Binance Witnesses Temporary USDC Stablecoin Depreciation, Plummeting to $0.74

The stability of the USDC stablecoin on the Binance platform faced a brief challenge but swiftly restored its $1 peg.

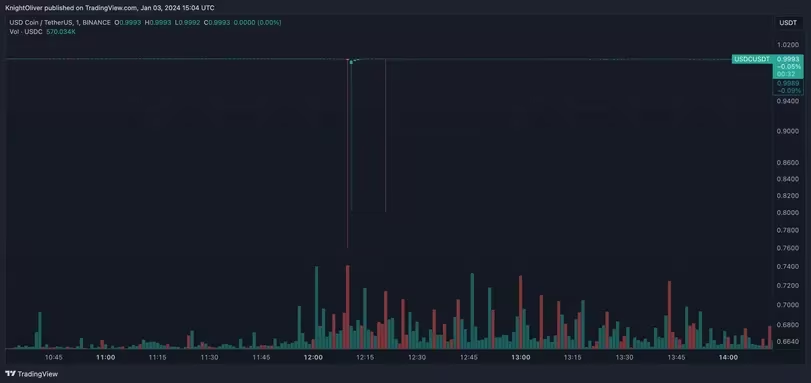

Today, Circle's USDC, a stablecoin tethered to the US dollar, underwent a temporary dip, hitting as low as $0.74 on three separate occasions. This decline was a consequence of a broader market sell-off triggered by uncertainties surrounding the potential approval of a spot bitcoin (BTC) ETF this month.

Between 12:10 and 12:21 UTC, USDC encountered three intermittent declines, reaching $0.74, $0.80, and $0.79 against its tether (USDT) trading pair on Binance. Remarkably, the price promptly bounced back to $1 on all three occasions. Such fluctuations often occur when traders sell USDC for USDT, and there's insufficient liquidity to maintain the $1 peg.

Analyzing the USDC/USDT Chart on TradingView: Insights into Market Fluctuations and Stability Trends

Analyzing the USDC/USDT Chart on TradingView: Insights into Market Fluctuations and Stability Trends

Examining the market depth for the USDC/USDT pair on Binance, there's a 2% imbalance, with $26 million in buy orders up to $1.02 and $6.1 million in sell orders down to $0.98, according to CoinMarketCap. This suggests that if a trader executes a sell order exceeding $6.1 million, the price could dip below $0.98. At 12:10 UTC, the trading volume reached $6.2 million, followed by $4.3 million at 12:21 UTC.

A report from Matrixport, anticipating the SEC's rejection of several spot bitcoin ETF applications this month, resulted in the liquidation of over $500 million in derivative positions.

It's crucial to note that this trading pair has experienced occasional minor depegs in recent months, with none exceeding a 4% deviation in either direction. The last notable depeg for USDC took place in March after the collapse of a Silicon Valley bank, leading it to trade at $0.86. This incident unfolded following revelations that Circle had funds backing the stablecoin held at the distressed bank.

Read More: India Takes Stringent Measures: Blocks URLs of 9 Offshore Exchanges, Including Binance, Following Compliance 'Show Cause' Notices

Trending

Press Releases

Deep Dives