Bitcoin Ballet: Navigating the Crypto Symphony Amidst Waves of Volatility

Bitcoin (BTC), the enigmatic digital currency, finds itself on a rollercoaster ride as its ticker takes a dip to $36,758, inviting speculation on short-term price trajectories amid the ebbs and flows of consolidation and volatility.

In the aftermath of a classic "short squeeze" that propelled the flagship cryptocurrency tantalizingly close to the $36,000 mark, fervent discussions within the Bitcoin community revolve around pivotal levels to scrutinize, starting from the auspicious date of Nov. 8.

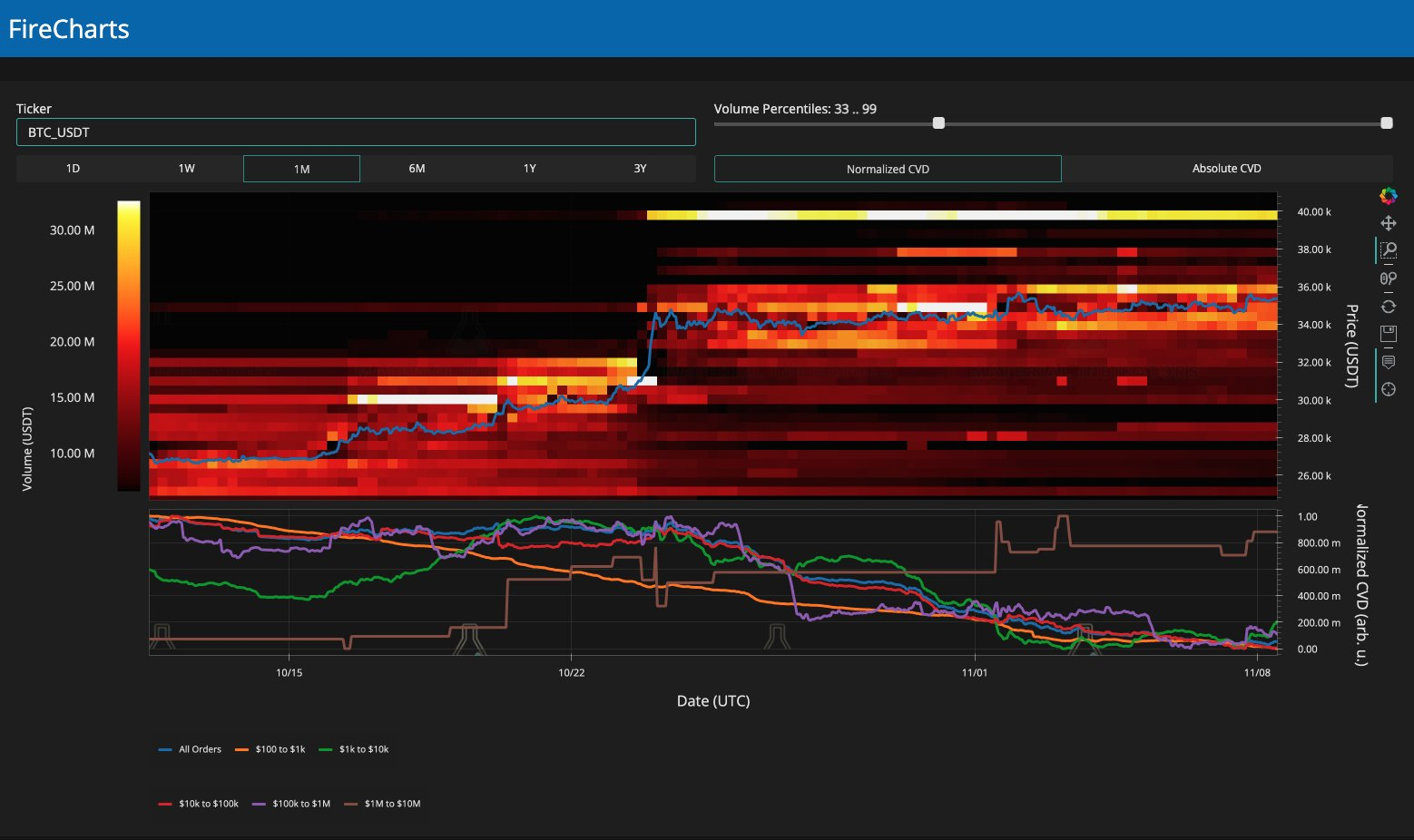

Buy support for Bitcoin gradually decreases, approaching the $34,000 mark

The challenge for Bitcoin lies in surmounting the formidable resistance at the $36,000 milestone, with several attempts at breaching it fizzling out in a spectacle revealed by data gleaned from TradingView.

As the narrative unfolds, sellers emerge as active players on intraday timeframes, their maneuvers cautioning the buy side, as evidenced by discerning data extracted from exchange order books.

A Nov. 8 missive from on-chain monitoring maestro Material Indicators signals a decline in support liquidity, orchestrating a symphony of change from $34,500 to $34,000.

"The dynamics of the Bitcoin market are evolving," the commentary notes, injecting a sense of intrigue into the unfolding drama.

A visual tour of the BTC/USDT order book on Binance further corroborates the saga, with $36,000 witnessing a surge in sell liquidity, reminiscent of the previous day's dip to $35,900. Meanwhile, the psychological barricade at $40,000 looms large.

BTC/USDT order book data for Binance. Source: Material Indicators/X

BTC/USDT order book data for Binance. Source: Material Indicators/X

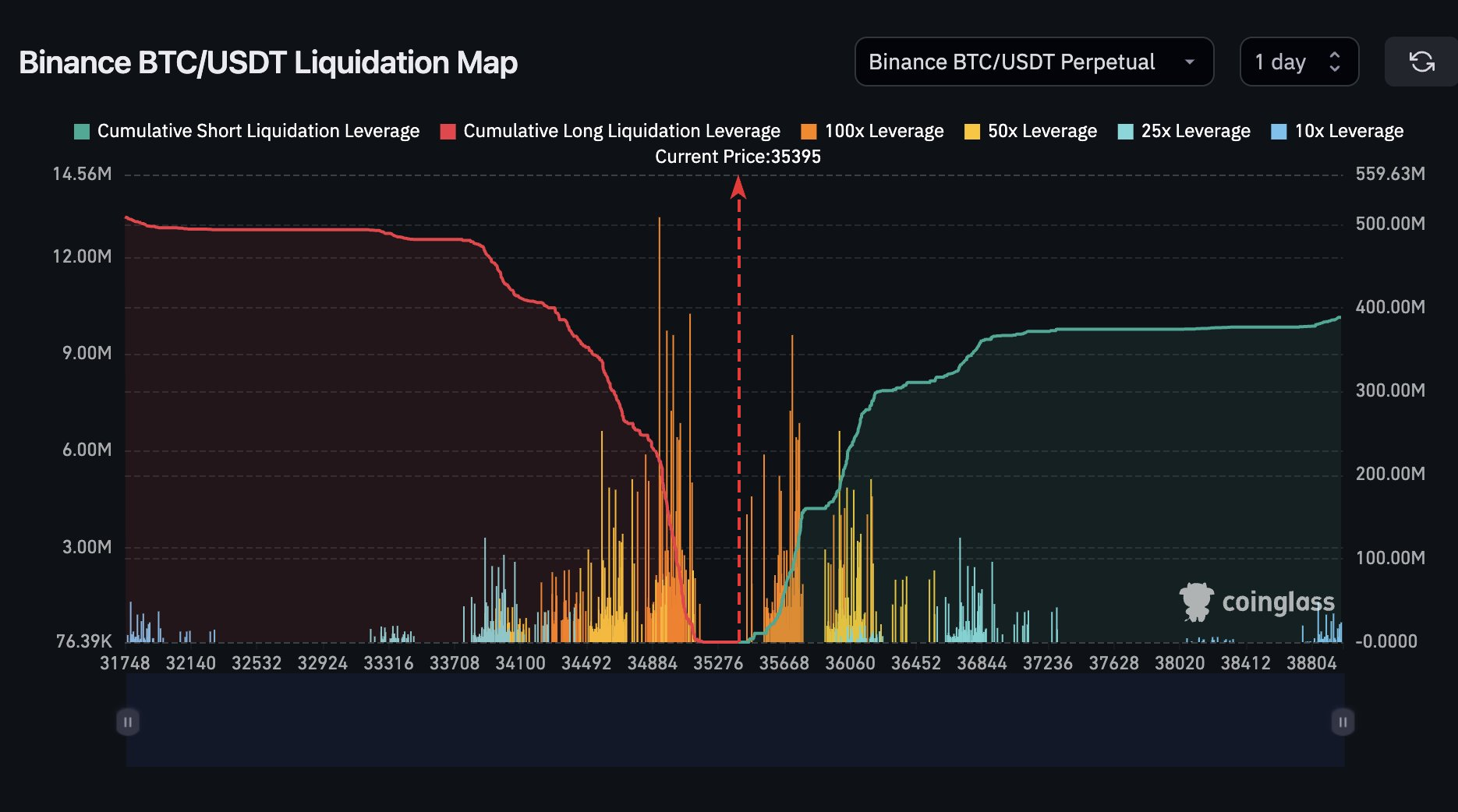

In this unfolding drama, $34,000 emerges as a potential battleground, should the market succumb to the pressures exerted by the sell-side, transforming it into a theater of speculative warfare. Daan Crypto Trades, a prominent trader, sketches lines in the sand at $35,000 and $35,700, envisaging potential liquidation clusters that could spark a dazzling short squeeze should the bulls seize the reins.

"Clear liquidation clusters located around $35K & $35.7K," he muses about Binance BTC/USDT perpetual swaps. "Expect a bit of a squeeze to occur if either of these levels are tagged."

BTC/USDT perpetual swap liquidity chart. Source: Daan Crypto Trades/X

BTC/USDT perpetual swap liquidity chart. Source: Daan Crypto Trades/X

In the grand tapestry of the current spot and perpetual status quo, the oracle-like trader Skew discerns a need for spot bidders, casting them as protagonists essential for scripting a potential sequel of market ascension.

$BTC Market Data thread

— Skew Δ (@52kskew) November 8, 2023

Binance Spot orderbook

Clear quoted range from liquidity perspective after high volume spot buying yesterday

note lack of spot volume currently

Binance Futures orderbook

very thick bid depth & high short float led to the short squeeze yesterday as… pic.twitter.com/OUzfdRdl9q

Examining the Bitcoin scenario, the most pessimistic price projection hovers around $33,700

Navigating through the most bearish contours of the Bitcoin landscape, the ever-optimistic trader and analyst Credible Crypto dismisses the notion of Bitcoin retracing below $33,700, injecting a dose of buoyancy into the unfolding narrative.

In an update to subscribers, he unveils two BTC price scenarios, with a bold proclamation that $34,500 shall stand resolute as a bastion of support.

"In my 'most bearish' low timeframe scenario, I don't expect we see below 33.7k," he asserts, weaving a tale of resilience. "In other words, regardless of how things unfold in the coming days, I believe the downside is extremely limited."

The cryptic soothsayer Credible Crypto tantalizingly hints at revelations within the next day or two, adding an element of suspense to the unfolding saga.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Zooming out to the broader canvas of longer-term BTC price perspectives, the bulls find cause for jubilation. Year-end targets, adorned with the shimmering possibility of $45,000 or more, dance on the horizon, with the impending block subsidy halving casting a hopeful glow over the digital realm.

Read more: Stablecoin Liquidity Guidelines

Trending

Press Releases

Deep Dives