Bitcoin Symphony: The Harmonious Surge and the Ripple Effect of U.S. Enthusiasm

In the ever-fluctuating landscape of cryptocurrency, Bitcoin, often denoted as BTC, witnessed a descent, its ticker sliding down to the tune of $36,748. However, on the unexpected turn of events on November 9, it made a leap, edging close to the $37,000 threshold, leaving traders astir with a sudden surge in BTC prices.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

U.S. propelling Bitcoin to higher levels

Across the ocean in the United States, Bitcoin experienced an ascent, as indicated by data from TradingView, surpassing the $36,000 mark post the daily closing. The BTC/USD pair continued its ascent, scaling up to $36,864 on Bitstamp, marking its highest point since the early days of May 2022.

In the preceding day, the market was rife with concerns among participants as bid liquidity seemed to dwindle, hinting at a potential retest at $34,000. Contrary to these apprehensions, the market witnessed an upswing during the United States trading hours, defying expectations.

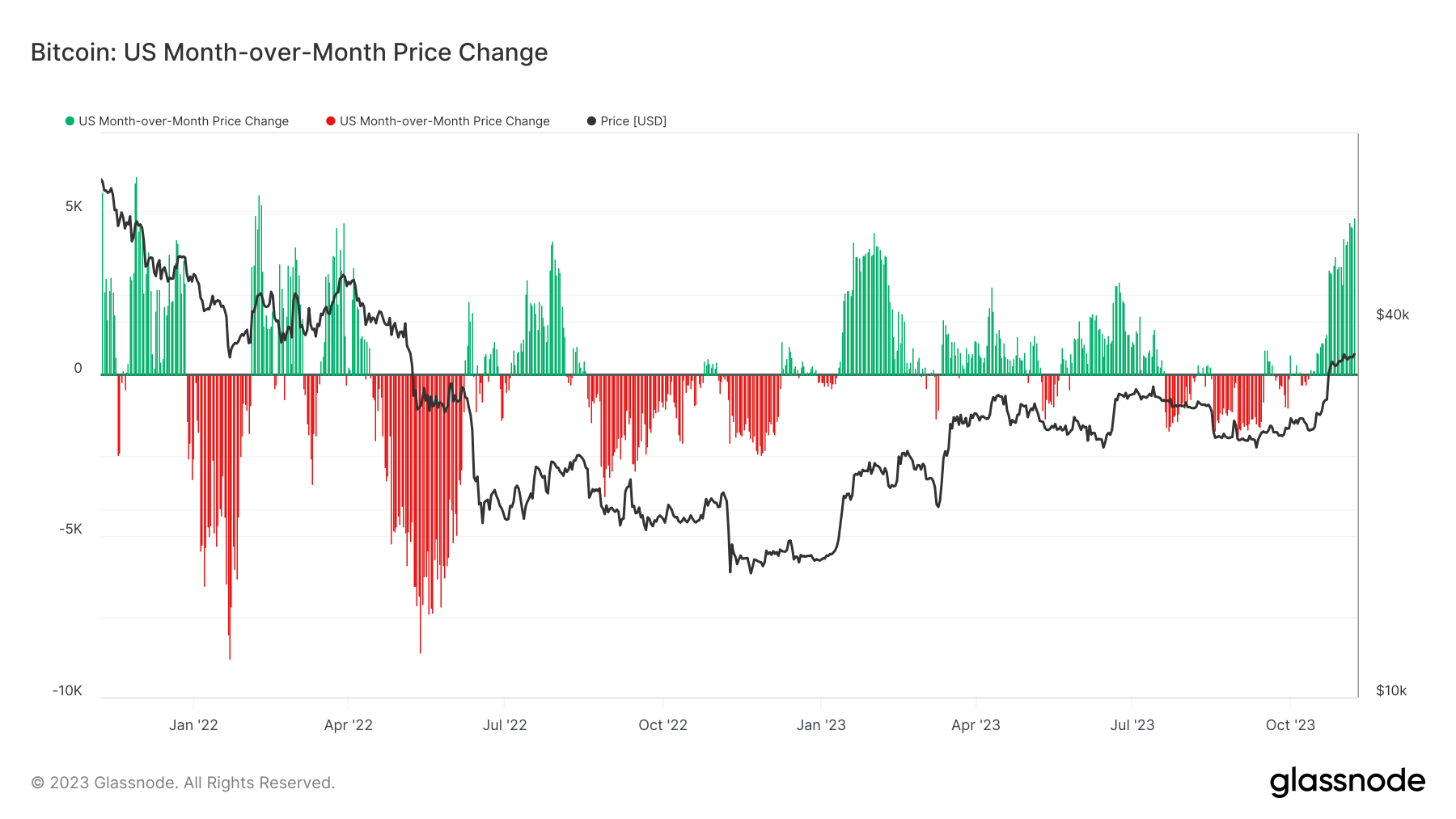

James Van Straten, a research and data analyst at the crypto insights firm CryptoSlate, highlighted the robust bullish sentiment the United States displayed towards Bitcoin, echoing a fervor not witnessed since early 2022. Van Straten drew attention to data from Glassnode, painting a picture of unwavering support from U.S. buyers sustaining the rally.

William Clemente, co-founder of the crypto research firm Reflexivity, chimed in, emphasizing the pivotal role played by Americans in propelling this positive momentum forward.

Bitcoin month-over-month price change during U.S. trading hours. Source: Glassnode

Bitcoin month-over-month price change during U.S. trading hours. Source: Glassnode

Speculation rippled through the market, attributing the revived bullish sentiment to a prospective approval of a U.S. Bitcoin spot price exchange-traded fund (ETF). Although slated for 2024, November 9 marked the inception of a period wherein regulators could potentially unveil the much-anticipated decision.

James Seyffart, a research analyst at Bloomberg Intelligence, injected confidence into the discourse, asserting a 90% likelihood of spot Bitcoin ETF approvals by January 10. He speculated that an expedited approval could usher in a wave of approval orders for all current applicants, a prospect that loomed on the horizon.

Financial commentator Tedtalksmacro aligned with Seyffart's sentiment, noting how BTC seemed to be navigating its trades as if an ETF decision loomed on the imminent horizon.

BTC/USD 1-week chart. Source: TradingView

BTC/USD 1-week chart. Source: TradingView

BTC price increases surpass predictions

The unexpected gains in BTC prices surpassed even the most seasoned observers' forecasts. Material Indicators, a vigilant on-chain monitoring resource, reported an anomaly as the overnight gains invalidated signals on two proprietary trading tools, a peculiar occurrence, according to co-founder Keith Alan.

Needless to say, the Trend Precognition ⬇️ signals on the BTC Weekly chart invalidated after the push above $36k. First time I've seen that happen when both algos had signals on the same candle. https://t.co/7nGahmgCDW

— Material Indicators (@MI_Algos) November 9, 2023

Skew, a trader of repute who had previously cautioned about liquidity fluctuations, drew parallels between BTC's current price action and the late-January scenario, when Bitcoin's bullish momentum from the start of the year began to lose steam.

$BTC sweep of $36K & not so great 4H candle here

— Skew Δ (@52kskew) November 8, 2023

zoom out to daily & this structure is starting look a lot like late january

Despite these surprises, Skew contended that the low-timeframe uptrend remained steadfast, supported by a sequence of higher lows on the 15-minute chart and robust relative strength index (RSI) values.

Read more: Bitcoin Ballet: Navigating the Crypto Symphony Amidst Waves of Volatility

Trending

Press Releases

Deep Dives