- Home

- Latest News

- Aave Community's Decision: Embracing PayPal's Stablecoin Integration through Collective Vote

Aave Community's Decision: Embracing PayPal's Stablecoin Integration through Collective Vote

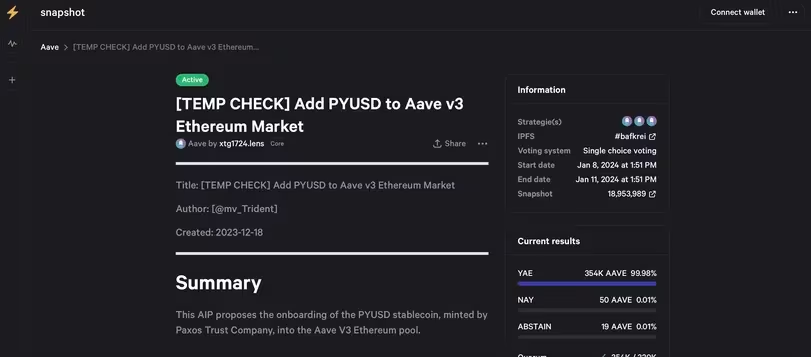

The ongoing voting process within the Aave community strongly endorses the integration of PayPal's PYUSD stablecoin into Aave's Ethereum pool. Aave, a decentralized lending and borrowing protocol, is actively utilizing its decentralized governance to make decisions regarding the inclusion of PayPal's stablecoin, PYUSD, issued by Paxos Trust Company.

As the voting unfolds, an overwhelming 99.98% of AAVE token holders participating in the process express their preference for integrating PYUSD into Aave's Ethereum-based pool. Initiated by Trident Digital on December 18, the voting initiative, termed a "temperature check," is expected to conclude today. This decision aligns with Curve's recent decision in December to host PYUSD on its decentralized exchange.

PYUSD, a stablecoin pegged to the U.S. dollar, made its debut in August and has rapidly gained traction, boasting a market capitalization of $289 million. Although this constitutes only 0.3% of the market cap of the industry-leading tether, which stands at $94 billion, the growth of PYUSD is noteworthy.

Aave holds a prominent position as a decentralized finance (DeFi) protocol, providing users the ability to lend and borrow funds without intermediaries. According to DappRadar, AAVE ranks as the world's third-largest DeFi solution, with nearly $5 billion in crypto assets secured within its protocol.

Resounding Support: AAVE Token Holders Overwhelmingly Back PYUSD Integration in Aave's Decentralized Finance Ecosystem

Resounding Support: AAVE Token Holders Overwhelmingly Back PYUSD Integration in Aave's Decentralized Finance Ecosystem

The proposed integration of PYUSD into Aave, presented by Trident, aims to create synergies between Aave and PayPal's stablecoin. Trident believes this integration will enhance the relationship between PYUSD and Aave's decentralized multi-collateral stablecoin, GHO.

In the governance proposal chat, Trident, incentivizing the PYUSD/USDC liquidity pool on Curve, commits to providing a substantial liquidity contribution of $5 million to $10 million for PYUSD on Aave from day one, the firm said in the governance proposal chat. The firm's strategy revolves around maintaining high yields on Curve to stimulate organic borrowing demand for PYUSD on Aave. While direct incentives on Aave are not part of their plan, Trident believes their overall incentive strategy will drive borrowing demand from the outset.

This initiative signifies a strategic move within the decentralized finance space, positioning Aave and PayPal's stablecoin for collaborative growth and increased utility within the crypto ecosystem.

Read More: Circle's Bold Leap into Web3: Revolutionizing Decentralized Finance with Perimeter Protocol

Trending

Press Releases

Deep Dives