- Home

- Police & Regulations

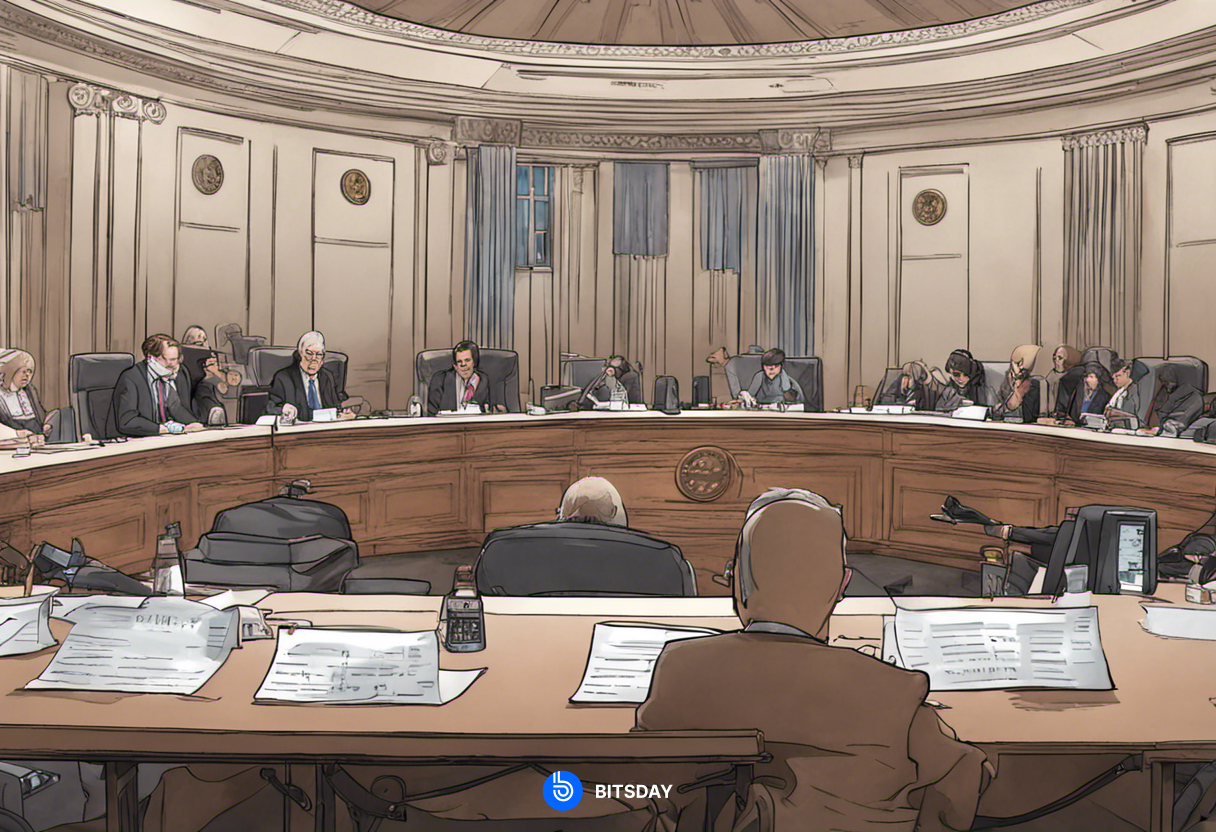

- SEC Chair Gensler Delivers Cryptocurrency Insights During Congressional Hearing

SEC Chair Gensler Delivers Cryptocurrency Insights During Congressional Hearing

Gary Gensler, the Chair of the U.S. Securities and Exchange Commission (SEC), remained tight-lipped about the future of spot bitcoin ETFs in the wake of a recent legal setback, refraining from providing definitive answers during his congressional testimony. Gensler used the opportunity to once again express his concerns over the way crypto firms handle customer assets, emphasizing that the practice of commingling assets has often led to unfavorable outcomes.

Despite facing questions about the SEC's stance on spot bitcoin ETFs, Gensler maintained that it remains an active consideration within the commission. He expressed the agency's respect for the courts and their decisions.

The recent court ruling in the Grayscale Investments case, which deemed the SEC's rejection "arbitrary and capricious," prompted Gensler to reevaluate the agency's position on bitcoin ETF applications. However, Gensler's testimony did not provide specific details on the SEC's forthcoming actions or a timeline for their decision.

While the hearing covered various topics beyond crypto, including concerns about a potential government shutdown and debates over the SEC's priorities, Gensler's testimony highlighted the ongoing divide between Democrats and Republicans regarding the agency's approach to digital assets.

Chairman Patrick McHenry criticized the SEC's legal track record and its perceived adversarial stance toward the digital assets industry, expressing concerns over potential confusion and lasting damage within the sector.

Gensler also confirmed once again that bitcoin is not classified as a security, addressing a key distinction in the regulatory landscape.

Regarding the SEC's case against Ripple, Gensler refrained from offering specifics, citing its ongoing status before the court. He emphasized the need for any potential congressional action to address the issue of commingled assets in the crypto space, suggesting that a legislative solution would involve separating out conflicts related to asset management. Gensler also acknowledged the potential staffing challenges the SEC may face in the event of a government shutdown, which could significantly impact the agency's day-to-day operations.

Read more: Cybersecurity Coalition for Quantum Resilience

Trending

Press Releases

Deep Dives