Harmony in Financial Futures: Hashdex's Innovative Approach to Spot Bitcoin ETF

Asset management firm Hashdex recently hosted a pivotal meeting with the United States Securities and Exchange Commission in an effort to address the regulator's concerns regarding its application for the inclusion of spot Bitcoin in the Hashdex Bitcoin Futures exchange-traded fund (ETF), as shared by a source with deep knowledge of the situation.

A detailed memorandum released by the Division of Trading Markets unveiled that this critical meeting unfolded on a crisp autumn day, precisely on October 13. In attendance were a group of six diligent SEC officials, along with representatives from Hashdex, NYSE Arca, Tidal Financial Group, and the esteemed law firm K&L Gates. The meeting, bathed in a setting of regulatory collaboration and compliance, set the stage for a significant exchange of ideas and insights.

Within this influential gathering, Hashdex, with an air of confidence and expertise, unveiled its ingenious mechanism designed to enable the seamless trading and integration of spot Bitcoin (BTC) within the illustrious ETF portfolio. This proposal specifically targets the Chicago Mercantile Exchange (CME), a prominent marketplace governed by the Commodity Futures Trading Commission.

Notably, Hashdex's application marks a departure from the conventional approach taken by other spot Bitcoin enthusiasts. The distinctive feature here is the absence of a surveillance-sharing agreement with the renowned cryptocurrency exchange Coinbase. Instead, Hashdex boldly outlines its plan to acquire spot BTC from the various physical exchanges operating within the CME market. This approach, although unconventional, positions the ETF to rely entirely on the pricing dynamics set by the CME for its transactions, a noteworthy detail echoed in an SEC filing by NYSE Arca back in late August.

To further illustrate the strength and viability of this strategy, a compelling presentation was shared with the attentive SEC officials during this month's meeting. Central to the strategy is the commission's Teucrium Order, which firmly asserts that the Bitcoin futures market has matured sufficiently to accommodate financial products seeking exposure to BTC.

As we shift our focus to the next stages of this intricate process, it's worth noting that the SEC may, as is customary, seek additional information and clarifications in the lead-up to the application's first deadline, which is firmly set for November 17. This prudent step aligns with the regulator's commitment to thorough examination and due diligence, ensuring the integrity and robustness of the proposed ETF.

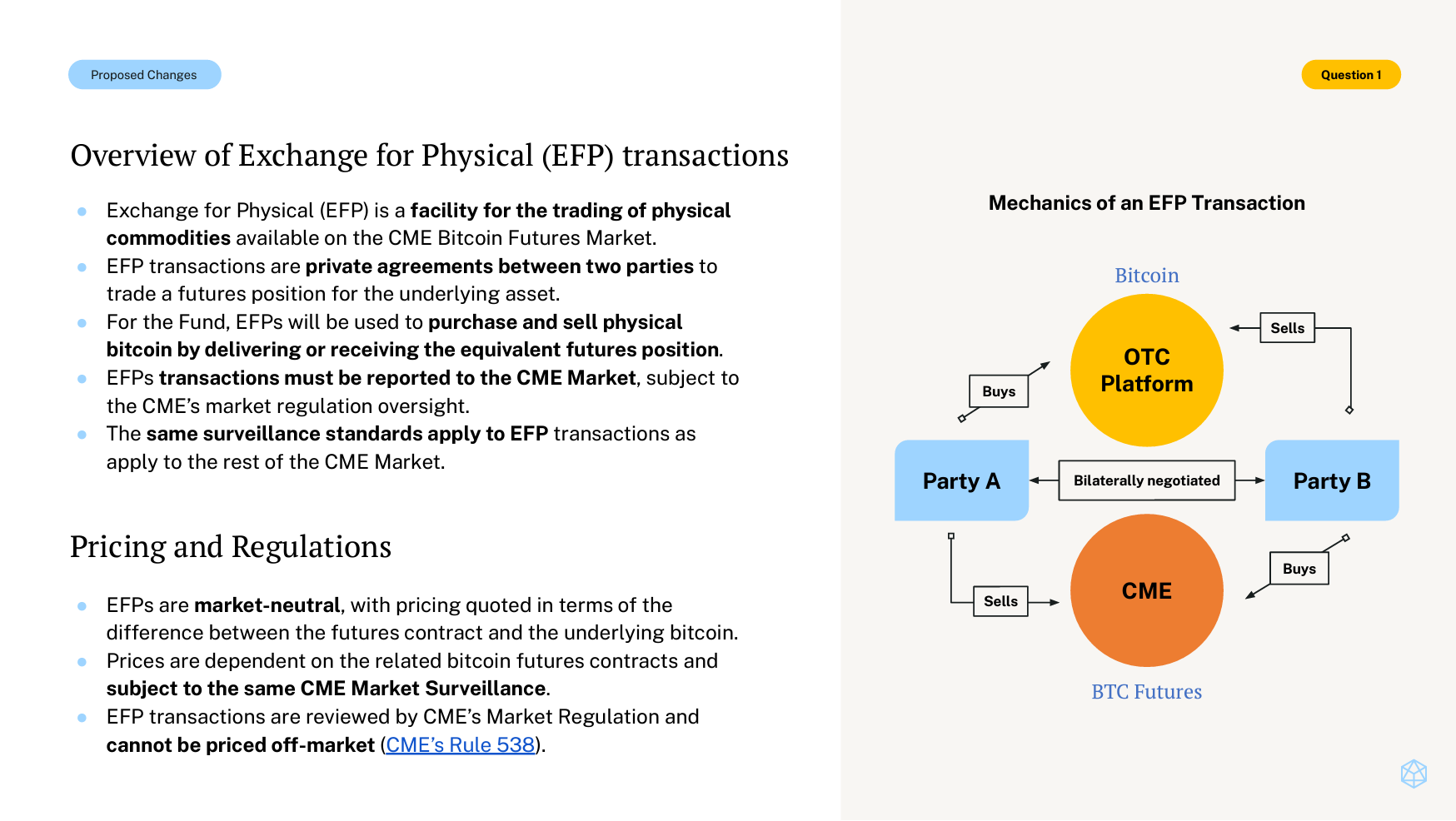

Screenshot of Hashdex’s presentation to the U.S. Securities and Exchange Commission. Source: SEC

Screenshot of Hashdex’s presentation to the U.S. Securities and Exchange Commission. Source: SEC

In the broader context of the asset management landscape, Hashdex takes pride in its claim of overseeing an impressive portfolio valued at over $380 million. Its global footprint extends to a remarkable 14 exchange-traded products (ETPs) that are actively available in seven diverse countries, making it a key player in the world of financial services.

Let's not forget that the SEC had previously bestowed its approval upon Hashdex's Bitcoin Futures ETF back in the spring of 2022. This momentous product successfully secured its listing on NYSE Arca, marking its debut in September of the preceding year. The ongoing quest for regulatory adjustments aims to grant the ETF the coveted privilege of including spot Bitcoin within its investment strategy, a step that holds significance in the evolving landscape of financial markets.

It's interesting to note that Hashdex finds itself in the midst of a competitive race within the asset management sector. Numerous industry heavyweights are vying to be the first to introduce a spot Bitcoin ETF in the United States, and the recent listing of BlackRock's ETF proposal on the Depository Trust & Clearing Corporation (DTCC) provides a glimmer of hope, suggesting that regulatory approval may soon follow, as eloquently pointed out by Bloomberg's perceptive ETF analyst, Eric Balchunas.

Indeed, the consensus view within the financial circles is that the SEC is poised to grant its approval for all spot ETFs within the next three months. This anticipation reflects the industry's ever-evolving dynamics and the regulators' commitment to staying ahead of the curve.

You might also like: Unlocking the Crypto Clarity: Debunking Myths and Realities

Trending

Press Releases

Deep Dives