- Home

- Cryptocurrency

- Whale Tales: Resurfacing Fortunes in Crypto Seas

Whale Tales: Resurfacing Fortunes in Crypto Seas

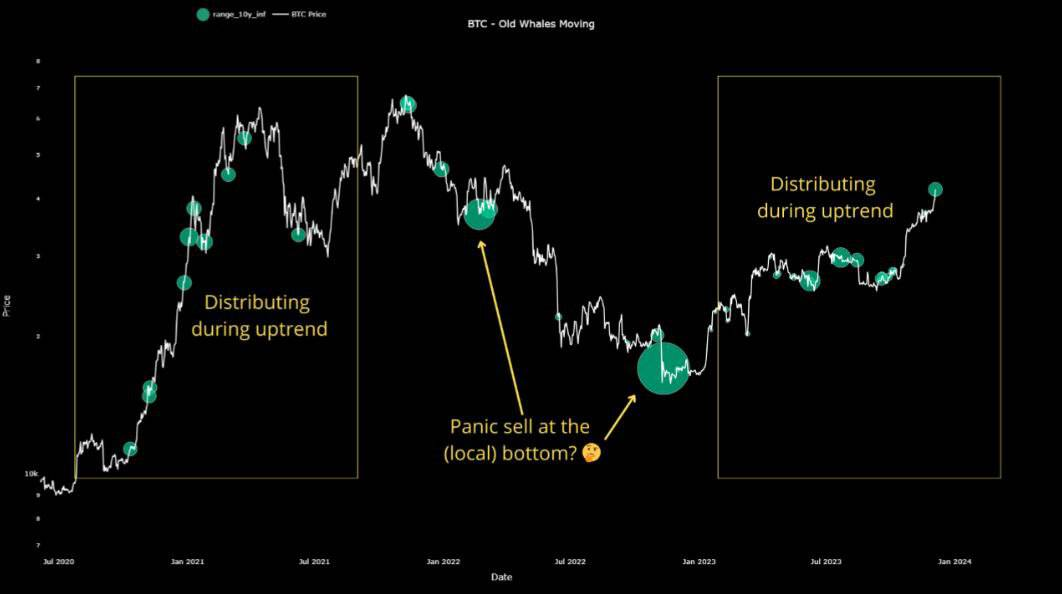

In the midst of the current market dynamics, there has been a notable resurgence of "veteran whales," harkening back to patterns reminiscent of the bullish market observed in 2021.

Caught in the analytical spotlight of CryptoQuant's discerning analyst 'Maartun'n, a recent transaction on December 5th involving 1000 bitcoins, which had remained inert for over a decade, has stirred the waters of market conversation.

The resurgence of older whales indicates parallels with the bullish trend observed in the 2021 market surge

Drawing intriguing parallels to the 2021 Bull Run through the reactivation of these aging whales, the engagement within the community has been sparked by the activation of wallets holding these long-forgotten BTC after a substantial decade-long slumber.

Coins, often aging into inactivity due to loss, take on a mystique of dormancy. Some, whether forgotten or lost, resurface, prompting a decision by the discoverer, be it the original owner or not, to either promptly sell for profit or strategically await the opportune market timing to gracefully unload the Bitcoin.

Adding a layer of intrigue, this event is not isolated but part of a series, with the crypto intelligence firm's analyst uncovering over 13 similar transactions in recent months. Interestingly, these transactions align with a bullish trend in Bitcoin, fueled by the optimistic aura surrounding the potential introduction of an ETF.

This intriguing trend reflects the 2021 bull market, characterized by a surge in Bitcoin's value and a plethora of transactions involving Bitcoins aged over a decade. It appears that the current market is undergoing a phase reminiscent of the observed trends in 2021.

Source: CryptoQuant

Source: CryptoQuant

Delving deeper into the data, two substantial transactions indicative of panic selling, involving 2200 and 3741 BTC, respectively, emerge. These transactions unfolded during a pronounced downturn in Bitcoin's value, hinting at a correlation between the movements of older BTC and the prevailing market sentiment during challenging periods.

Recent weeks have witnessed a reawakening of several Bitcoin wallet addresses after years of dormancy. On November 30, a dormant whale stirred the waters by relocating its entire stash of 3,623 BTC – valued at approximately $137 million – to two new wallets. Prior to this, three Bitcoin whale addresses orchestrated a grand movement, transferring a total of 6,500 Bitcoins to new wallets, boasting a combined value of around $230 million.

Bitcoin whales entering a 'risk-on mode' and embracing a higher-risk stance

Beyond the mysterious undercurrents of previously inactive addresses, whales, in a broader context, have been actively engaged in an accumulation spree since August, injecting a subtle element of liquidity into the market.

Ki Young Ju, the perceptive co-founder and CEO of CryptoQuant, has keenly observed that Bitcoin whales have shifted into a "risk-on mode," signaling a bullish market sentiment by orchestrating the transfer of BTC to derivative exchanges. These whales have strategically initiated long positions, particularly when Bitcoin (BTC) was valued at $29,000.

The executive sheds light on the fact that numerous whales entered the market during a cyclical low for BTC, aligning with the November 2022 collapse of the FTX crypto exchange. This is discernible in the heightened activity of crypto transfers to derivative trading platforms during that period, adding a nuanced dimension to the narrative of market dynamics.

You might also like: Crypto Surge: Altcoins Shine in December Rally

Trending

Press Releases

Deep Dives