PayPal's Stablecoin Integration Contributes to Curve's Third-Largest Liquidity Pool

The FRAXPYUSD liquidity pool on the Curve platform marked a significant milestone by reaching a Total Value Locked (TVL) of $135 million since its launch on December 27th. This achievement positions it as the third-largest liquidity pool in the market.

The growing prominence of PayPal's dollar-backed stablecoin, PYUSD, in decentralized finance (DeFi) is evident in its integration into the newly introduced liquidity pool on Curve, an automated market maker (AMM) platform. The pool now holds an impressive $135 million in TVL, securing its rank as the third-largest, trailing behind the well-established 3pool.

Launched on December 27th, the FRAXPYUSD pool includes not only PayPal's PYUSD but also features Frax Finance's collateralized algorithmic stablecoin, FRAX. Regulated by Paxos, PYUSD has found a notable use case within the DeFi ecosystem.

In the realm of decentralized exchanges, a liquidity pool refers to a reserve of two or more cryptocurrencies locked in a smart contract, facilitating seamless asset exchanges. Curve, as a decentralized exchange, serves as a platform for traders to efficiently swap stablecoins. The platform's activities provide valuable insights for large traders seeking to convert one stablecoin into another.

The distinctive characteristic of the FRAXPYUSD pool lies in its utility for traders holding FRAX, enabling them to exchange it for PYUSD. Consequently, they can leverage the acquired PYUSD on the PayPal app for various transactions, including purchases and remittances. However, the current state of the pool reveals an imbalance, with FRAX constituting over 80% of the total liquidity.

Sam Kazemian, the founder of Frax Finance, shed light on the dynamics, explaining,

"FRAX is kind of like the on-chain liquidity for PYUSD, and the latter is the off-chain fiat ramp."

Since its inception, the pool has maintained an average daily trading volume of $5.5 million.

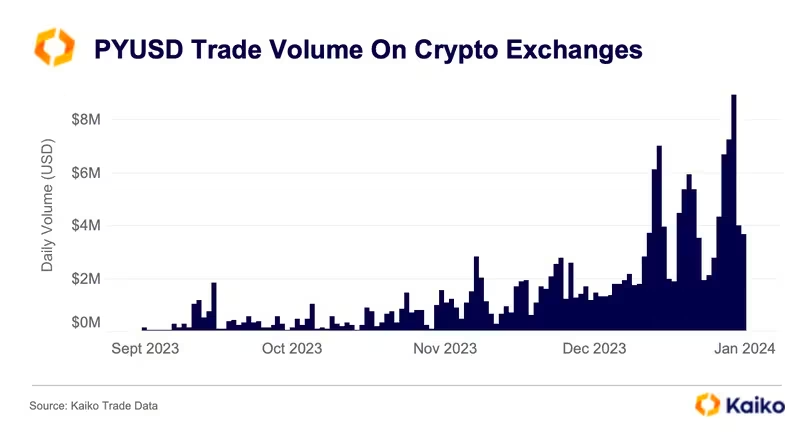

Inquiries have been made to Paxos, the issuer of PYUSD, by Bitsday, seeking additional insights into PYUSD's expanding role in DeFi. Despite entering the DeFi space in August, PYUSD is still playing catch-up with industry leaders Tether and Circle. According to data from Kaiko, PYUSD's daily trading volume reached a peak of $9 million in December and currently hovers around $4 million. This pales in comparison to Tether's USDT, which records a 24-hour trading volume exceeding $55 billion.

Tracking PYUSD Trading Trends: Insights from Centralized Exchanges (Kaiko)

Tracking PYUSD Trading Trends: Insights from Centralized Exchanges (Kaiko)

Clara Medalie, Research Director at Kaiko, views this as a positive development for DeFi. She observes that PayPal appears to be actively investing in broadening the stablecoin's utility beyond payments, particularly within the PayPal app. Nevertheless, Medalie acknowledges the stiff competition posed by USDT and USDC, emphasizing their dominance in terms of liquidity.

Kazemian expresses optimism about the future growth of FRAXPYUSD, hinting at potential DeFi integration supported by PayPal's payment app. This suggests ongoing advancements at the intersection of stablecoins, DeFi, and mainstream payment platforms.

Read More: Crypto Security Report 2023: Unveiling a $2 Billion Loss Landscape to Hacks, Scams, and Exploits, According to De.Fi

Trending

Press Releases

Deep Dives