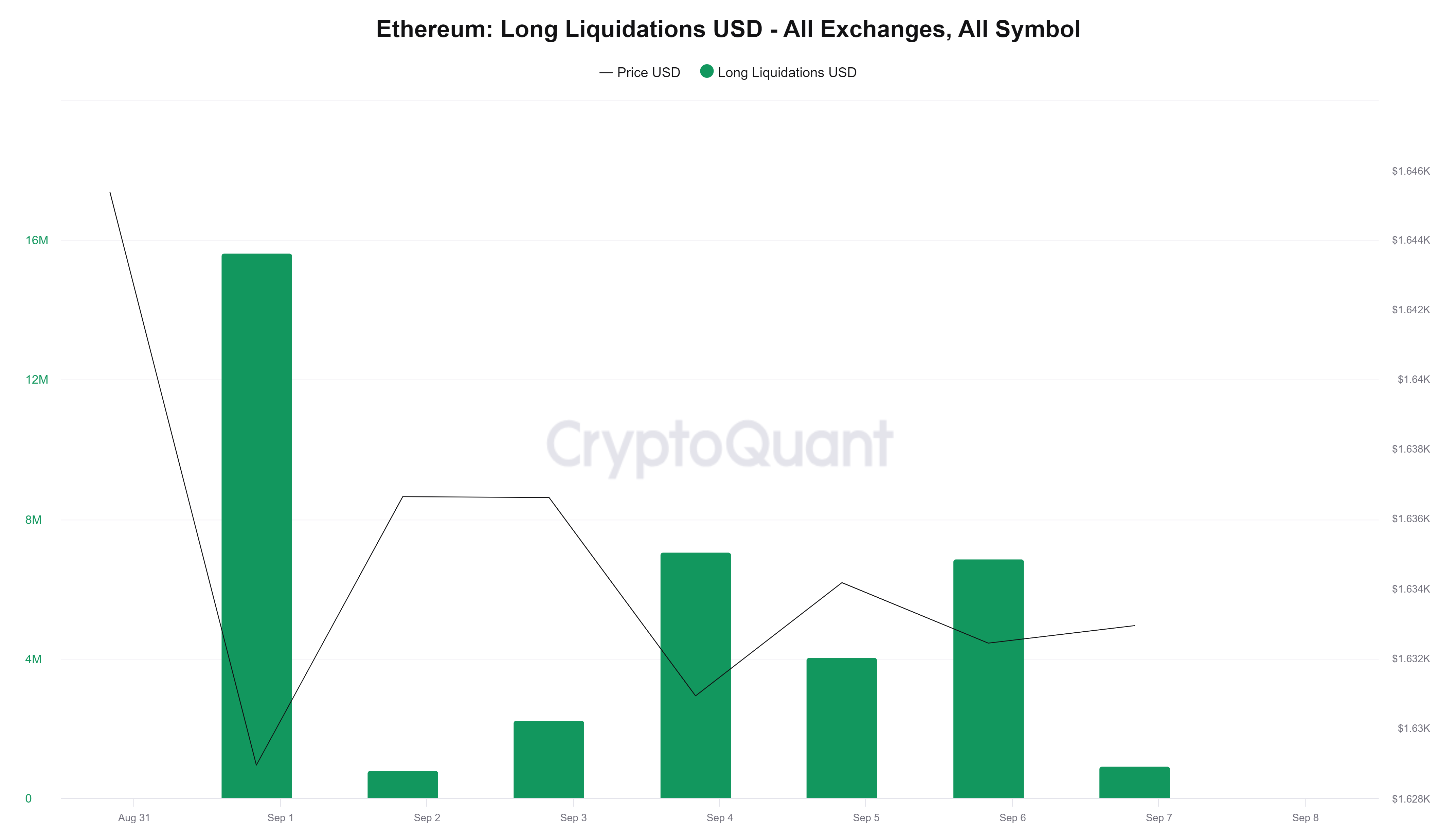

The start of September has witnessed a surge in Ethereum leveraged liquidations, with over $37 million liquidated in the first week of the month.

Ethereum long position liquidations. Source: CryptoQuant

Ethereum long position liquidations. Source: CryptoQuant

This wave of Ether liquidations coincides with a broader decline in total value locked (TVL) across the entire cryptocurrency market, accompanied by diminishing trading volumes. The crypto market's TVL reached its peak for 2023 on April 15 at $53 billion, but it has since dropped to $37.7 billion, representing a loss of over $15 billion.

Data on cryptocurrency market trading volume and Total Value Locked (TVL) sourced from DefiLlama

Data on cryptocurrency market trading volume and Total Value Locked (TVL) sourced from DefiLlama

Some analysts attribute this decline to the resurgent strength of the U.S. dollar, which reached a six-month high on September 7, posing a potential threat to cryptocurrency assets.

As the cryptocurrency market grapples with these multifaceted challenges, the interplay of various economic factors and regulatory developments will undoubtedly continue to shape its trajectory in the coming months.

Trending

Press Releases

Deep Dives