Ethereum's Ascendance: Navigating Key Resistance and Market Dynamics

Market enthusiasts in the realm of Ethereum have recently propelled the digital currency into an assertive upward trajectory, witnessing a surge to a noteworthy resistance level at $2K. However, navigating through a substantial obstacle around this pivotal milestone, there emerges the potential for an interim phase of correction and consolidation in the foreseeable days.

Unpacking the Daily Chart

A meticulous analysis of the daily chart exposes a considerable support foundation around the critical zone, encapsulating the static support at $1,500 and the lower boundary of the wedge pattern. This support acted as the catalyst for a noteworthy upswing, signifying robust buying momentum as buyers set their sights on breaching the significant $2K resistance zone.

Despite the achievement of this pivotal level, aligned with the upper boundary of the wedge, Ethereum encountered resistance, triggering a modest retracement towards the breached 200-day moving average at $1,783.

Given the gravity of the $2K resistance and the upper limit of the wedge pattern, the prospect of a temporary extension of the ongoing retracement, coupled with consolidation around the breached moving averages, appears highly plausible. If a pullback to the breached moving averages materializes, buyers may seize the opportunity to re-enter the market, once again directing their efforts toward the substantial $2K level.

Source: TradingView

Source: TradingView

Insights from the 4-Hour Chart

On the 4-hour chart, heightened buying pressure in the vicinity of the $1.5K support region propelled Ethereum towards the substantial $2K resistance. This upward momentum showcased substantial bullish strength, underscoring the prevailing dominance of buyers in the market.

However, the $2K region assumes the role of a pivotal psychological barrier, presenting formidable challenges for buyers seeking to propel the price higher. Notably, a bearish divergence between the price and the RSI indicator hinted at insufficient buying pressure, prompting a reversal and minor corrections.

Furthermore, a discernible double-top pattern around this critical resistance corroborated the presence of sellers in the short term.

Against the backdrop of current market dynamics, there is a strong likelihood of an extended phase of consolidation and correction in the short term. This implies that the market may sustain its retracement before definitively charting its next course of action. In this scenario, the support range between the 0.5 and 61.8 levels of the Fibonacci retracement ($1,839 – $1,769) is anticipated to emerge as the subsequent focal point for Ethereum’s price.

Source: TradingView

Source: TradingView

On-chain Analysis

The futures market continues to wield a substantial influence on Ethereum’s price dynamics, underscoring the imperative for the prevailing uptrend to uphold favorable conditions in this arena.

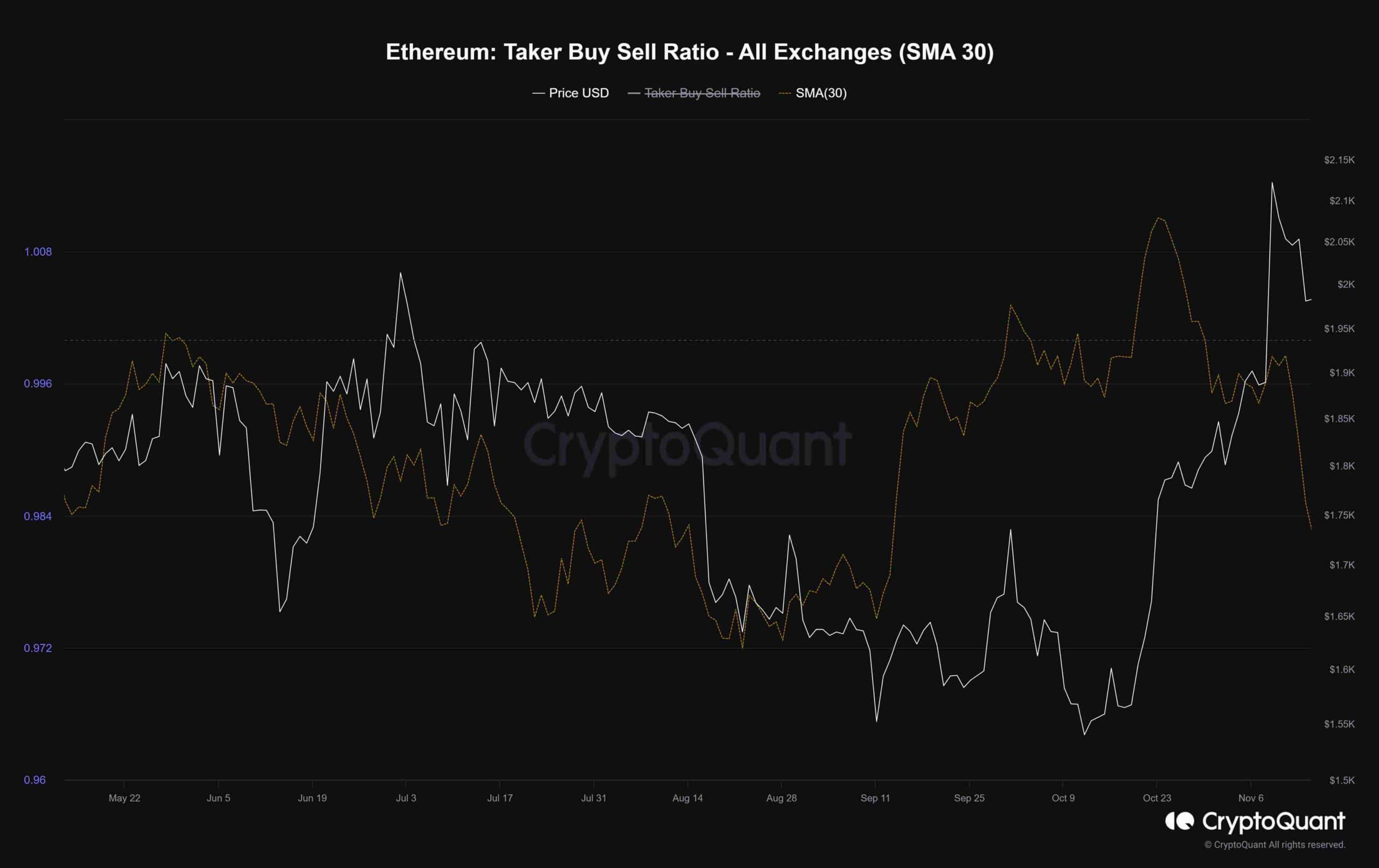

Highlighted in the chart is the 30-day moving average of the Ethereum Taker Buy Sell ratio, a pivotal metric for gauging sentiment in the futures market. Amidst a notable surge in Ethereum's value, the taker buy-sell ratio exhibited a robust upward trend, indicative of pronounced buying interest. However, a recent reversal in the metric's trend has ushered in a downtrend, descending below the threshold of 1. This reversal suggests that sellers are now executing more assertive orders collectively, potentially driven by profit-taking or the establishment of short positions.

Crucially, this shift in the metric aligns with the recent market rejection and its uphill battle to ascend. The convergence of these events hints at the potential for a short-term retracement in Ethereum’s price.

Should the taker buy-sell ratio resume its upward trajectory, surpassing the 1 threshold, it would signal a revival of bullish sentiment in the short term, potentially fortifying the continuation of the ongoing uptrend. Conversely, a lack of upward movement in the metric would raise apprehensions regarding the sustainability of any bullish momentum.

Source: CryptoQuant

Source: CryptoQuant

You might also like: The Aquarian FinTech Odyssey: Navigating Digital Horizons with Project Guardian

Trending

Press Releases

Deep Dives