Insights on Bitcoin Ordinals and Network Dynamics

Despite some minor concerns floating around about potential network congestion caused by the introduction of Bitcoin Ordinals, it's important to note that there's scant concrete evidence indicating that inscriptions are encroaching on the allocated blockspace reserved for more substantial and valuable Bitcoin (BTC) transactions.

"In a report dated September 25, the insightful analysts at Glassnode shed light on this matter, stating, 'The available evidence pointing to engravings displacing monetary transactions is indeed quite sparse.'"

The rationale behind this seems to stem from the prudent approach taken by engraving users, who typically opt for lower fee rates, showcasing their patience in waiting for confirmations, even if it takes a bit longer.

It is apparent that engravings strategically choose and utilize the most economically viable blockspace, demonstrating their willingness to take a back seat when more pressing monetary transactions are in line.

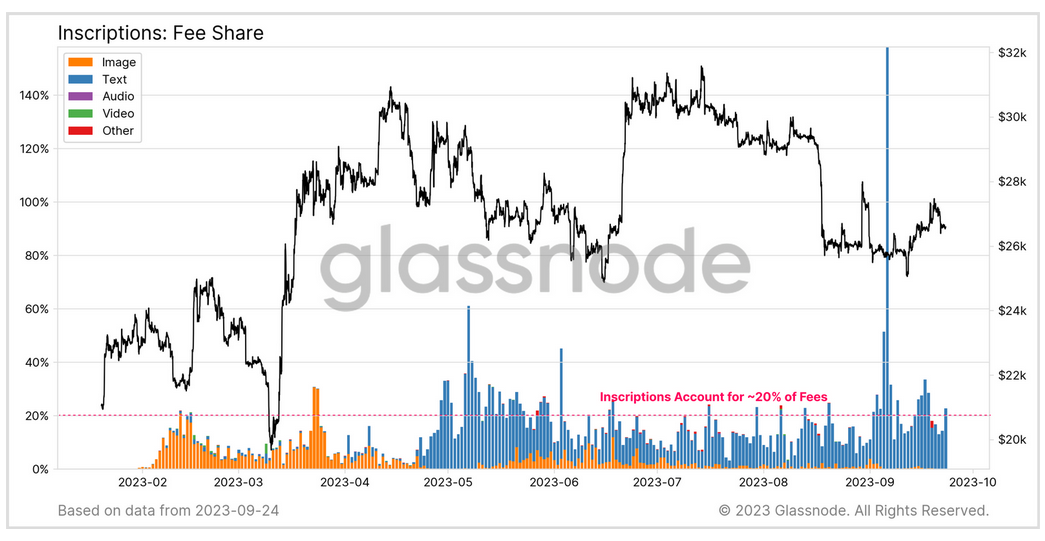

Making its debut in February 2023, Bitcoin Ordinals have remarkably dominated the daily transaction counts on the network. However, interestingly, this prominence hasn't been fully reflected in their share of mining fees, contributing only to approximately 20% of Bitcoin transaction fees, as astutely observed by Glassnode.

Inscription fee share between images, text, audio, video and other data types on Bitcoin. Source: Glassnode.

Inscription fee share between images, text, audio, video and other data types on Bitcoin. Source: Glassnode.

Greater engravings result in increased earnings, but there's a caveat

While a surge in engravings translates to increased revenue, there's a twist to the narrative. As per Glassnode, the rise in engravings has elevated the baseline demand for blockspace and consequently led to an uptick in fees for miners. Coincidentally, Bitcoin's hashrate has witnessed an impressive 50% surge since February.

This amplified hashrate has stirred up fierce competition among miners, all vying for a slice of the lucrative revenue fees, as highlighted by Glassnode:

With an intense climate of competition prevailing among miners, coupled with the imminent halving event, one can reasonably speculate that miners are teetering on the edge of financial stress, and their profitability is about to face a litmus test unless BTC prices witness a surge in the short term.

As of the current moment, Bitcoin is valued at $26,216; however, there's a prevailing sentiment among industry pundits suggesting a plausible degree of price appreciation in the lead-up to Bitcoin's highly anticipated halving event, scheduled for April 2024.

Notably, a significant proportion of the prevailing engravings can be attributed to BRC-20 tokens, introduced into the ecosystem just a month after Casey Rodamor launched the groundbreaking Ordinals protocol on Bitcoin in February.

In a recent development on September 25, Rodarmor introduced the intriguing concept of "Runes" as a potential substitute for BRC-20s, putting forth a compelling argument that a UTXO-based fungible token protocol would leave a more minimal trail of "leftover" unspent transaction outputs on the Bitcoin network.

Read more: OKX's 11th Proof-of-Reserves Report: Ethereum 2.0 Staking Ignites Explosive Asset Growth

Trending

Press Releases

Deep Dives