Crypto and M2: Charting a New Frontier in Financial Dynamics

The burgeoning expansion of the total money supply (referred to as M2) is creating quite a stir in the financial landscape, and some experts believe it could serve as a catalyst for the cryptocurrency market to embark on yet another impressive bull rally, potentially outshining traditional financial markets. In a recent social media post on a platform previously known as Twitter (now a part of the X ecosystem), Raoul Pal, the co-founder and CEO of Real Vision, a prominent financial media platform, delved into this intriguing concept.

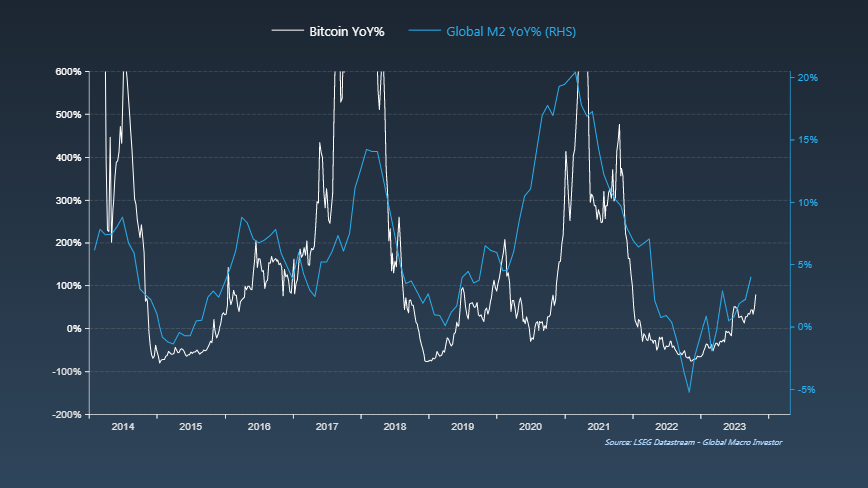

In this post, Pal generously shared a graph illustrating Bitcoin's yearly performance, where the BTC ticker is currently clocking in at a substantial $34,468. This performance was juxtaposed against the backdrop of the global M2 money supply, revealing a noteworthy correlation between the upward trajectory of Bitcoin's value and the expansion of the global M2 supply. Historical data suggests that the cryptocurrency market typically exhibits its strength when the global M2 supply experiences growth.

Bitcoin vs. global M2 supply. Source: Global Macro Investor

Bitcoin vs. global M2 supply. Source: Global Macro Investor

The visually compelling chart above offers a compelling insight, suggesting that Bitcoin's price is poised to disentangle itself from the traditional market, primarily as a result of the continually rising M2 supply. This pattern mirrors historical trends, as illustrated by Bitcoin's remarkable performance in 2021, 2017, and 2014.

Bitcoin/NDX vs. global M2 supply. Source: Global Macro Investor

Bitcoin/NDX vs. global M2 supply. Source: Global Macro Investor

Pal, brimming with enthusiasm, expressed his affinity for the influence of the expanding global M2 supply on Bitcoin's performance, stating, "I'm truly enthused about the Global M2 phenomenon... this is the moment when BTC eclipses the NDX, and the cryptocurrency market evolves into a Super Massive Black Hole."

It is noteworthy to mention that M2 represents the comprehensive estimation of the currency in circulation as calculated by the United States Federal Reserve, encompassing both physical cash and monetary assets held in savings accounts, checking accounts, and various short-term savings instruments, such as certificates of deposit.

While Bitcoin's price surge is often attributed to the block reward halving, which occurs every four years (with the next one slated for April 2024) and reduces the available supply of BTC amid growing demand, it's crucial to recognize that multiple macroeconomic factors play pivotal roles in shaping these market dynamics.

Over the past decade, Bitcoin has displayed impressive price gains during periods of rapid M2 expansion, largely driven by factors such as reduced interest rates, quantitative easing, and fiscal stimulus. Conversely, during phases of monetary tightening orchestrated by central banks, the cryptocurrency market has struggled to gain the bullish momentum that characterizes bull markets. Remarkably, the remarkable bull run of 2021 coincided with a 6% or higher aggregate M2 growth rate across major central banks, including the Federal Reserve, European Central Bank, Bank of Japan, and the People's Bank of China.

Read more about: Digital Asset Revolution: Navigating the Cryptocurrency ETF Landscape

Trending

Press Releases

Deep Dives