Wintermute Witnesses a Whopping 400% Surge in Crypto OTC Trading Amidst 2023

In the dynamic landscape of cryptocurrency trading, Wintermute, a prominent market maker and liquidity provider, emerged as a key player attributing the surge in over-the-counter (OTC) trading to a notable migration of volumes away from traditional exchanges. The year 2023 witnessed a multi-year low in crypto trading volume, characterized by significant declines on exchanges during the crypto winter. However, the overall trading activity managed to maintain its robustness.

Wintermute's recent report shed light on an extraordinary 400% increase in OTC volume throughout the year, signaling a clear trend of trading volumes shifting away from conventional exchanges. The initial half of 2023 experienced a dip in Wintermute's OTC trading volume, while the number of individual trades remained consistent. Contrasting this, the latter half of the year showcased a remarkable surge, with the number of unique trades escalating sixfold to 29 million, and weekly OTC volume reaching an impressive $2 billion.

According to insights shared by Evgeny Gaevoy, the CEO and Co-Founder of Wintermute Group, the industry confronted a challenging outlook as 2022 drew to a close. Sluggish markets, diminished liquidity, and a noticeable migration of volumes from exchanges to OTC were key observations. Liquidity, a vital component in cryptocurrency trading, defines the ease with which substantial orders can be executed without significantly impacting market prices. The enduring lack of liquidity in exchanges throughout 2023 propelled numerous institutional traders towards OTC desks.

Despite Bitcoin's remarkable 150% rally throughout the year, the market grappled with the persistent challenge known as the 'Alameda Gap' in liquidity.

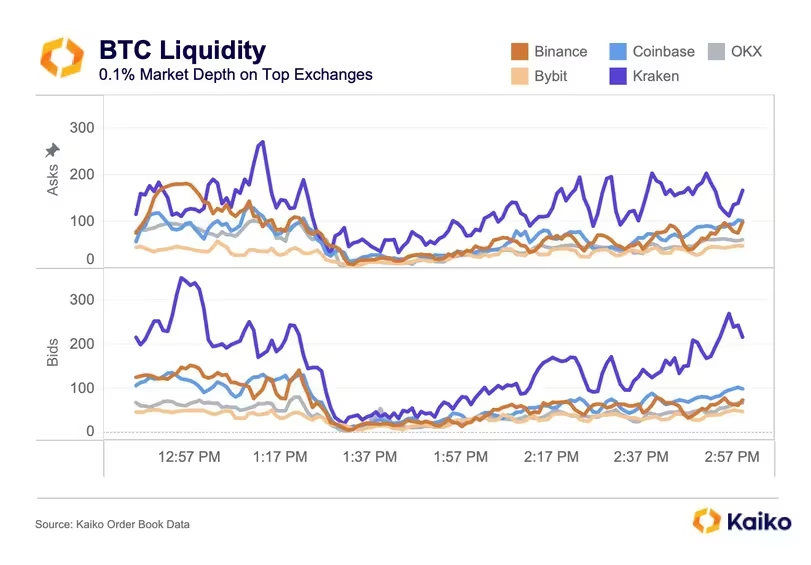

Market Turbulence: A Deep Dive into the Drastic Decline of Liquidity on Major Exchanges (Kaiko Analysis) Binance, recognized as the world's largest crypto exchange, encountered significant hurdles linked to liquidity. In November, the liquidity available in its order book plummeted by 25%, further compounded by a $4 billion settlement with U.S. authorities and the subsequent resignation of its CEO, Changpeng 'CZ' Zhao. This tumultuous backdrop underscored the ongoing complexities faced by the cryptocurrency market and the consequential shifts in trading dynamics.

Market Turbulence: A Deep Dive into the Drastic Decline of Liquidity on Major Exchanges (Kaiko Analysis) Binance, recognized as the world's largest crypto exchange, encountered significant hurdles linked to liquidity. In November, the liquidity available in its order book plummeted by 25%, further compounded by a $4 billion settlement with U.S. authorities and the subsequent resignation of its CEO, Changpeng 'CZ' Zhao. This tumultuous backdrop underscored the ongoing complexities faced by the cryptocurrency market and the consequential shifts in trading dynamics.

Read More: Binance Witnesses Temporary USDC Stablecoin Depreciation, Plummeting to $0.74

Trending

Press Releases

Deep Dives