Tesla's Unchanged Bitcoin Holdings and AI Advancements

Tesla, the renowned electric vehicle manufacturer, made no adjustments to its substantial Bitcoin (BTC) holdings for the fifth consecutive quarter, maintaining its stance in the cryptocurrency market. However, the company strategically allocated additional funds to bolster its computational capabilities, a move that is in alignment with its continuous endeavors in the realm of artificial intelligence.

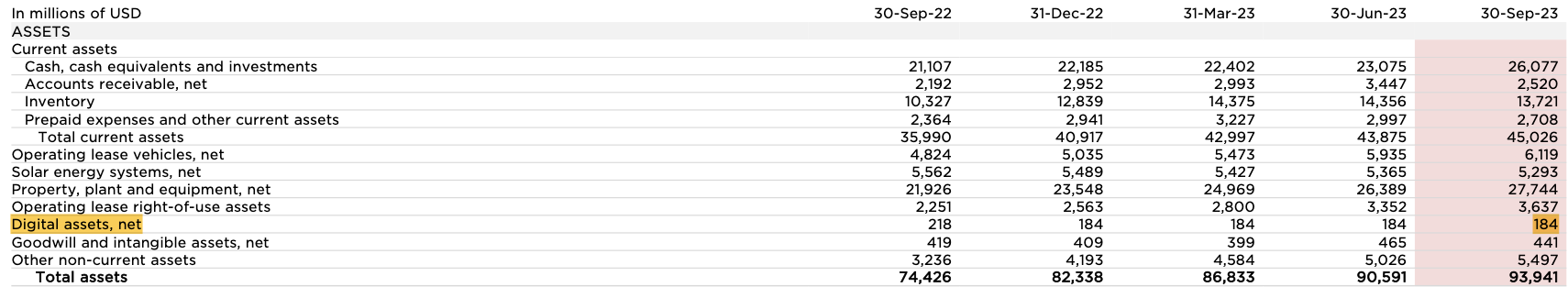

The quarterly financial report for Tesla's Q3 2023, unveiled on October 18, unveiled that as of September 30, the company retained digital assets with a valuation of $184 million. This figure constitutes a portion of the $1.5 billion worth of Bitcoin it initially procured back in March 2021. Significantly, it's worth noting that Tesla has refrained from participating in any Bitcoin transactions since its sizable sell-off in Q2 2022, a transaction that yielded $936 million from the liquidation of over 30,000 BTC.

Excerpt of Tesla’s Q3 2023 balance sheet with its digital asset holdings highlighted. Source: Tesla

Excerpt of Tesla’s Q3 2023 balance sheet with its digital asset holdings highlighted. Source: Tesla

In an intriguing development, Tesla disclosed an enhancement in its computational capabilities, highlighting that it had "more than doubled the size" of its computational power dedicated to its ongoing AI projects. This expansion was attributed to the broadening of its training data sets and the pivotal transition in the training methodology of its humanoid robot, Optimus, shifting from conventional software coding to a more AI-centric approach.

Tesla's report elucidated, "We have engaged one of the world's most powerful supercomputers to accelerate the pace of our AI development, resulting in a substantial increase in computational capacity compared to Q2."

However, Tesla's financial performance in the third quarter fell short of Wall Street's expectations, reporting total revenues of $23.35 billion. While this did represent an uptick of nearly 9% from the preceding year, it missed the mark of the $24.38 billion forecasted by Zacks Investment Research.

The company also fell short of the projected profit figures, with reported earnings per share (EPS) at $0.66, compared to Zacks' estimate of $0.72 EPS. Furthermore, the total operating expenses for the third quarter amounted to $2.41 billion, marking a substantial increase of over 13% from the prior quarter and a staggering 42.5% rise from the previous year.

Tesla's research and development expenditures for the quarter amounted to $1.16 billion, representing a substantial 58% increase compared to the previous year. These augmented expenses were directly attributed to the vigorous development of the "Cybertruck, AI, and other R&D projects."

Tesla (TSLA) shares continued to fall after the bell to a low of $230.19. Source: Google Finance

Tesla (TSLA) shares continued to fall after the bell to a low of $230.19. Source: Google Finance

Consequently, Tesla's stock experienced a decline of nearly 4.8% during the day, ultimately closing at $242.68. Subsequently, in after-hours trading, the stock dipped a further 4.25%, reaching a value of $232.37, as indicated by data sourced from Google Finance.

Read more: Bitcoin's Trailblazing Path: Snowden's Insights

Trending

Press Releases

Deep Dives