Bitcoin's Price Odyssey: Navigating the Macro Waves

Bitcoin (BTC), the world's most renowned cryptocurrency, is currently navigating a fluctuation in its market performance, with its price dwindling to $34,112 as of October 27th, coinciding with the opening of Wall Street for the day.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

The Bitcoin price range is approaching the weekly and monthly closing dates

This price movement has piqued the interest of investors and analysts alike, as they closely monitor how Bitcoin compares to other macroeconomic assets.

In the ever-evolving landscape of cryptocurrency, Bitcoin has managed to maintain a semblance of stability, effectively preserving the gains it had accrued earlier in the week, as evidenced by data gleaned from TradingView. This relative stability comes as the deadlines for the weekly and monthly closes draw nearer, critical moments that shed light on Bitcoin's performance throughout the month of October.

Daan Crypto Trades, a trader of considerable repute, has weighed in on the situation, expressing the belief that Bitcoin may linger within a particular price range for an extended period. Daan suggests a price range of approximately $33,000 to $35,000 and advises vigilant observation for potential swift trading opportunities that may arise within this range.

BTC/USD annotated chart. Source: Daan Crypto Trades/X

BTC/USD annotated chart. Source: Daan Crypto Trades/X

Adding further nuance to the analysis, Daan pointed out that open interest (often abbreviated as OI) has experienced a resurgence, nearing levels last observed during the sudden upsurge that catapulted Bitcoin to 17-month highs. It is worth noting that elevated levels of open interest have frequently been associated with dramatic price fluctuations in the world of Bitcoin in recent weeks.

#Bitcoin Open Interest on Bybit has almost recovered to the level before the massive short squeeze this week.

— Daan Crypto Trades (@DaanCrypto) October 27, 2023

During that squeeze, we saw a 21% decrease in Open Interest on Bybit which was worth ~$450M pic.twitter.com/YbCM6XWZHW

Meanwhile, Material Indicators, a resource dedicated to monitoring on-chain data, has identified a concerning downside signal within one of its proprietary trading instruments. With not one, but two daily signals indicating a bearish trend, Material Indicators has posited that only a substantial rise to $34,850 would effectively counteract the bearish implications. Nonetheless, they acknowledge the potential for Bitcoin to reach this level before the closure of the monthly candle.

Trend Precognition continues to show the way.

— Material Indicators (@MI_Algos) October 27, 2023

For me, a move above $34,850 invalidates on the D chart. That doesn’t mean we can’t go there before the Monthly candle close.

If you want to get these #TradingSignals when they are actionable, subscribe.

Get the tools. Gain the… pic.twitter.com/bpOomEv5Tq

An analysis suggests there is ample momentum to propel the Bitcoin price to $40,000

Trend Precognition, an essential aspect of Bitcoin price analysis, continues to play a pivotal role in shaping market sentiments and predictions.

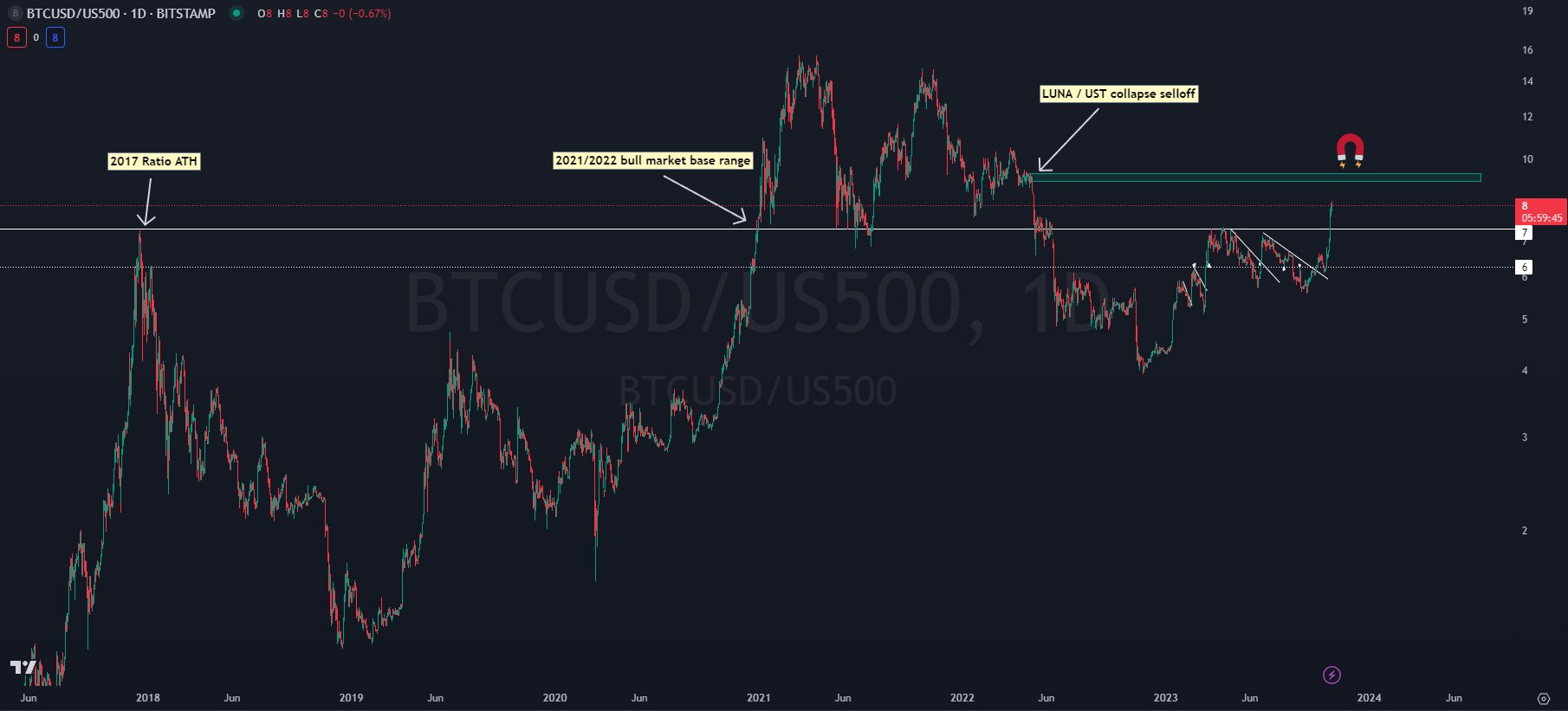

Taking a step back and assessing Bitcoin's performance from a macroeconomic perspective, there is a sense of optimism among some analysts. Notably, social media trader Kaleo has drawn attention to Bitcoin's impressive outperformance when compared to the S&P 500 since the beginning of September. This outperformance suggests favorable prospects for Bitcoin's price.

Over the past month, Bitcoin has experienced what Kaleo aptly dubs the "bullish decoupling" from traditional equities, a development that many had been eagerly awaiting. While Bitcoin has recorded a relatively modest 36% increase against the US dollar since the lows of September, it has significantly outpaced the S&P 500, registering a remarkable 48% gain.

BTC/USD vs. S&P 500 annotated chart. Source: Kaleo/X

BTC/USD vs. S&P 500 annotated chart. Source: Kaleo/X

To support this argument, an illustrative chart featuring BTC/USD versus the S&P 500 has been included, reinforcing Kaleo's belief in Bitcoin's potential to surge to $40,000.

Additionally, some experts emphasize the significance of recent resistance levels that are on the verge of transitioning into crucial weekly and monthly support levels. Matthew Hyland, a seasoned crypto and macro analyst, asserts that breaking through the $32,000 price barrier is a monumental achievement. He further contends that the dwindling options for bearish investors leave them with a last glimmer of hope, hinging on Bitcoin's ability to close below these pivotal levels on both weekly and monthly timeframes.

You might also like: Unveiling the Cryptocurrency Conundrum: How Full Blocks Fortify Security

Trending

Press Releases

Deep Dives