BTC's Resilient Trend: Price Insights

Bitcoin (BTC), valued at $27,344, is maintaining its upward trajectory this week, prompting certain traders to amplify their optimistic bets on the BTC price.

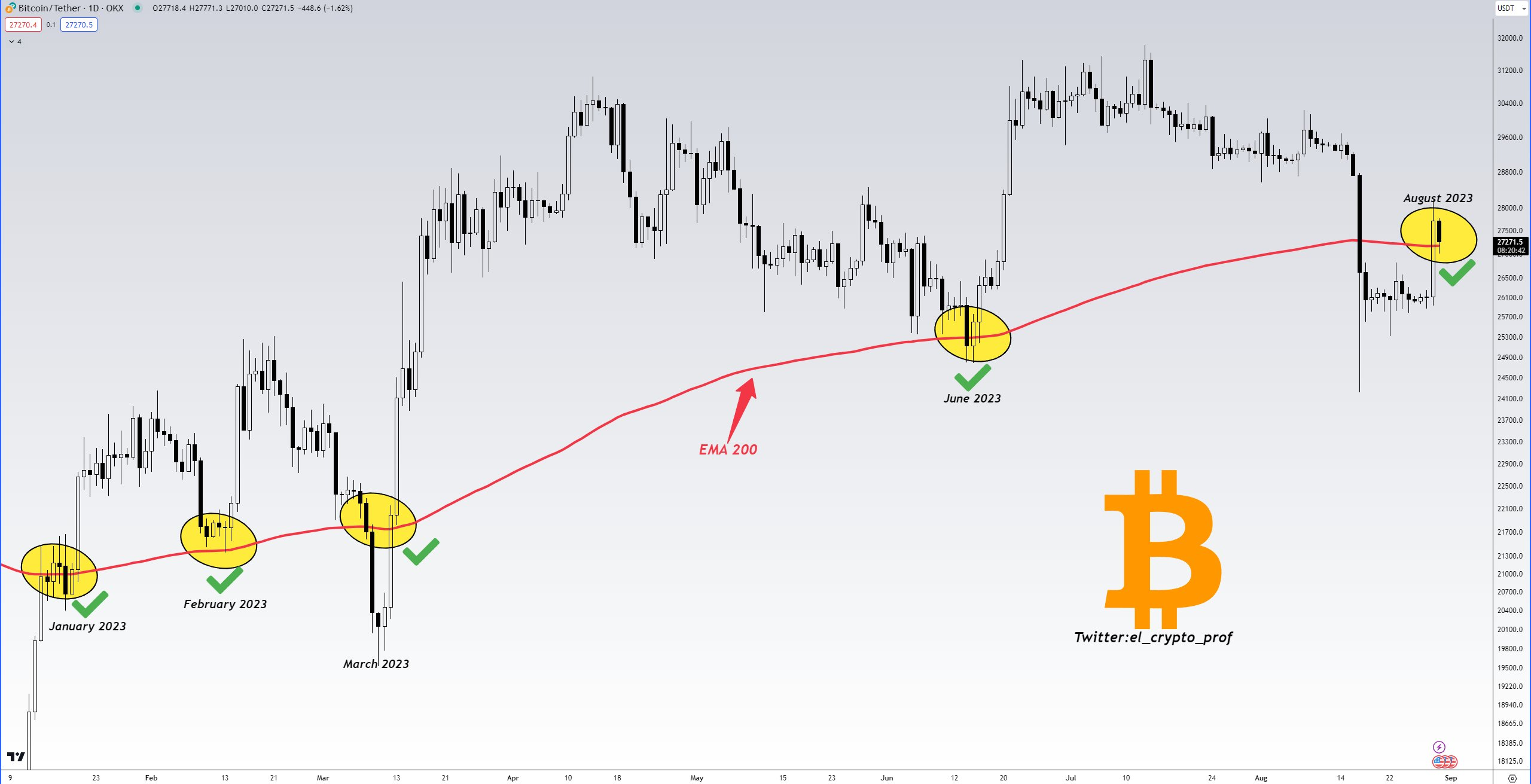

1-hour BTC/USD chart featuring the 200-day EMA. Data sourced from TradingView.

1-hour BTC/USD chart featuring the 200-day EMA. Data sourced from TradingView.

Trader Suggests Possible Bottom for Bitcoin Price

A trader's perspective on Bitcoin's potential bottom has emerged. The price movements of BTC on lower timeframes are being upheld by a crucial moving average, as per TradingView's data. Despite receding slightly from its recent peaks exceeding $28,000, the decline has yet to provoke a comprehensive reversal of the trend.

This development is being embraced by some as encouraging news, particularly due to the fact that BTC/USD is successfully upholding a long-standing trend line that had been relinquished as a supportive factor in early August. This support takes the shape of the 200-day exponential moving average (EMA), currently positioned at $27,180.

Even though there were instances of hourly candles closing below this level in the run-up to August 31, they failed to initiate a major downturn. As the month of August concludes, Bitcoin remains closely aligned with the 200-day EMA.

A prominent trader known as Moustache conveyed, "Bitcoin has risen above the daily EMA 200-Line." He added, "Many individuals are waiting for a more favorable entry point, yet I am skeptical that such an opportunity will materialize."

BTC/USD chart with 200-day EMA marked, referencing Moustache/X as the source.

BTC/USD chart with 200-day EMA marked, referencing Moustache/X as the source.

This viewpoint stands in stark contrast to the multitude of more pessimistic assessments prevalent among well-established sources, many of which are forecasting a regression to $25,000 or even lower.

Another trader, Jelle, retains an optimistic stance and attaches importance to Bitcoin's capacity to remain above $27,000. He summarized his perspective on August 30, saying, "This is precisely the sequence I anticipate post a significant surge: rapid ascent, shallow retracement, and maintaining a pivotal high timeframe level. Propel it further."

Looking ahead, the BTC price scenario diverges

There remains an outstanding task for BTC price action to reclaim certain bull market moving averages from earlier in the month. Rekt Capital, a trader and analyst displaying prudence in the current environment, recently observed that a few of these averages now function as obstacles to price advancement.

Annotated BTC/USD Chart Sourced from Rekt Capital/X

Annotated BTC/USD Chart Sourced from Rekt Capital/X

Furthermore, Material Indicators, a monitoring resource, cautioned that Bitcoin might experience a complete cycle, necessitating a revival of bullish sentiment to establish a higher local peak. Based on insights derived from its in-house trading tools, Material Indicators has pinpointed $27,760 and $24,750 as the upper and lower thresholds to closely monitor, respectively.

Trending

Press Releases

Deep Dives