- Home

- Blockchain

- Unleashing DeFi's Potential: Exploring On-Chain Structured Products Frontier

Unleashing DeFi's Potential: Exploring On-Chain Structured Products Frontier

During the prior bullish market phase, there was a surge of on-chain structured products. Jordan Tonani, a representative from The Index Coop, anticipates an even greater influx of investment into these ventures during the upcoming bull run.

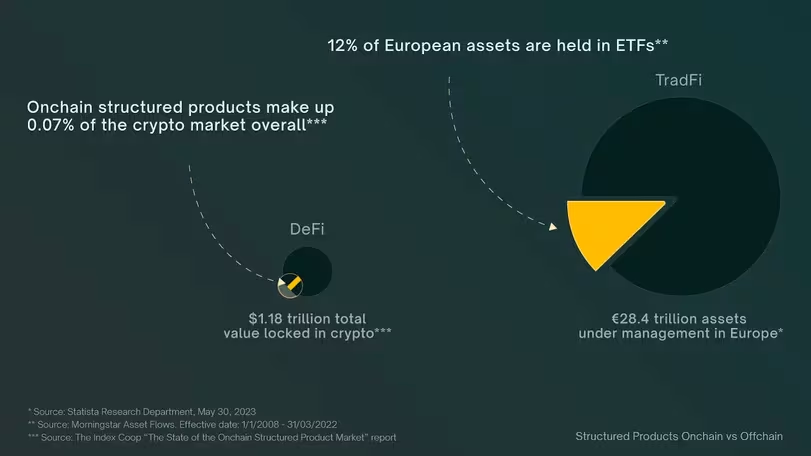

On a global scale, the asset management sector commands significant influence. A substantial portion of each country's assets are managed through vehicles such as exchange-traded funds (ETFs), index funds, and other passive financial instruments. In Europe, this industry oversees an astounding €28.4 trillion in assets, with 20% of these assets earmarked for passive investment strategies. This allocation is fairly evenly split between exchange-traded products and index funds. Notably, passively managed assets have doubled in volume since 2015, with approximately one-fifth of European retail investors holding such products. Analysts project that by 2027, ETFs will make up 24% of total assets in Europe, a significant rise from the 12% recorded in 2022. In the realm of decentralized finance and digital assets, some industry observers liken the on-chain structured product market to the traditional asset management sector. However, the on-chain structured product market has yet to capture a substantial market share, currently representing only 0.07% of the overall cryptocurrency market, with a combined Total Value Locked (TVL) of $2.46 billion across various blockchain protocols. In contrast, the DeFi market boasts a TVL of $48.29 billion, while the total cryptocurrency market capitalization stands at $1.18 trillion.

Nonetheless, in recent years, on-chain structured products, including index tokens and strategy tokens, have demonstrated potential similar to that which led to the dominance of similar products in traditional financial markets. In 2020, the on-chain structured product market saw the introduction of 20 projects, including nine that emerged during the period now known as "DeFi Summer." Platforms like Yearn, Compound, and the Index Coop began offering such products during this time. At the height of the 2021 bull market, Index Coop's on-chain structured products accumulated over $550 million in TVL.

In total, 47 projects have ventured into the on-chain structured product space since 2016, with the majority focusing on index products or yield-generating strategies. Of these, 37 projects remain operational. The Index Coop maintains an optimistic outlook regarding the long-term potential of on-chain structured products, citing their advantages in transparency, security, accessibility, automation, and liquidity. Unfortunately, the sector has faced hurdles arising from regulatory uncertainties and the early stage of technology and market infrastructure. Nevertheless, promising developments have recently emerged. The potential approval of BlackRock's Bitcoin ETF and Grayscale's Ethereum ETF in the United States would signify a major milestone for the on-chain structured product sector.

As digital asset markets continue to mature, it is expected that the on-chain structured product market will experience further growth, especially as correlations between digital assets decrease. Currently, high correlation among digital assets results in them moving in tandem, diminishing the effectiveness of diversification strategies. As digital assets become less correlated, diversification is likely to become a more attractive strategy. Additionally, enhancements in user experience and cross-chain infrastructure could further contribute to the expansion of this space. In the long run, on-chain structured products are anticipated to thrive due to their unique advantages, enabling underlying tokens to reach a broader audience.

For more in-depth insights into the on-chain structured product space, readers are encouraged to peruse our comprehensive annual industry report.

Read More: Blockchain Breakdown: Bitcoin's Rollercoaster Ride and the Road Ahead

Trending

Press Releases

Deep Dives