Fed's Fiscal Shake-up: Implications and Shifts

The U.S. Federal Reserve dropped a bombshell on September 14th, disclosing staggering losses of a whopping $100 billion for the year 2023. Reuters hints that the Fed might be in for an even rougher ride. However, for riskier assets like Bitcoin (BTC), currently dipping to $27,103, this situation might just have a silver lining.

The Fed's Finances in Dire Straits

The main cause of this financial setback is the interest payments on the Fed's debt surpassing the earnings from its holdings and services provided to the financial sector.

Investors are now grappling with how this will affect interest rates and the demand for assets like BTC, known for their scarcity.

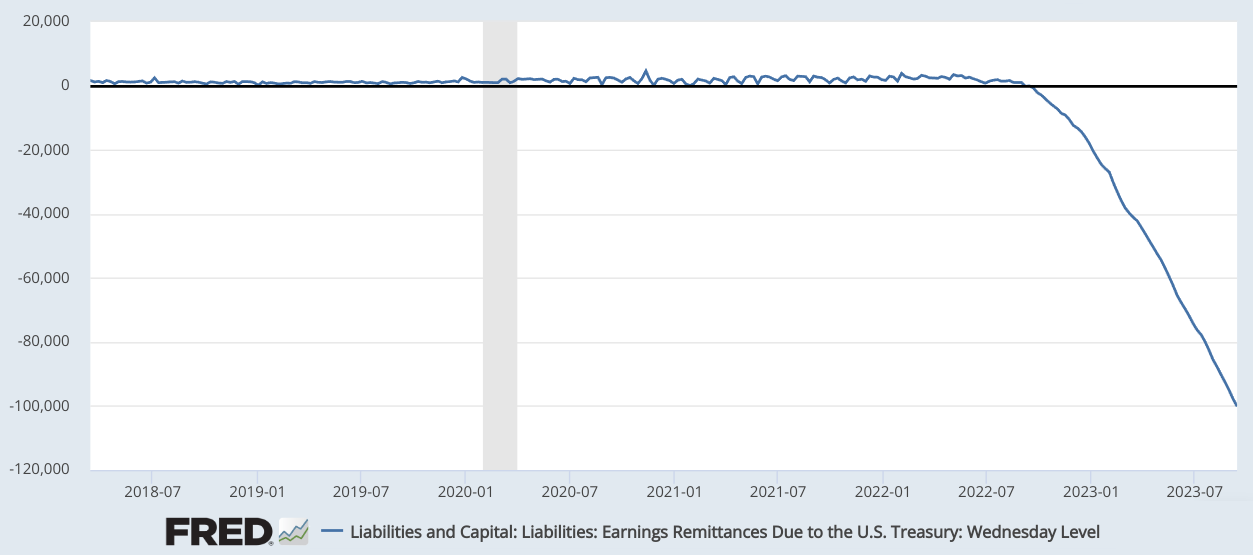

Fed earnings remittances due to the U.S. Treasury, USD (millions). Source: St. Louis Fed

Fed earnings remittances due to the U.S. Treasury, USD (millions). Source: St. Louis Fed

Some analysts speculate that the Fed's losses, which began a year ago, could potentially double by 2024. The central bank labels these losses as "deferred assets," arguing that there's no immediate need to cover them.

The Fed's Financial Performance Over Time

Traditionally, the Federal Reserve has been a money-making institution. However, the lack of profits doesn't hinder the central bank's ability to conduct monetary policy and meet its objectives.

The fact that the Fed's balance sheet is in the red isn't surprising, especially considering the significant interest rate hikes, jumping from near-zero in March 2022 to the current level of 5.25%. Even if interest rates stay put, Reuters suggests that the Fed's losses are likely to endure. This is because of the expansive measures taken in 2020 and 2021, when the central bank aggressively acquired bonds to ward off a recession.

Essentially, the Fed operates like a typical bank, obligated to provide returns to its depositors, primarily banks, money managers, and financial institutions.

An article in Barron's vividly portrays the impact of the $100 billion loss, stating,

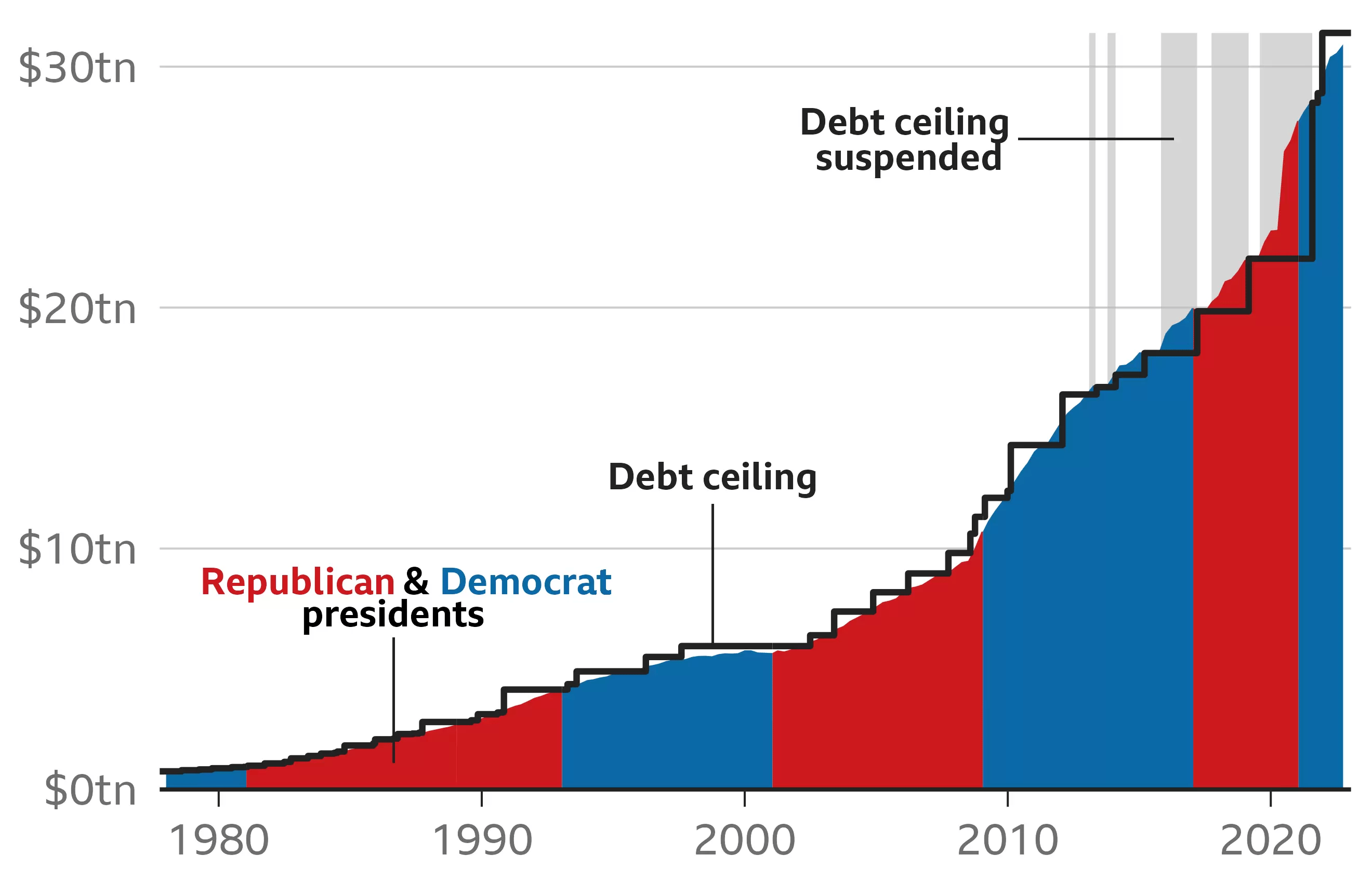

The Fed banks’ losses don’t increase federal budget deficits. But the now-vanished big profits that they used to send the Treasury did help hold down the deficit, which is $1.6 trillion so far this fiscal year..

U.S. total gross debt and debt ceiling, USD (trillions). Source: BBC

U.S. total gross debt and debt ceiling, USD (trillions). Source: BBC

It's evident that this situation is unsustainable, especially with the U.S. debt now soaring to $33 trillion. While blame might be pointed at the Fed for initiating interest rate hikes, it's crucial to realize that without such actions, inflation would not have tapered down to 3.2%, and the cost of living would have continued to burden the economy.

In the end, the high demand for short-term bonds and money market funds mirrors the trillions of dollars pumped into the economy during the peak of the pandemic. However, even if one settles for a fixed 5% yield on a three-month investment, there's no assurance that inflation will remain below this threshold for an extended period.

Additionally, investors face the risk of dilution whenever the U.S. Federal Reserve infuses liquidity into the market, whether through asset sales from its balance sheet or when the Treasury raises the debt limit.

Ultimately, it's improbable that returns from fixed-income investments will outpace inflation for another 12 months, as the government will eventually deplete its funds and be forced to issue more Treasuries.

Real Estate and Stocks Losing their Luster as Value Stores

There's a pressing, unanswered question about which sector or asset class will benefit the most when inflation catches up with short-term Treasury yields. This uncertainty arises as the S&P 500 sits just 7% below its all-time high, while the real estate market shows strain due to mortgage rates reaching their highest levels in over two decades.

On one hand, the S&P 500 index doesn't seem overly valued, trading at 20x estimated earnings—especially when compared to previous peaks that reached 30x multiples or even higher. However, investors fear that the Fed might be forced to further raise interest rates to combat prevailing inflationary pressures.

As the cost of capital continues to rise, corporate earnings will face pressure, leaving investors without a secure haven for their cash reserves.

Currently, Bitcoin and other cryptocurrencies might not appear as a reliable hedge option, but this perspective could change as investors grasp the essentially limitless nature of the U.S. government's debt ceiling. Hence, gradually accumulating these assets irrespective of short-term price trends might make sense.

Read more: CryptoFusion

Trending

Press Releases

Deep Dives