Shifting Tides: Cryptocurrency Traders Pivot to Ether Over Bitcoin, Highlighting Key Metrics and Market Trends

Key indicators in the futures and options markets suggest a potential redirection of funds from Bitcoin to Ethereum, revealing a nuanced shift in market dynamics. Notably, data from CME futures highlights a more rapid capital influx into Ether compared to Bitcoin.

While Bitcoin has witnessed a robust 60% surge in the current quarter, Ethereum has shown a more modest gain of 35%. This performance gap is consistent over longer time frames, with Bitcoin displaying a 163% year-to-date gain, contrasting with Ethereum's 89%.

Recent statistics from the Chicago Mercantile Exchange (CME) uncover a significant uptick in notional open interest for cash-settled Ether futures, soaring by 30% to reach $711 million over the past five days. In contrast, Bitcoin experienced a 19% growth in this metric, reaching $4.9 billion. The standardized futures contract for Ethereum on CME is structured with a size of 50 ETH, while its Bitcoin equivalent is sized at 5 BTC.

The positive spread observed in pricing between Ether and Bitcoin CME futures further substantiates this emerging trend. Reflexivity Research highlights a 5% premium in Ether futures concerning the spot index price, surpassing Bitcoin by 5% earlier in the week.

Reflexivity Research suggests that traditional finance players ("tradfi") may be in the early stages of shifting towards involvement in the Ethereum ETF trade, indicating a trend worth monitoring for potential insights into market expectations regarding an Ethereum ETF.

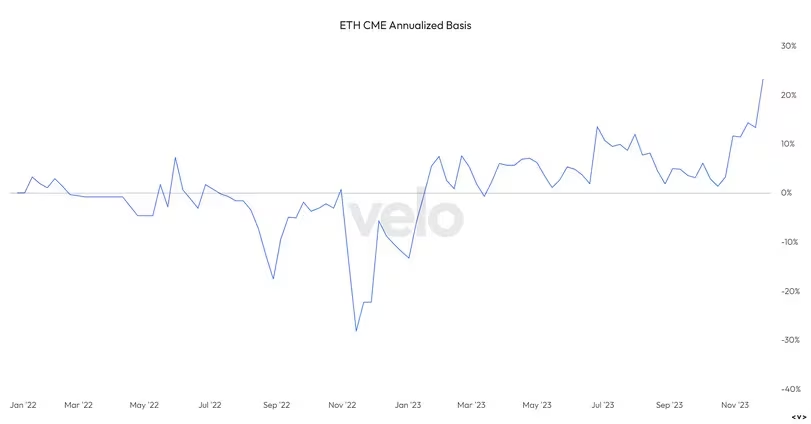

Futures vs. Spot Prices Spread: A Closer Look at Basis According to Velo Data

Futures vs. Spot Prices Spread: A Closer Look at Basis According to Velo Data

Within the Deribit options market, traders are displaying a preference for Ether calls and Bitcoin puts. The one-month Ether call-put skew, measuring the difference in implied volatility premium for call and put options expiring in four weeks, has doubled to over 4% this month, signaling a strengthening call bias. Conversely, Bitcoin's one-month skew has decreased from 5% to 2%, indicating a shift towards puts relative to calls.

These dynamics within the options market and notable metrics in the futures market suggest the possibility of Bitcoin experiencing a slowdown, providing an opportunity for Ethereum to catch up in the coming weeks. The evolving trends underscore the dynamic and adaptable nature of cryptocurrency markets, with the potential for shifts in investor sentiment.

Read More: CryptoETFChronicle: SEC's Extended Evaluation and Grayscale's Strategic Moves

Trending

Press Releases

Deep Dives