- Home

- Latest News

- Membrane Labs Secures $20M Investment from Brevan Howard, Point72, and Jane Street: Powering the Crypto Prime Brokerage Revolution

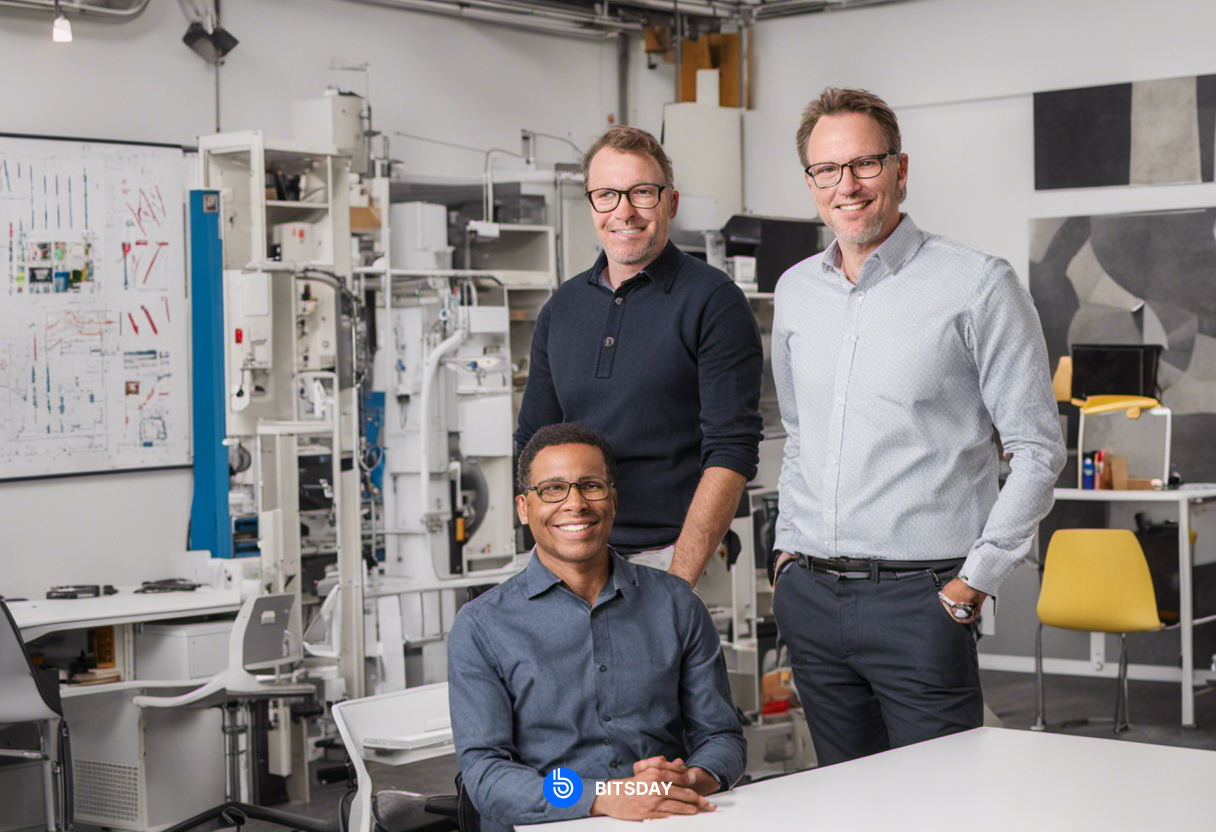

Membrane Labs Secures $20M Investment from Brevan Howard, Point72, and Jane Street: Powering the Crypto Prime Brokerage Revolution

Membrane Labs, a specialized platform dedicated to crypto trading and lending protocol, has recently concluded an exceptionally successful Series A funding round, amassing a substantial sum of $20 million. This substantial financial influx, spearheaded by industry behemoths such as Brevan Howard Digital and Point72 Ventures, is poised to usher in a revolutionary epoch for the cryptocurrency sector, especially in fortifying its trading infrastructure.

The Series A funding round witnessed the active participation of an illustrious roster of entities, including Flow Traders, QCP Capital, Two Sigma Ventures, Electric Capital, Jump Crypto, GSR Markets, Belvedere Trading, and Framework Ventures. This diverse consortium of supporters underscores the wider industry's recognition of Membrane Labs' potential to reshape the dynamics of crypto trading.

The allocated funds are earmarked for the development of a robust trading infrastructure, addressing vulnerabilities that have surfaced in the crypto industry over the past year. Through heightened security protocols and augmented operational transparency, Membrane Labs aims to proactively forestall potential future crises.

Responding to the escalated scrutiny that has laid bare opaque and inequitable practices within multi-billion dollar trading and lending platforms, regulators are advocating for heightened transparency, seeking to align the crypto sector more closely with conventional finance.

CEO Carson Cook expounded upon Membrane's initial emphasis on crafting a clearing, netting, and settlement engine. This groundbreaking system empowers institutions to handpick their preferred custody methods, whether through a custodian or a multi-party computation (MPC) wallet. Concurrently, the front office retains authority over trade execution.

Cook likened Membrane's role to that of a linchpin, operating as a settlement network that seamlessly interlinks all facets of crypto trading. Additionally, the platform has introduced a workflow management system covering collateral management, loans, over-the-counter (OTC) trades, and derivatives. Collectively, these measures aim to bolster transparency and risk management, especially in the aftermath of the FTX and 3AC incidents.

While there is a strong impetus to transition operations onto blockchain and embrace a decentralized finance (DeFi) infrastructure, Cook acknowledges that such an approach may not be universally applicable. Cook explicated, "We offer classic settlement, involving straightforward signing and sending—a functionality favored by many institutions familiar with assuming settlement risk. Additionally, we extend smart settlement, employing a system of smart contracts as an escrow for payments between parties. This empowers clients to choose whether to undertake smart contract risk, thereby mitigating counterparty risk in the process."

Membrane Labs' triumph in the Series A funding round and their astute strategy in fortifying the crypto trading infrastructure portend a promising trajectory towards a safer and more transparent crypto market. With the unwavering support of major industry players, Membrane Labs stands on the precipice of effecting significant change in the operational landscape of the crypto industry.

Read more: Ethereum Staking Dynamics: A JPMorgan Analysis

Trending

Press Releases

Deep Dives