Tech Turmoil and Crypto Surge

The release of various earnings reports on October 25 has brought about a significant setback for the leading seven technology giants, causing the collective loss of over $280 billion from their combined market value. This has prompted concerns and apprehensions about the potential emergence of a technology market recession, leading many to question the stability of the tech sector.

These distinguished seven tech companies, often playfully dubbed the "magnificent seven," encompass Apple, Microsoft, Meta, Amazon, Alphabet, Nvidia, and Tesla. Together, they constitute a significant portion, approximately a quarter, of the S&P 500 index's total worth, underscoring their importance in the broader market landscape.

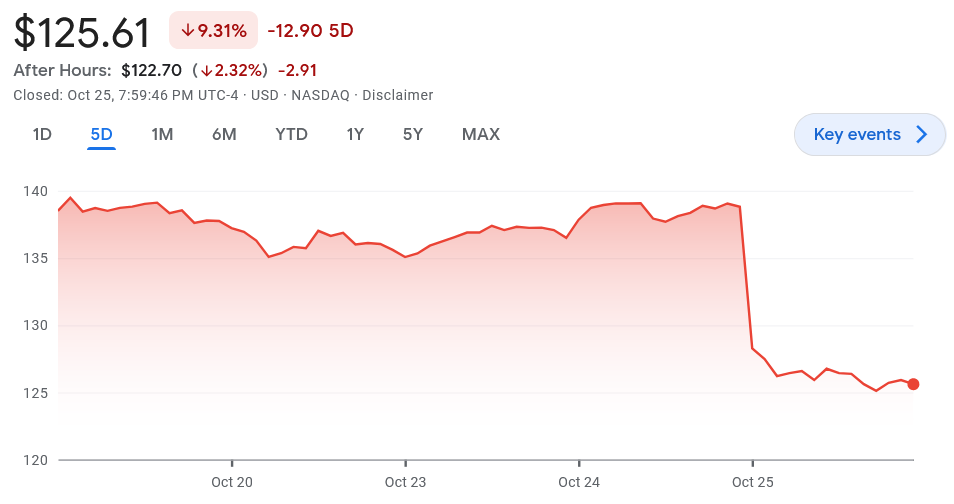

Alphabet, the parent company of Google, has experienced a substantial decline in its stock price, plummeting by more than 9%. This resulted in a staggering $180 billion loss in market capitalization, marking Google's poorest performing day since the onset of the COVID-19 pandemic in March 2020.

Google’s (Alphabet Inc Class A) share price over the last five days. Source: Google Finance

Google’s (Alphabet Inc Class A) share price over the last five days. Source: Google Finance

According to data from Y Charts, Amazon, Nvidia, and Meta observed drops of 5.5%, 4.3%, and 4.2% in their share prices, respectively. These figures reflect a broader pattern of decline in the tech sector that is causing consternation among investors.

In contrast, Apple and Tesla's stock prices experienced milder decreases, with losses amounting to 1.35% and 1.9%, respectively. Microsoft, on the other hand, bucked the trend by registering a 3.1% increase in its share price following a better-than-anticipated growth report in its Azure business division. This slight upward movement in Microsoft's stock provides a glimmer of hope amidst the otherwise somber tech landscape.

The broader consequence of this widespread technology sell-off has been a five-month low for the S&P 500, as noted by Kobeissi. Investors and market participants are grappling with uncertainty as they witness a downturn in the very stocks that have propped up the entire market, thus raising questions about the health and resilience of the technology sector. This growing unease among investors could potentially lead to a downturn, as tech stock investors may now be considering the possibility of an impending recession, leading to a more cautious approach.

Reflecting these concerns, Google search trends have exhibited a 233% surge in searches for the term "stock market crash" over the past week, as reported by Andrew Lokenauth of TheFinanceNewsletter.com. This growing interest in such a term underscores the pervasive sense of apprehension in the financial markets.

Google searches for Stock market crash up 233% in past week.

— Andrew Lokenauth | TheFinanceNewsletter.com (@FluentInFinance) October 24, 2023

If the stock market crashed 10%, what stocks are you investing in? pic.twitter.com/TQz8tVyL5U

In stark contrast, the cryptocurrency market has demonstrated a more optimistic trajectory, buoyed by hopes of potential approvals for spot Bitcoin exchange-traded funds (ETFs) in the United States. The market capitalization has surged by an impressive 16.3%, reaching a total of $1.3 trillion in the past week, according to CoinGecko. This surge in market value, while not entirely immune to external factors, provides a glimmer of positivity amidst the tech sector's woes.

Particularly, Bitcoin (BTC), Ether (ETH), Binance Coin (BNB), and XRP have seen significant increases of 23.3%, 16.7%, 8%, and 15.2%, respectively, over the last seven days. These numbers represent a stark contrast to the downward trend in tech stocks, offering a potential refuge for investors seeking higher returns and diversification.

Nonetheless, the cryptocurrency market has not proven to be invulnerable to challenging macroeconomic conditions. When the United States saw a decline in real gross domestic product over the first two quarters of 2022, the cryptocurrency market capitalization plummeted by 61.7%, shrinking from $2.37 trillion to $907 billion, as per CoinGecko data. This demonstrates that the crypto market is not immune to broader economic fluctuations, serving as a reminder of its inherent volatility.

Change in the cryptocurrency market cap over the last 60 days. Source: CoinGecko

Change in the cryptocurrency market cap over the last 60 days. Source: CoinGecko

While analysts continue to debate the potential decoupling of Bitcoin from technology stocks and the S&P 500, prior research from the Multidisciplinary Digital Publishing Institute suggests that Bitcoin often exhibits trading patterns akin to a "tech stock" due to its extreme volatility. However, it's worth noting that Bitcoin can also serve as a viable hedge against the U.S. dollar, given its negative correlation, as deduced from an October 2022 report by the research firm. This unique dual role of Bitcoin in the financial landscape adds a layer of complexity to its behavior in times of market turmoil.

Since September 1, Bitcoin has seemingly decoupled from the NASDAQ 100, recording a 34% increase while the NASDAQ index has fallen by 8.6% during the same period. This shift in Bitcoin's behavior compared to traditional tech stocks highlights the evolving nature of the cryptocurrency market and its potential to serve as a safe haven in times of market uncertainty.

Meanwhile, recent shifts in investor sentiment have prompted some observers to speculate that this movement may be interpreted as a "flight to safety" toward Bitcoin, particularly in light of the recent declines in various banking stocks. This suggests that investors are seeking alternative avenues to preserve and potentially grow their wealth, and cryptocurrency is emerging as a candidate in this regard.

BREAKING: Google stock, $GOOGL, is now down by 10% posting its worst day since March 2020.

— The Kobeissi Letter (@KobeissiLetter) October 25, 2023

Nearly $200 billion in market cap has been erased today alone.

The 7 largest tech stocks in the S&P 500 have lost more than a combined $500 billion today.

This is the most widespread… pic.twitter.com/1NcZx3b7eM

Read more: Cryptocurrency Chronicles: Navigating the Digital Frontier

Trending

Press Releases

Deep Dives