Ethereum Staking Dynamics: A JPMorgan Analysis

The significant uptick in Ethereum staking following the major network enhancements, notably known as the Merge and Shanghai upgrades, has brought about a discernible increase in centralization and a decrease in staking returns, as indicated by a recent and comprehensive report from JPMorgan.

On the notable date of October 5, the adept analysts at JPMorgan, led by the esteemed senior managing director Nikolaos Panigirtzoglou, released a fresh and insightful investor advisory. This advisory carefully sounded the alarm about the potential risks that loom due to the palpable growth of centralization within the Ethereum ecosystem.

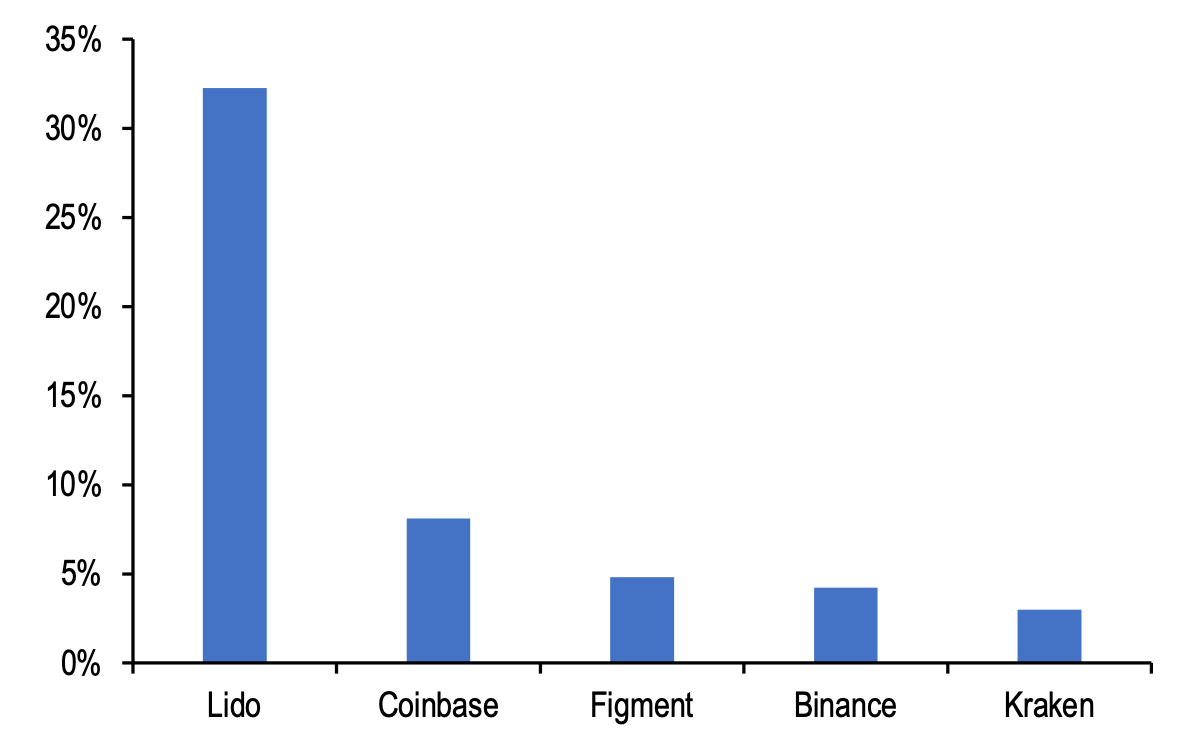

Market share of top five liquid staking providers. Source: JPMorgan

Market share of top five liquid staking providers. Source: JPMorgan

In their astute report, the diligent JPMorgan analysts aptly highlighted that the top five most prominent liquid staking providers—Lido, Coinbase, Figment, Binance, and Kraken—command an impressive majority, totaling over 50%, of the staking activity on the expansive Ethereum network. Notably, Lido alone contributes significantly, accounting for nearly one-third of this substantial share.

Moreover, the report pointed out that within the crypto community, Lido, a well-regarded decentralized liquid staking platform, has emerged as a superior and favored alternative to the traditional centralized staking platforms commonly associated with renowned exchanges such as Coinbase or Binance. However, the pragmatic insights shared in the JPMorgan report emphasized that "even within the realm of decentralized liquid staking platforms, a discernible level of centralization is evident." For instance, a solitary Lido node operator assumes a pivotal role, overseeing an impressive number, exceeding 7,000 validator sets or a staggering 230,000 Ether (ETH).

These node operators, carefully selected by Lido's intricate decentralized autonomous organization (DAO), governed by a select group of wallet addresses, contribute to the operational decisions, highlighting a tendency towards a somewhat centralized decision-making process for Lido's platform, the analysts astutely pointed out. Furthermore, the report cited a specific instance where Lido's DAO firmly rejected a proposal aiming to cap the staking share at 22% of Ethereum's overall staking in an effort to curtail centralization.

Lido refrained from active participation in these initiatives, as its DAO rejected the proposal with an overwhelmingly unanimous majority of 99%," conveyed the JPMorgan analysts, underscoring the significance of this decision, and further adding, "It is evident that any form of centralization, whether associated with an entity or a protocol, inherently poses risks to the robustness of the Ethereum network. A concentration of liquidity providers or node operators could serve as a vulnerable single point of failure or become susceptible to targeted attacks or even collusive efforts to form an oligopoly.

In addition to the acknowledged increase in centralization, the post-Merge Ethereum era has also witnessed a noticeable and generalized decline in staking yields, a fact thoroughly observed and acknowledged by JPMorgan. The typical block rewards have experienced a notable decline, transitioning from the pre-Shanghai upgrade figure of 4.3% to the current and modest 3.5%, as meticulously outlined in the analysts' findings. Adding to this, the total staking yield has undergone a discernible decrease, slipping from the pre-Shanghai upgrade level of 7.3% to a current and somewhat diminished figure of approximately 5.5%.

While the detailed insights shared by the analysts at JPMorgan offer a critical perspective, they are by no means the solitary observers of the Ethereum landscape who have taken note of this notable surge in network centralization following the momentous Merge upgrade. The Merge, implemented on the noteworthy date of September 15, 2022, has been widely recognized as a substantial obstacle to Ethereum's cherished decentralization goals and has notably been attributed to the observed decrease in staking yields.

you are the yield pic.twitter.com/ONJT6QmDch

— Pledditor (@Pledditor) October 5, 2023

Acknowledging this critical issue, Ethereum's esteemed co-founder, Vitalik Buterin, openly admitted that the dilemma of node centralization stands as one of the most pressing challenges for Ethereum's continued development. In a candid admission made in September 2023, he openly stated that finding a perfect and sustainable solution to address this issue could potentially require an additional and significant two decades of thoughtful and sustained effort and innovation.

Read more: Navigating Hong Kong's Crypto Landscape: Insights and Prospects

Trending

Press Releases

Deep Dives