Analyzing Bitcoin's Largest Public Holder: Uncovering a 26% Overvaluation, Insights from the Analyst Who Accurately Predicted BTC's Rally

Investors who entered the MicroStrategy (MSTR) market early are now faced with a crucial decision, as 10x Research, led by Markus Thielen, warns of potential overvaluation and a looming 20% decline. Thielen, known for accurately predicting this year's Bitcoin surge, emphasizes the importance of scrutinizing MSTR's current market standing.

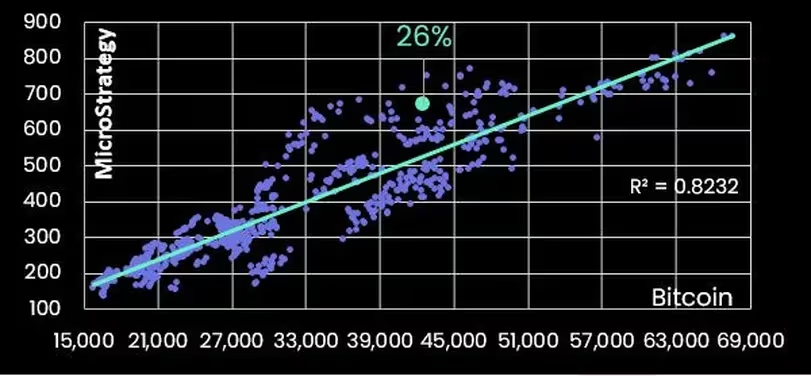

The most recent research note from 10x Research reveals a perceived overvaluation of MSTR's shares by 26%. This evaluation stems from the firm's regression model, meticulously examining the interplay between the dependent variable (MSTR) and the independent variable (BTC's spot price).

According to the regression model's findings, MicroStrategy is currently considered overvalued by +26%, with a potential 20% downside based on prevailing Bitcoin prices. In response to this analysis, 10x Research advises investors to consider taking profits at this juncture.

MicroStrategy, recognized for holding a significant amount of bitcoin, has witnessed an extraordinary surge, quadrupling its value this year to reach a 25-month peak of $673. This impressive performance positions it among the top-performing crypto-related stocks of 2023. As a Nasdaq-listed company, MicroStrategy has strategically accumulated 189,150 BTC over three years, utilizing the cryptocurrency as a reserve asset. Meanwhile, Bitcoin itself has experienced a 160% gain this year, with a 60% surge in the current quarter, primarily fueled by the spot ETF narrative.

The performance of crypto-related stocks, including MSTR and Coinbase, often serves as a barometer for institutional interest in digital assets. These listed instruments provide investors with exposure to digital assets without necessitating direct ownership.

Decoding Asset Dynamics: Unveiling a Positive Linear Relationship Through the Upward Sloping Line (Insights from 10x Research)

Decoding Asset Dynamics: Unveiling a Positive Linear Relationship Through the Upward Sloping Line (Insights from 10x Research)

Analyzing the chart featuring an upward-sloping line of best fit, drawn through a scatter plot, reinforces the positive relationship between bitcoin and MSTR. With an R² value of 0.8232, indicating that 80% of the variation in MSTR can be explained by BTC's price, the chart underscores the correlation between the two variables. The analysis, based on Thursday's closing price of $673, reveals a 20% overvaluation of MSTR relative to bitcoin's current market rate of approximately $43,000.

10x Research advocates a cautious approach, suggesting that several crypto-related stocks are trading close to fair value based on bitcoin's price. The recommendation for investors is to secure profits and trim long positions. While stocks like HIVE, HUT, and GALAXY still offer some value, according to 10x, the substantial gains in these stocks may have already been realized.

Read More: Harmonic Crypto Crescendo: A Symphony of Market Optimism

Trending

Press Releases

Deep Dives