Harmonic Crypto Crescendo: A Symphony of Market Optimism

In today's ever-evolving cryptocurrency landscape, a noticeable upswing graced the market, with Bitcoin (BTC) gracefully stepping down to $37,027, Ether (ETH) taking a gentle dip to $2,061, and Cardano (XRP), along with Solana (SOL), gracefully gliding to $54. Simultaneously, a multitude of alternative coins embarked on a rallying journey, creating a mosaic of optimism among investors as their positive sentiments towards the crypto domain reached new heights. This optimistic momentum found its orchestration in Ether, which soared to a six-month pinnacle, propelled by the confirmation of BlackRock's Ethereum ETF for the illustrious Nasdaq.

Crypto performance map. Coin360

Crypto performance map. Coin360

Now, let's immerse ourselves in the three pivotal factors orchestrating this current crypto market crescendo.

Institutional investors and fund managers are considering investments in Ether

The allure of Ether is becoming an enchanting melody for institutional investors and fund managers alike. The symphony crescendoed on November 9, as BlackRock unveiled plans for a spot Ether exchange-traded fund (ETF) through the SEC's 19b-4 form filing, resulting in Ether's price executing a 12.2% pirouette, gracefully outshining Bitcoin for the first time in months.

BlackRock's potential entrance into the Ether sphere is a harmonious note signaling the growing intrigue of institutional investors in the cryptocurrency symphony. Their participation could be the resonant chord leading to a significant capital influx into the Ether market, elegantly elevating prices.

UPDATE: BlackRock #Ethereum ETF confirmed. They just submitted a 19b-4 filing with Nasdaq pic.twitter.com/pLhuhhK7jo

— James Seyffart (@JSeyff) November 9, 2023

Beyond BlackRock's Ether ETF overture, the maestro of financial analysis, James Seyffart of Bloomberg, anticipates at least five firms tuning their instruments to seek SEC approval, suggesting a broader symphonic movement of institutional interest. This crescendo in involvement is harmonizing sentiment across the market, echoing in the options market, hinting that Ether's virtuosity may extend into the immediate future. The Chicago Mercantile Exchange (CME), a favored stage for major institutions, gracefully surpassed Binance futures on November 9, a performance heightened by the removal of $1 billion in open interest from the market.

We've now been officially insitutionalized

— JJ the Janitor (@JLabsJanitor) November 9, 2023

Notable this major regime change happens on the day that Blackrock all but confirmed their ETF will be approved

Old guard market makers carried out in body bags in both options and perps this month

The king is dead long live the king https://t.co/vuYtIOPEmB

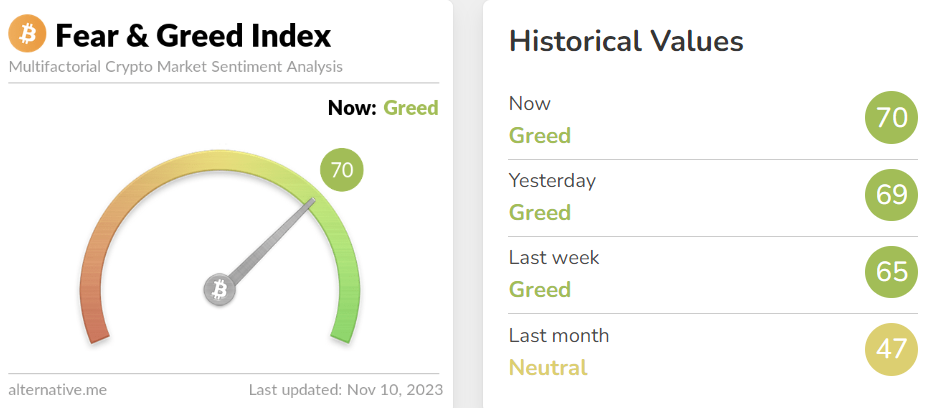

Optimism, like a gentle stream, is not only flowing in the institutional realm; retail investors are also catching the current, reflected in a 23-point rise in the Bitcoin Fear & Greed Index over the past month, akin to the rising tide lifting all boats.

Bitcoin Fear & Greed Index. Source: Alternative.me

Bitcoin Fear & Greed Index. Source: Alternative.me

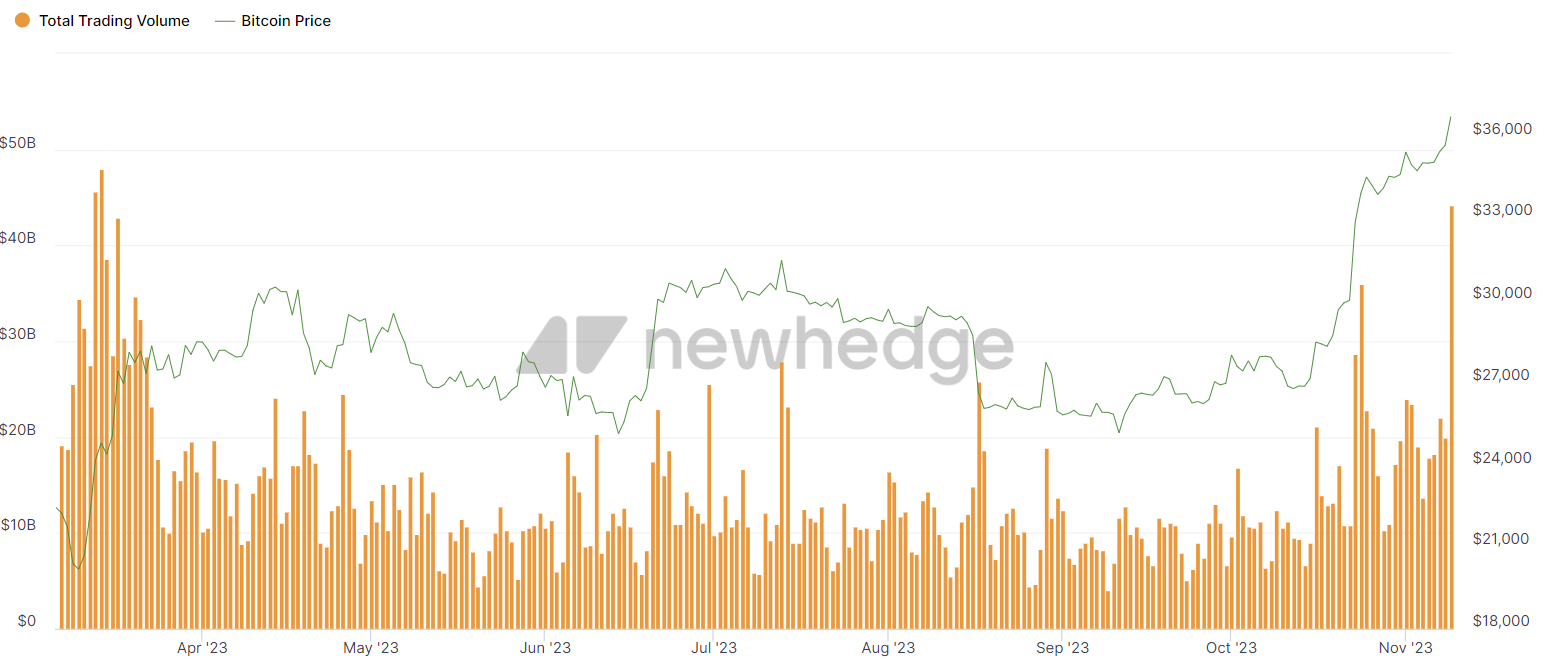

There is a significant increase in both total value locked and trading volumes

Another ripple in this crypto symphony comes in the form of heightened activity in total value locked and trade volumes. The combined trading volume of Bitcoin and the crypto market, akin to a tidal wave, reached $44.1 billion on November 9, marking the highest level since the ides of March.

Total crypto market trading volume. Source: Newhedge

Total crypto market trading volume. Source: Newhedge

This harmonious surge in trading volume harmonizes with the highest total value locked (TVL) since the whispers of June 3, rising to $46.5 billion, a crescendo marking a 3.7% increase in a 24-hour sonata.

Crypto market TVL. Source: DefiLlama

Crypto market TVL. Source: DefiLlama

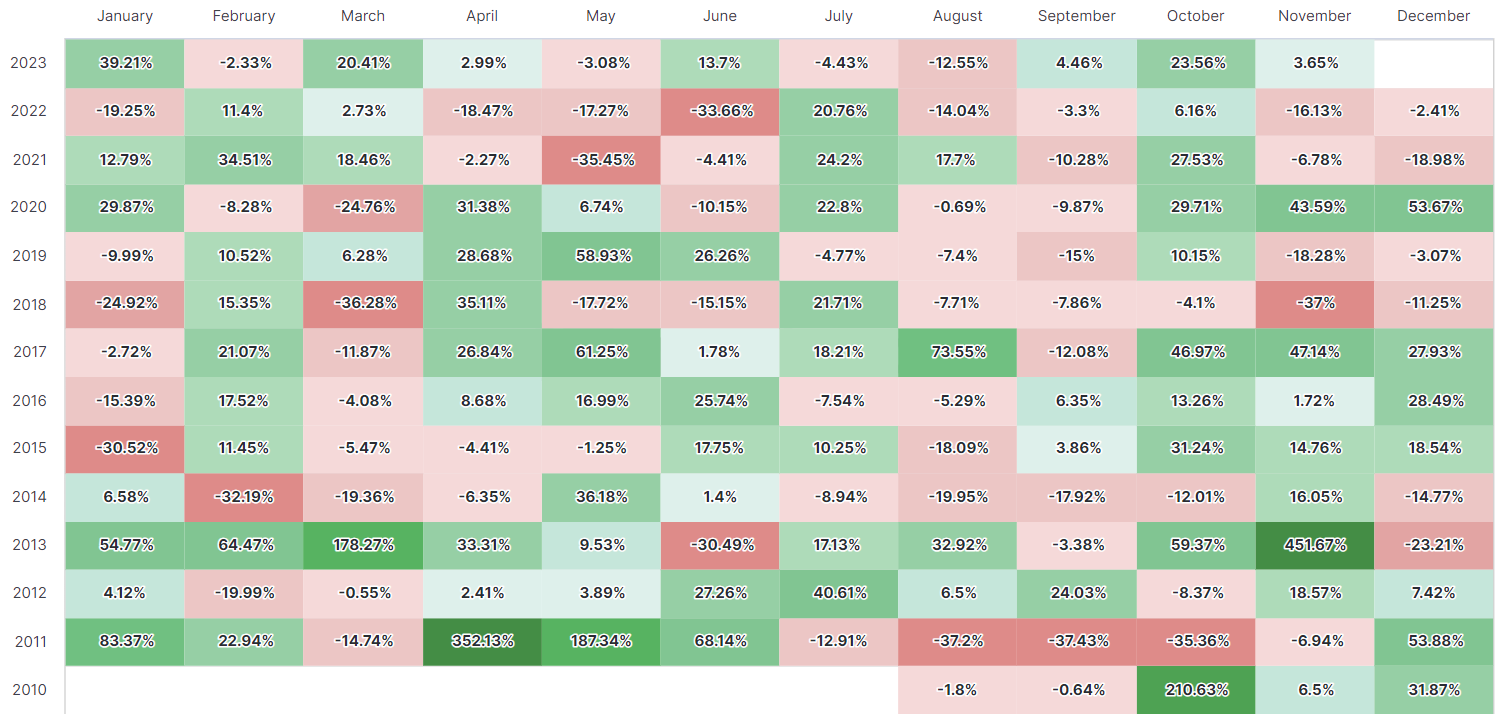

This heightened sentiment, akin to a sweet serenade, holds the promise of breaking November's two-year losing streak in returns.

Bitcoin returns by month. Source: Newhedge

Bitcoin returns by month. Source: Newhedge

Despite the looming clouds of risk events casting shadows on Bitcoin and altcoins, the crescendo of institutional interest and heightened trading volumes paints a promising symphony that whispers of the potential end of the bear market.

In conclusion, while the current institutional overture adds a melodic short-term cadence to crypto prices, the market's response to regulatory crescendos or economic diminuendos will ultimately shape its destiny, hinting at the likelihood of continued undulations and harmonies in the crypto markets.

Read more about: Bitcoin Odyssey: Navigating the Ripple Effect of Demand Surges and Market Metamorphosis

Trending

Press Releases

Deep Dives