- Home

- Latest News

- MarketInsight: High Optimism for SEC Approval of BTC ETF by January 15th

MarketInsight: High Optimism for SEC Approval of BTC ETF by January 15th

In response to potential delays in the SEC's approval process for spot ETFs, a number of investors have chosen to hedge their bets by acquiring shares on the "No side" within the prediction contract. The decentralized prediction platform, Polymarket, has become a hub for traders expressing confidence in the imminent launch of one or more Bitcoin (BTC) exchange-traded funds (ETFs) in the United States within the next two weeks.

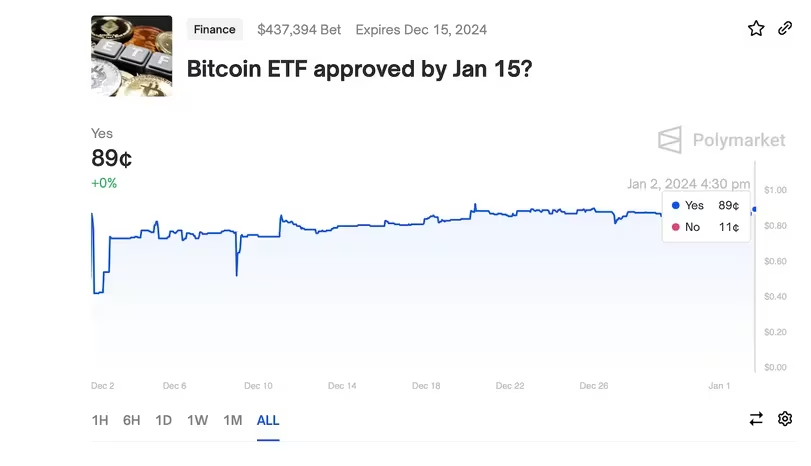

As of the most recent update, shares on the "Yes" side of the contract titled "Bitcoin ETF approved by Jan 15" are actively trading at 89 cents. This suggests an 89% likelihood of the eagerly anticipated event coming to fruition by the latter half of the month, marking a significant increase from the 50% probability recorded just a month ago.

Speculation surrounding the introduction of a U.S.-based spot ETF has been rife since early October, coinciding with a remarkable 55% surge in Bitcoin's value, pushing it beyond the $45,000 mark. This upward momentum is fueled by the widespread belief that the forthcoming ETFs could draw substantial investor capital into the Bitcoin market, potentially amounting to billions of dollars.

Since its establishment in 2020, Polymarket has solidified its position as a leading prediction market, allowing investors to engage in bets across a diverse range of events.

Market Odds: Polymarket Reports 89% Probability of SEC Approval for Spot ETFs by January 15

Market Odds: Polymarket Reports 89% Probability of SEC Approval for Spot ETFs by January 15

Currently, traders have collectively invested $437,394 in a prediction contract exclusively dedicated to ETFs. The contract is set to resolve with a "Yes" outcome if the SEC grants approval to any ETF by January 15.

Reports from Reuters indicate that the SEC could communicate approval to the existing 14 spot ETF applicants as early as Tuesday or Wednesday, providing the green light for the launch of their respective ETFs in the subsequent weeks.

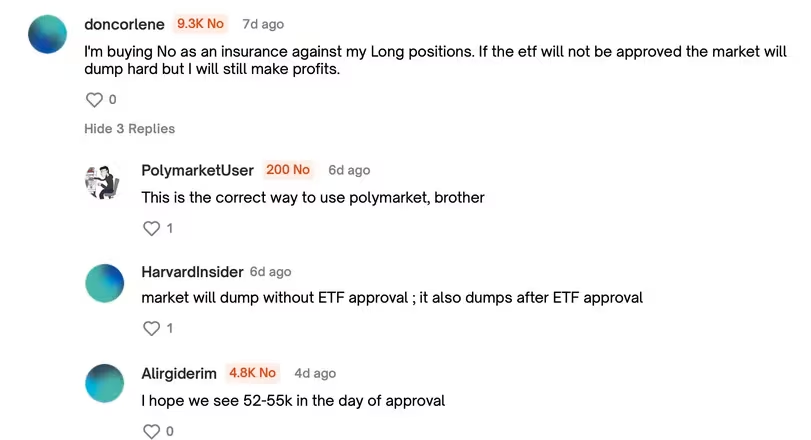

In anticipation of potential delays in the expected ETF launch, some traders have taken positions on the "No side" of the contract to hedge against bullish exposure in the spot/futures market. One trader, commenting on the prediction contract, articulated their strategy, stating,

"I'm acquiring No as insurance for my Long positions. If the ETF faces disapproval, the market may witness a significant downturn, but I stand to generate profits nonetheless."

Insights and Opinions: Polymarket Users Discuss Bitcoin ETF Approval by Jan 15 in Comments Section Read More: Blockchain Betting Boom: OpenAI CEO Drama Sparks Market Frenzy

Insights and Opinions: Polymarket Users Discuss Bitcoin ETF Approval by Jan 15 in Comments Section Read More: Blockchain Betting Boom: OpenAI CEO Drama Sparks Market Frenzy

Trending

Press Releases

Deep Dives