- Home

- Latest News

- Binance Witnesses Bitcoin Reserve Decline Amidst Retail Shift to Coinbase: CryptoQuant

Binance Witnesses Bitcoin Reserve Decline Amidst Retail Shift to Coinbase: CryptoQuant

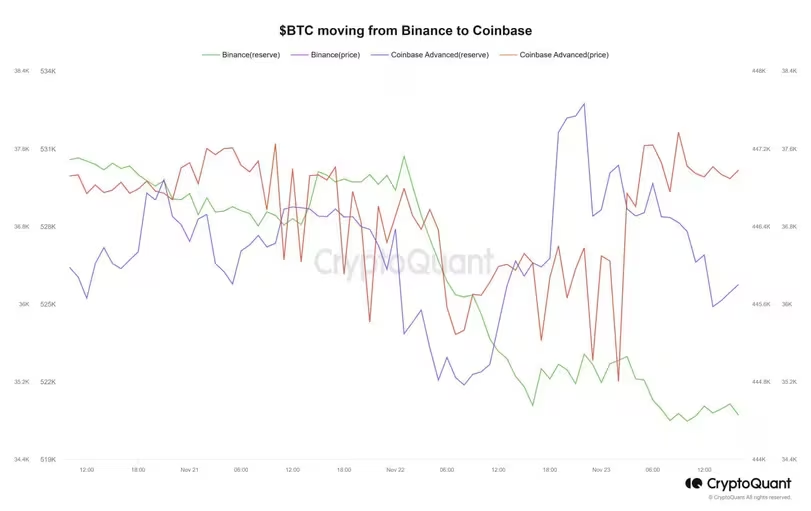

Bitcoin (BTC) is undergoing a notable shift from Binance to Coinbase, according to on-chain data analyzed by CryptoQuant. In the past 24 hours, Coinbase's reserves have seen a significant increase of around 12,000 BTC, while Binance's reserves have concurrently decreased by 5,000 BTC. This key insight has been highlighted in a recent communication from the research firm.

CryptoQuant

CryptoQuant

Bradley Park, CryptoQuant's Web 3 analyst, pointed out the decrease in Bitcoin reserves on Binance, attributing it to retail outflows. Park conveyed this observation in a note to Bitsday, emphasizing the visible movement of funds from Binance to Coinbase.

Greta Yuan, the head of research at VDX, a Hong Kong-based digital asset platform, provided additional perspective on market dynamics. Yuan suggested that the decline in Bitcoin reserves on Binance could be linked to ongoing concerns about the platform's recent legal challenges. In the short term, Yuan expects a trend where users transfer their funds to exchanges that are compliant or licensed, seeking a higher level of security.

Yuan expressed confidence in Coinbase, stating,

"Coinbase has stood the test of time,"

underscoring the platform's enduring reputation and reliability in the market.

Market analysts point to the recent settlement between Binance and the U.S. Department of Justice as a significant factor influencing the movement of funds. Some experts believe that this settlement removes a crucial obstacle to the approval of a spot Bitcoin ETF. Matrixport, a crypto services provider, highlighted that expectations for a spot Bitcoin ETF may have surged to 100% with the conclusion of the plea deal, as the industry is expected to adhere to regulatory standards comparable to traditional financial firms.

CryptoQuant's data highlighted a withdrawal of 1,000 BTC from Coinbase, with Park suggesting that this transaction represents an

"institutional over-the-counter (OTC) trade and can be seen as anticipation of the approval of ETFs."

Throughout the year, CryptoQuant's data consistently indicates a decline in exchange reserves of Bitcoin, generally considered a bullish trend. However, some analysts acknowledge a diminishing trust in centralized exchanges since the collapse of FTX last year. Investors are reportedly diversifying and opting for alternative storage solutions for their holdings in response to these concerns.

Read More: Crypto Traders Embrace Bitcoin Upside Options Post Binance's Guilty Plea

Trending

Press Releases

Deep Dives