Spartan's Cryptic Pas de Deux: Unveiling Pendle's Financial Symphony in the DeFi Ballet

In the dynamic tapestry of the global financial landscape, Spartan Group, headquartered in the vibrant metropolis of Singapore, has orchestrated a symphony of financial intrigue with its recent revelation of a strategic commitment to Pendle Finance. Cloaked in an air of mystery, the exact quantum of this financial infusion remains an enigmatic detail, injecting an extra dose of suspense into this unfolding narrative.

Against the backdrop of the ever-evolving crypto sphere, Spartan Capital, the crypto venture capital (VC) arm of the illustrious Spartan Group, has deftly chosen to amplify its support for Pendle Finance through the sophisticated channels of an over-the-counter (OTC) purchase. This strategic maneuver, akin to a financial ballet, is a testament to Spartan's unwavering dedication to Pendle, a commitment that has stood the test of time since the inception of this transformative project in the crucible of 2021.

Spartan Capital has been with Pendle since the very beginning of our journey since the days of Pendle V1.

— Pendle (@pendle_fi) November 9, 2023

It's an honour to link hands with one of our longest supporters once more on our next leg of journey, as we strive to reshape the crypto landscape together ???? https://t.co/7C1t8g5DQu

The harmonious partnership between Spartan and Pendle, akin to a well-choreographed dance, finds resonance in the additional injection of funds. The financial ballet, conducted behind the scenes, aligns with the shared vision of propelling Pendle Finance towards its lofty ambitions. Spartan Capital, with its keen foresight, recognizes the metamorphic potential embedded within Pendle, offering applause for its pivotal role in advancing the frontiers of on-chain yield trading.

Pendle's trajectory resembles a meteoric ascent, with its total value locked (TVL) surging into the stratosphere by over 2,000% since the winds of November 2022, as meticulously documented by the vigilant DefilLama. In this complex ballet of financial movements, Spartan expresses unbridled confidence in Pendle's diverse repertoire, ranging from the avant-garde Liquid Staking Derivatives to the ambitious Real World Assets yielding project. The stage is set for anticipation, with the expectation that these financial pirouettes will magnetically attract off-chain capital, enriching the vibrant tapestry of the DeFi ecosystem.

Pendle Protocol TVL. Source: DefiLlama

Pendle Protocol TVL. Source: DefiLlama

Kelvin Koh, the sagacious managing partner at Spartan Capital, paints a canvas of exceptional growth, envisioning a symphony emerging from the convergence of Liquid Staking Derivatives and Real World Assets. According to Koh, Pendle's meticulously crafted yield trading toolkit stands as a masterpiece poised to elevate the intrinsic value of an eclectic array of digital, yield-bearing assets. This strategic positioning casts Pendle as a virtuoso, orchestrating a harmonious melody that resonates as a potent catalyst for the unfolding chapters of future DeFi developments.

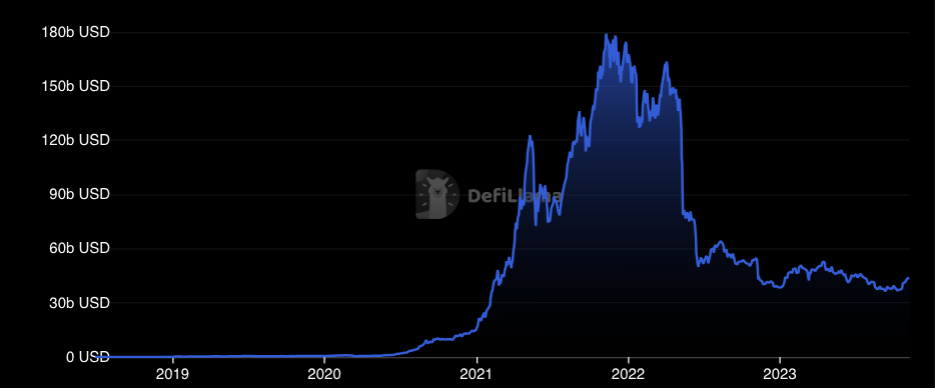

Spartan's optimistic overture towards DeFi unfolds against the backdrop of the industry's uphill battle for momentum in the unfolding chapters of 2023. Despite a modest 18% uptick in total DeFi TVL since the dawn of the year, the sector finds itself trailing by 279% from the dizzying all-time highs recorded in the crisp November of 2021.

Total DeFi TVL historically. Source: DefiLlama

Total DeFi TVL historically. Source: DefiLlama

A counterpoint emerges in the resolute ascent of Bitcoin, currently priced at $36,354, capturing attention with a remarkable surge exceeding 120% since the commencement of the year — a stark juxtaposition against its starting point of $16,600, meticulously chronicled by the vigilant CoinGecko.

Yet, in this intricate financial ballet, even amid the diminished cadence of DeFi-related economic activity this year, the sector paradoxically emerges as a beacon of attraction for substantial funding. Blockchain Capital, an influential venture capital group, takes center stage, unfurling the curtain on two substantial funds — a veritable financial reservoir totaling an impressive $580 million. The strategic focus of these funds extends beyond the DeFi realm, encompassing the realms of gaming and infrastructure investment, adding further layers of intrigue to the unfolding chapters of the financial narrative.

Read more about: Digital Dynamo: Marathon's Resilience in the Bitcoin Surge

Trending

Press Releases

Deep Dives