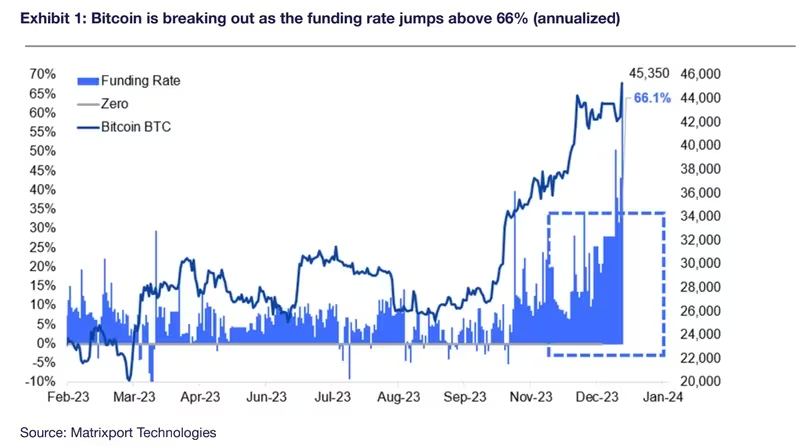

Record 66% Funding Rates Signal Unprecedented Cost for Bitcoin Bullish Bets

On Monday, Matrixport, a leading provider of crypto services, reported a remarkable surge in global average perpetual funding rates , reaching an unprecedented high of 66% annualized. This surge had a significant impact, particularly on individuals with long positions or leveraged bullish bets in the perpetual futures market associated with Bitcoin. The costs associated with maintaining such positions soared as Bitcoin surpassed the $45,000 threshold for the first time since April 2022.

Matrixport's data indicated that the surge in global average perpetual funding rates occurred during Asian trading hours. Perpetuals, which are a form of futures contracts without fixed expiration dates, employ the funding rate mechanism to ensure their prices align with the current market price of the cryptocurrency. Positive funding rates signify that perpetuals are trading at a premium to the spot price, with longs compensating shorts to keep their positions open. Conversely, negative rates indicate the opposite, and exchanges typically collect funding rates every eight hours.

Markus Thielen, Head of Research and Strategy at Matrixport and the founder of 10x Research, highlighted the importance of the funding rate surge. He clarified that

"This morning, the funding rate is reaching a new high at +66%. This implies that longs are paying shorts 66% annually to maintain their positions."

The accompanying chart illustrated a consistent elevation of the funding rate throughout the year-end holiday season, suggesting an overall bullish sentiment in the market.

Bullish Surges: Matrixport Reveals Sustained Funding Rate Highs During the Holiday Season

Bullish Surges: Matrixport Reveals Sustained Funding Rate Highs During the Holiday Season

Thielen expressed surprise at the sustained elevation of the Bitcoin funding rate during the holiday period. He interpreted this as an indication that crypto traders remained highly optimistic, anticipating the imminent approval of a Bitcoin exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission (SEC). This anticipation played a crucial role in driving Bitcoin's impressive 56% rally in the final quarter of 2023.

However, Thielen cautioned that excessively high funding rates could present challenges for long positions when the market ceases its upward momentum. This scenario might lead to the unwinding of bullish bets and trigger a price pullback. Despite these considerations, as of the current writing, Bitcoin exhibited no signs of bullish exhaustion, maintaining its trading position above $45,000. The cryptocurrency's outstanding performance in the final quarter of the previous year was largely attributed to speculation surrounding the potential approval of one or more spot-based BTC exchange-traded funds. According to Reuters, a decision from the SEC was expected as early as Tuesday.

Read More: Futures Market Stabilizes: Crypto Funding Rates Reset Post Bitcoin Decline

Trending

Press Releases

Deep Dives