Bitcoin's Soaring Surge and Market Buzz

Bitcoin BTC The price ticker for Bitcoin has undergone a minor dip, resting at $34,254, but it swiftly rebounded, surging to $35,280, marking a new high over a 17-month period before showing a slight retraction. This noteworthy movement in Bitcoin's valuation today aligns with the increasing buzz surrounding a spot Bitcoin exchange-traded fund (ETF), notably BlackRock's iBTC, which briefly made an appearance on the Depository Trust & Clearing Corporation (DTCC) website. While the listing may have mysteriously disappeared, this development has continued to fuel the bullish momentum of Bitcoin, a development often perceived as a significant stride towards obtaining official ETF approval.

Bitcoin price. Source: TradingView

Bitcoin price. Source: TradingView

Despite the retraction from the $35,000 milestone, the price action this week has left market observers pondering the potential sustainability of this upward trajectory. Now, let's delve into the factors underpinning today's surge in the price of Bitcoin.

Increased attention from institutional investors is elevating market confidence in Bitcoin

Institutional enthusiasm for Bitcoin is playing a pivotal role in elevating market sentiment. Despite several macroeconomic challenges, the listing of BlackRock's spot Bitcoin ETF on a Nasdaq trade clearing firm seems to be the dominant impetus driving Bitcoin's climb to $35,280, a level not witnessed in over a year.

While a flurry of spot Bitcoin ETF applications emerged in mid-October, BlackRock's iBTC fund achieved the distinction of becoming the first to secure a listing with the clearing firm. This notable development stands out amid the backdrop of the U.S. Securities and Exchange Commission (SEC) repeatedly denying approval for a spot Bitcoin ETF, despite numerous contenders, including BlackRock, Fidelity, ARK Invest, and 21Shares, which has made three attempts at securing approval. Notably, on October 14, Grayscale secured a substantial victory when the SEC opted not to challenge the decision of U.S. Court of Appeals Circuit Judge Neomi Rao. In response, Grayscale swiftly submitted a fresh application for a spot Bitcoin ETF on October 19.

What implications does a spot ETF have for BTC?

Speculation abounds regarding the potential ramifications of a spot Bitcoin ETF approval for BTC. Reports suggest that such approval could stimulate fresh demand amounting to a staggering $600 billion, with CryptoQuant positing that it might precipitate a jaw-dropping $1 trillion surge in Bitcoin's market capitalization.

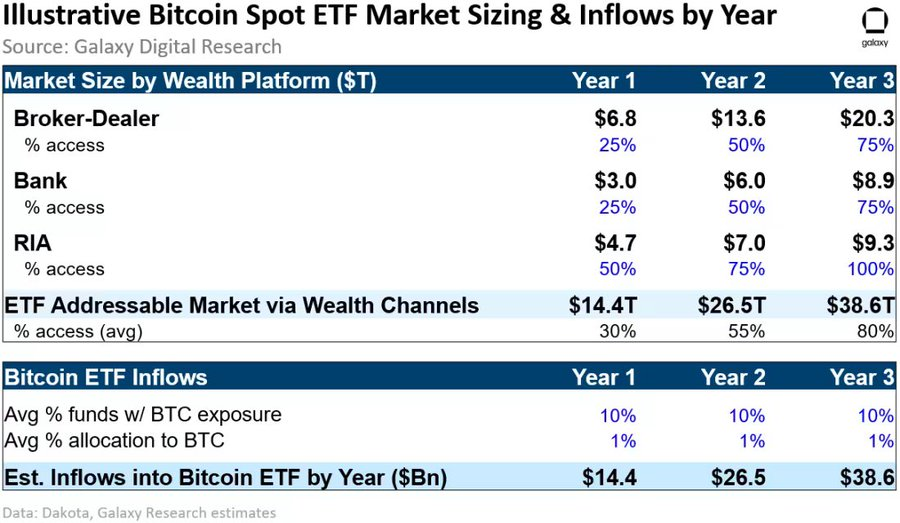

In a report released on October 24, Galaxy Digital postulated that upon approval of Bitcoin ETFs, BTC could experience a minimum of $14.4 billion in inflows within the first year, with this figure escalating to $38.6 billion by the third year.

Assumed Bitcoin inflows post ETF approval. Source: Galaxy Digital

Assumed Bitcoin inflows post ETF approval. Source: Galaxy Digital

Charles Edwards, the founder of Capriole Investments, further invoked historical parallels by drawing attention to the gold market, which witnessed a remarkable 350% upswing following the approval of a Gold ETF.

Gold performance. Source: TradingView

Gold performance. Source: TradingView

Liquidations in Bitcoin and the surge in open interest on CME experience a significant increase

Concurrently with Bitcoin's upward price momentum, exchanges are witnessing a noteworthy outflow of BTC. Market participants tend to interpret this outflow as a bullish signal, as it is often indicative of traders intending to secure their BTC holdings in self-custody for the long term.

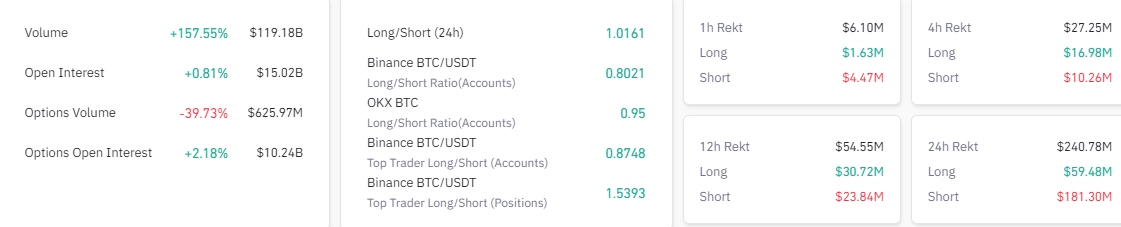

As Bitcoin continues to migrate away from exchanges, liquidations of leveraged positions have a pronounced impact on the price. Over the past 24 hours alone, liquidations of BTC shorts have surpassed $181.3 million, with a remarkable $4.5 million in shorts liquidated within a mere one-hour window.

Bitcoin liquidation data. Source: Coinglass

Bitcoin liquidation data. Source: Coinglass

Glassnode has characterized this recent surge in liquidations as a "double short-squeeze."

Several key price models were clustered around the $28k level and offered significant resistance for many months.$BTC has now firmly cleared these models, putting the market in a stronger position:

— glassnode (@glassnode) October 24, 2023

- 200D-SMA

- 200W-SMA

- Cointime True Market Mean

- Short-Term Holder Cost basis pic.twitter.com/olw5aNhXPr

In the wake of this "double short-squeeze," Bitcoin futures open interest has surged to 100,000 BTC on the Chicago Mercantile Exchange (CME) for the second time in history. The last time CME Bitcoin open interest reached this pinnacle was on November 22, 2022.

CME open interest. Source: Coinglass

CME open interest. Source: Coinglass

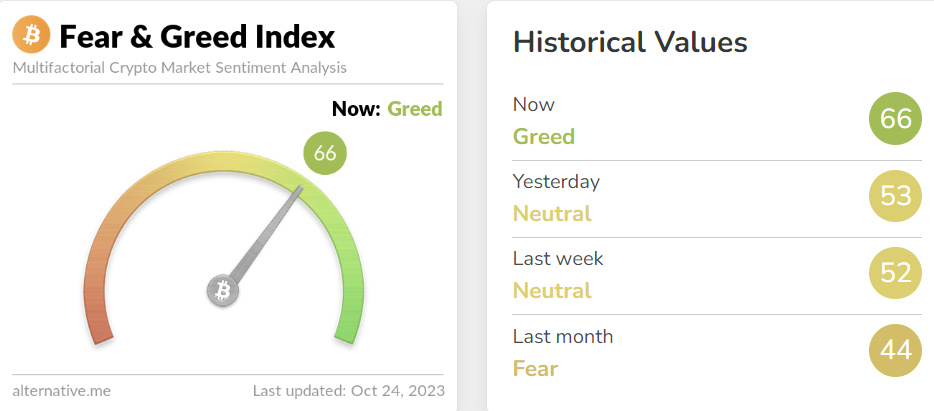

The robust performance of Bitcoin is not only bolstering market sentiment but is also reflected in the Bitcoin Fear & Greed Index, which has transitioned from a state of fear to one of greed, exhibiting a remarkable gain of 22 points over the past month.

Bitcoin Fear & Greed Index. Source: Alternative.me

Bitcoin Fear & Greed Index. Source: Alternative.me

Read more: Bitcoin's Market Resurgence and Prospects

Trending

Press Releases

Deep Dives