Crypto Reacts: Inflation Impact on Bitcoin

Bitcoin, often represented by the ticker BTC, experienced a downturn, touching the figure of $26,878. This dip occurred as it hovered in the vicinity of the significant $26,800 mark, just before the opening of Wall Street on October 12. The decline was attributed to unexpected inflation data emerging from the United States.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

BTC price responds to unexpected CPI increase

Interestingly, the cryptocurrency's price remained relatively stable, despite hitting a two-week low on October 11, as indicated by data from TradingView. The downward movement seemed to be a response to the Consumer Price Index (CPI) surpassing the predicted values, which indeed caught the market off guard.

Moving on to October 12, the CPI for September was reported to be at 3.7% year-on-year, surpassing the initially anticipated 3.6%. A deeper analysis, excluding food and energy, revealed a tally of 4.1%, aligning well with earlier forecasts. This inflationary trend was confirmed through an official press release from the U.S. Bureau of Labor Statistics.

In response to this development, The Kobeissi Letter, a notable financial commentary resource, emphasized the intricate position of monetary policy and the Federal Reserve. The unexpected rise in the Personal Consumption Expenditures (PCE) and Producer Price Index (PPI) inflation, coupled with CPI inflation exceeding expectations, raised the question of whether the Fed could consider reducing interest rates in the near future.

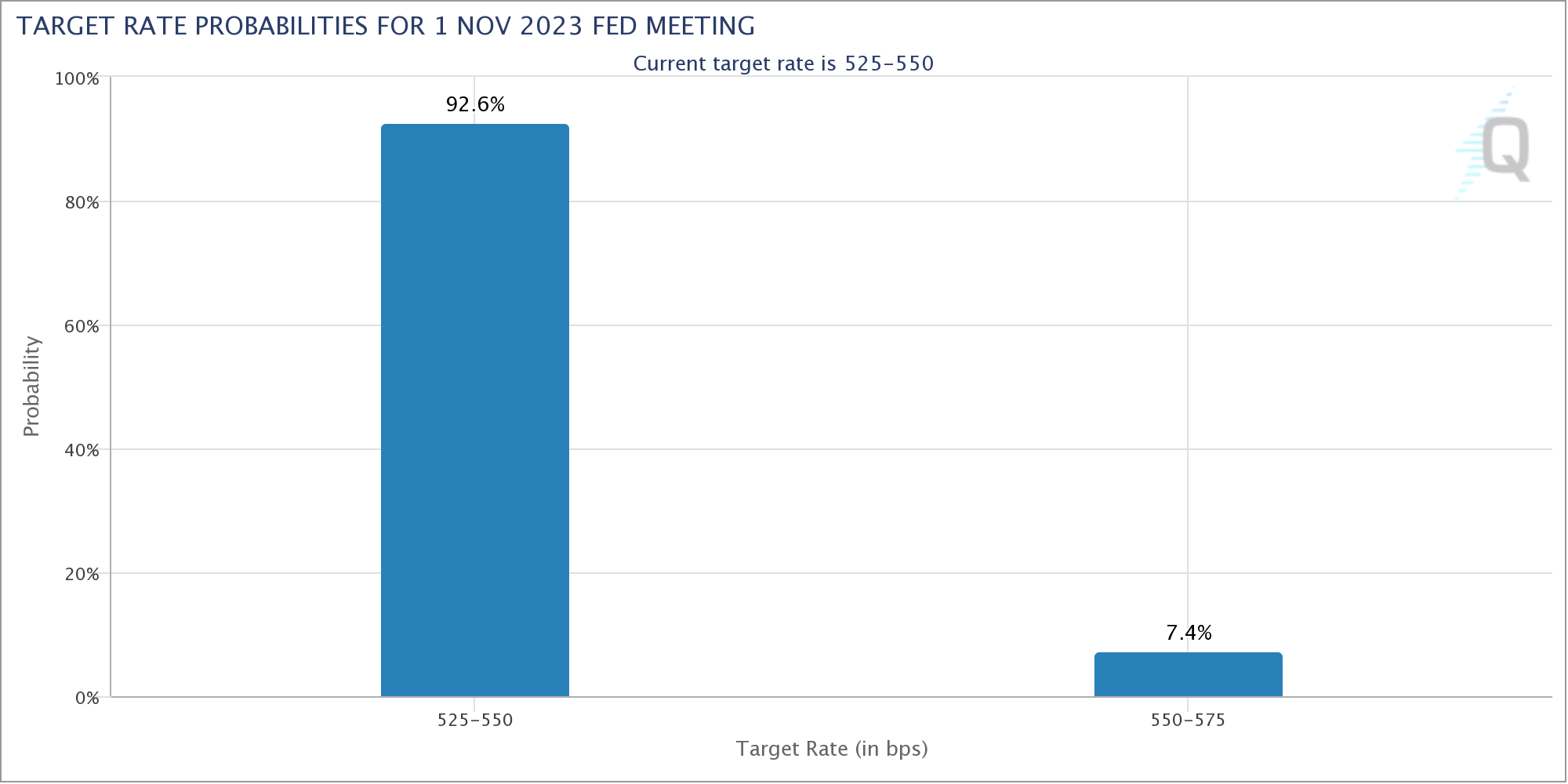

One interesting aspect to consider is the expectation of "higher for longer" U.S. interest rates. This expectation is broadly anticipated to exert pressure on risk assets, notably impacting the crypto market. Despite the CPI data, the likelihood of the Fed further raising rates at the next meeting of the Federal Open Market Committee (FOMC) on November 1 seemed minimal, according to data from CME Group’s FedWatch Tool.

Fed target rate probabilities chart. Source: CME Group

Fed target rate probabilities chart. Source: CME Group

Analyst's view on Bitcoin in the context of the macroeconomy: "Negative outcomes correlate"

Now, transitioning to the realm of Bitcoin itself, market participants didn't harbor much optimism regarding an immediate upward shift. The zone around $26,800 was identified as crucial for the bullish forces to establish a firm support base, as astutely pointed out by the popular trader Skew.

$BTC 4H

— Skew Δ (@52kskew) October 12, 2023

CPI later today going to see how LTF structure develops

clear 4H demand area here & $26.8K remains important for control

If buyers can reclaim & hold $26.8K will look for some kind of 4H EMA trend test or reclaim

staying more cautionary till confirmations pic.twitter.com/58BKDZyLBj

Material Indicators suggested a concerning lack of bid liquidity beyond $24,750, a significant level dating back to the past two quarters.

Looking at #BTCUSDT on #FireCharts < 30 mins ahead of today's Economic Reports 3 things stand out:

— Material Indicators (@MI_Algos) October 12, 2023

1. Bid liquidity laddered down to the LL at $24,750

2. Yellow stopped their TWAP sell strategy

3. Purple Whales have been selling pic.twitter.com/4cant18F4o

Delving into a broader economic perspective prior to the CPI release, co-founder Keith Alan expressed a degree of skepticism regarding its impact on BTC price. Meanwhile, QCP Capital, a reputable trading firm, noted a persistent downward trajectory for both Bitcoin and Ethereum (ETH), despite the potential bullish factors anticipated in the fourth quarter. The hope was that their relative underperformance might, in turn, mitigate downside risk, especially in the event that the CPI report unveiled stronger-than-expected figures. Notably, key levels of $25-26k on the downside and $29-30k on the upside were highlighted as critical junctures in determining the course of the market in the near future.

Read more about: Cryptic Moves: FTX Hack Saga

Trending

Press Releases

Deep Dives