Bitcoin's Price Journey: Insights and Trends

Bitcoin (BTC) is currently trading at approximately $34,000, displaying signs of stability and consolidation in the wake of a remarkable 15% daily gain following the Wall Street opening on October 24th.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Opinions vary regarding the funding rates of Bitcoin

Opinions regarding Bitcoin's funding rates appear to be diverse, contributing to a sense of uncertainty in the market. According to data from TradingView, the price of BTC has been fluctuating around the $34,000 mark, making it a point of interest as of the time of this writing.

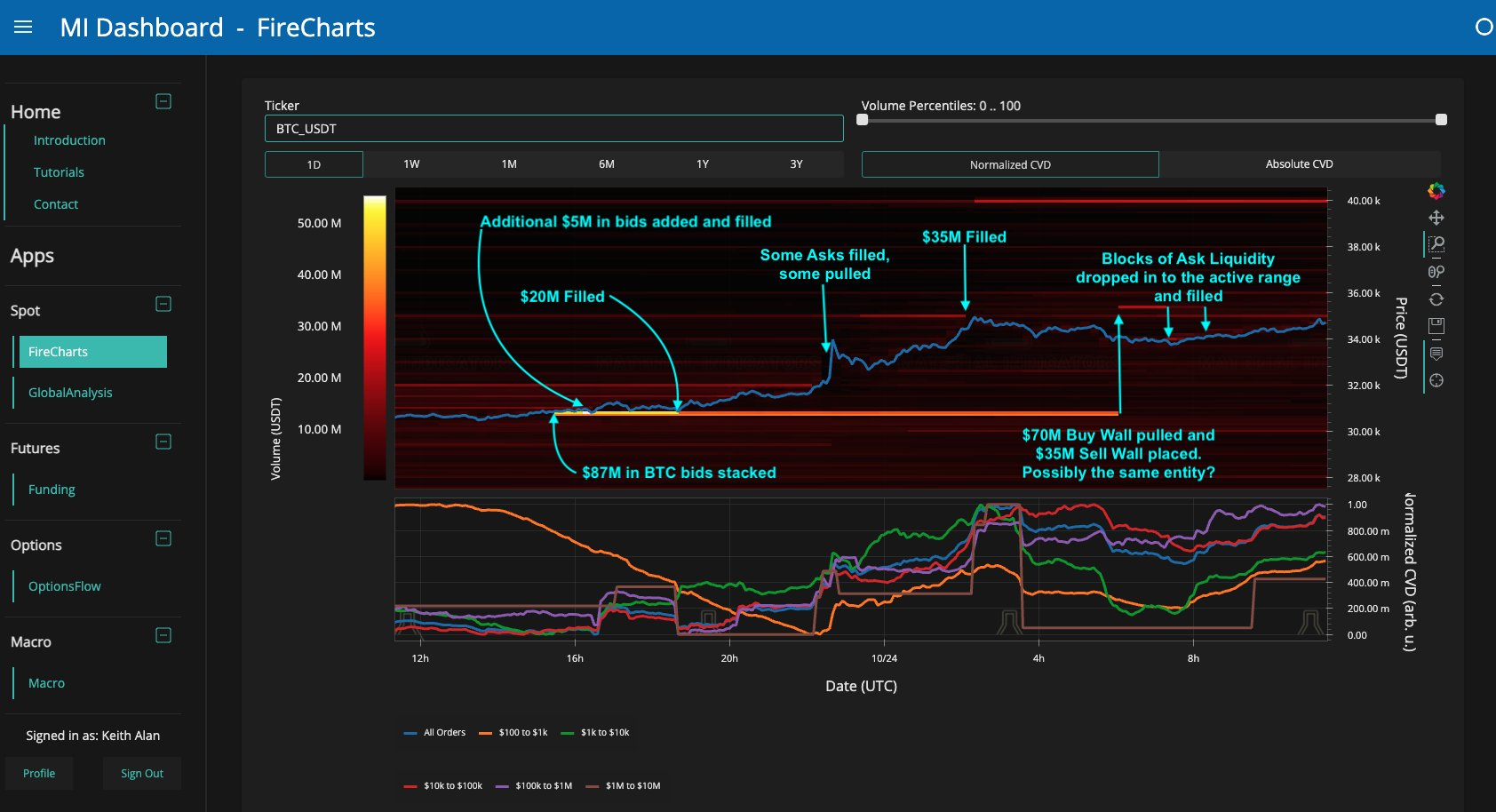

Notably, Bitcoin had recently surged to a 17-month high, nearly reaching the $35,200 mark, driven by the growing anticipation surrounding the potential approval of a Bitcoin spot price exchange-traded fund (ETF) in the United States. To better understand the sequence of events leading to a substantial $5,000 daily price increase, Material Indicators, a monitoring resource, meticulously examined the situation. Their analysis highlighted a significant shift in support and resistance (R/S) at the $30,600 level.

What astonished many market observers was the rapid and decisive breakthrough of resistance levels that had held steadfast for over a year and a half. Material Indicators, in particular, had anticipated more resistance at levels like $30.5k, $31.5k, and even $33k. Surprisingly, these levels were swiftly breached, particularly when an $87 million buy wall materialized at $30.6k, providing a solid foundation for an immediate R/S flip.

As the market crossed the critical $32k threshold, some of the overhead liquidity was removed, creating favorable conditions for BTC to surge to $35k swiftly. Additionally, the post suggested that with a decline in bid liquidity, the potential for a retracement should not be dismissed.

Taking a closer look at the Binance order book over the past 24 hours, one of the accompanying charts underscores additional factors that contribute to a more significant consolidation. Among these factors are funding rates across exchanges, which, at the time of writing, appeared to be notably positive.

BTC/USD order book data for Binance. Source: Material Indicators/X

BTC/USD order book data for Binance. Source: Material Indicators/X

The prevailing sentiment among traders seems to favor long positions, as the overwhelmingly positive funding rates suggest. It's worth noting, however, that in the history of financial markets, the consensus of the majority has often been proven incorrect. Consequently, market makers may need to liquidate the late long positions as the market dynamics evolve.

Be cautious with new longs❗️ pic.twitter.com/jsuXPdIhRq

— CryptoBullet (@CryptoBullet1) October 24, 2023

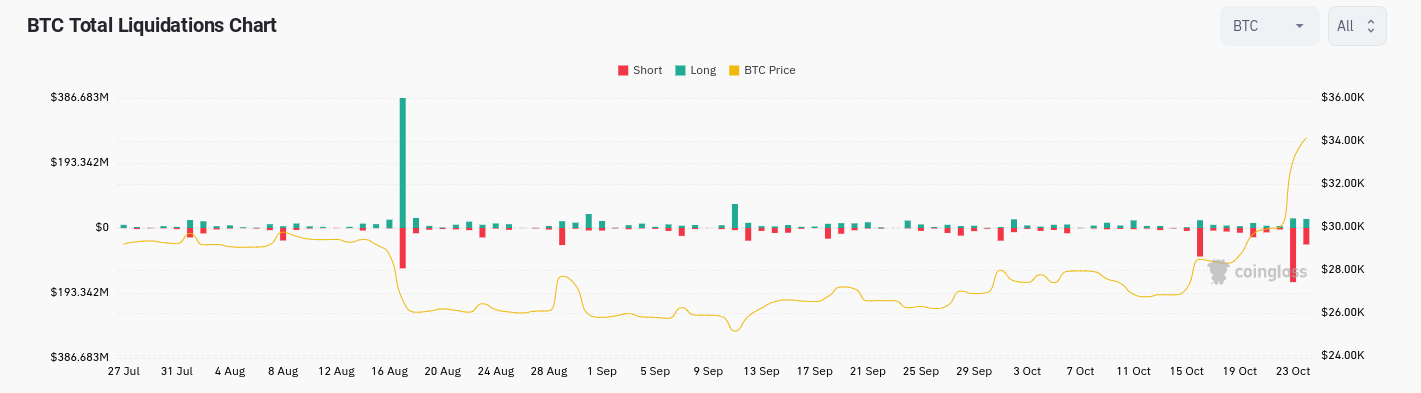

BTC experienced short liquidations totaling $161 million on October 23 and an additional $48 million on October 24, according to data from the monitoring resource CoinGlass. In discussions about these funding rates, another trader, Daan Crypto Trades, expressed a perspective that the market might still adhere to its current trajectory, consistent with typical behavior observed during bullish market trends.

Bitcoin liquidations (screenshot). Source: CoinGlass

Bitcoin liquidations (screenshot). Source: CoinGlass

#Bitcoin Still a perpetual premium but it has come down a bit.

— Daan Crypto Trades (@DaanCrypto) October 24, 2023

It's good to note that during the bull market, we often had weeks of positive funding rates as that was just seen as "the price to pay to participate".

Similar how during 2022-2023 we were mostly negative. https://t.co/W3AtaydaQd pic.twitter.com/Hl2mnVz9sa

Interestingly, Bitcoin's retracement aligned with a strengthening U.S. dollar, which had exhibited weakness the day before. The U.S. Dollar Index (DXY) saw a rebound to 106, marking a 0.5% increase from its intraday low.

The U.S. dollar strengthens while Bitcoin's price stabilizes

Bitcoin's response to movements in the DXY has been multifaceted, despite a previously evident inverse correlation.

It's too obvious that $DXY is moving downward since it forms a new lower low.

— Trader Tardigrade (@TATrader_Alan) October 24, 2023

At the same time, a nice breakout can be seen in #Bitcoin. pic.twitter.com/NP65yDnlRJ

Analyst James Stanley emphasized the significance of the forthcoming release of Personal Consumption Expenditures (PCE) data on October 26, which is expected to play a pivotal role in determining the short-term direction of the DXY. This data release holds particular importance as it precedes the November 1 meeting of the Federal Open Market Committee (FOMC), during which the U.S. Federal Reserve will make crucial decisions regarding interest rates. Stanley highlighted the importance of defending the low of 104.70 from the last FOMC meeting as a key priority for the bullish perspective.

U.S. Dollar Index (DXY) 1-hour chart. Source: TradingView

U.S. Dollar Index (DXY) 1-hour chart. Source: TradingView

You might also like: Bitcoin's Soaring Surge and Market Buzz

Trending

Press Releases

Deep Dives