Futures Market Stabilizes: Crypto Funding Rates Reset Post Bitcoin Decline

Over the weekend, notable shifts in the spot markets prompted a substantial rise in open interest, reaching an impressive $35 billion. This upswing indicated that traders were engaging in highly leveraged positions, anticipating further upward movements in prices. The provided data disclosed an almost 40% surge from the closing days of October when the open interest stood at $24 billion.

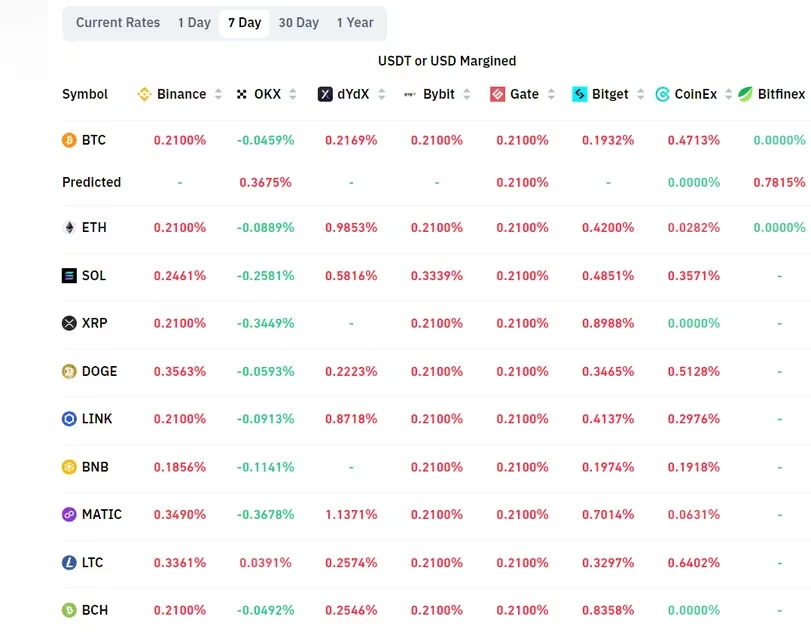

The market's exuberance led to the normalization of funding rates on major token futures. Recent excitement had compelled traders to pay unusually elevated fees to uphold their long positions. The accumulation of leveraged positions contributed to funding levels reaching some of their highest points in recent months. Funding rates involve periodic payments made by traders, contingent on the price differential between futures and spot markets.

Traders found themselves subject to fees ranging from 0.2% to 0.5% every eight hours on their borrowed funds to sustain their long positions. This translated to speculators paying as much as 50 cents to exchanges on a $100 position. However, apprehensions surfaced among market observers as traders leaned toward going short or betting against a price increase, as such positions generated fees from those adopting long positions.

Unprecedented Spike: Futures Funding Rates Soared Last Week, Coinglass Reports

Unprecedented Spike: Futures Funding Rates Soared Last Week, Coinglass Reports

The culmination of these factors seemed to manifest in a market decline on Tuesday, as traders opted to capitalize on profits following a week-long ascent. Nearly 90% of bullish bets were liquidated, totaling over $300 million. Bitcoin traders incurred losses of $120 million as prices dropped by 4%, while Ethereum traders faced a loss of $63 million. XRP and Solana’s SOL-tracked futures witnessed cumulative liquidations exceeding $30 million.

Liquidation occurs when an exchange forcibly closes a leveraged position due to a partial or total loss of the trader’s initial margin. This happens when a trader fails to meet the margin requirements for a leveraged position, lacking sufficient funds to maintain the trade.

Significant liquidations can act as indicators of the local top or bottom in a sharp price movement. Consequently, funding rates have reverted to standard levels, averaging 0.01% on most exchanges as of Wednesday morning.

The cryptocurrency markets recorded a 6% surge in the past week, primarily propelled by heightened expectations of the approval of a spot bitcoin exchange-traded fund (ETF) in the U.S. Analysts reiterated a 90% likelihood of approval in January. In the traditional finance realm, BlackRock, a financial behemoth, submitted an application for an ether (ETH) ETF, uplifting the token's value along with other alternatives like Avalanche, Solana, and Polygon.

Read More: Ethereum's Ascendance: Navigating Key Resistance and Market Dynamics

Trending

Press Releases

Deep Dives