BTC Weekly: Price Dynamics & FOMC Anticipation

Bitcoin (BTC) experiences a decline, dipping to $26,588 and narrowly skirting $26,500 by the close of the week on September 17, following a period of relative stability subsequent to the recent peaks in September.

BTC/USD on a 1-hour timeframe, as depicted on TradingView

BTC/USD on a 1-hour timeframe, as depicted on TradingView

Bitcoin reserves its volatility for the weekly conclusion

During the weekend, data from TradingView indicated a stabilizing trend in BTC price performance, as the foremost cryptocurrency had surged to $26,880 a couple of days earlier, representing the highest point for the month.

Analyzing the Binance BTC/USD order book, Credible Crypto, a renowned trader and analyst, observed a substantial concentration of bid liquidity supporting the market, suggesting a level of seller absorption and current defense of this price level.

Some seller absorption happening here- this level being defended atm. Not much below it so if lost would probs see a nice flush to downside targets. Been fun watching this but going to call it a night. Let's see what tomorrow brings. Hopefully a slow weekend so we can just chill… https://t.co/NFD7qcfAnC pic.twitter.com/4gWXpEDfsX

— CrediBULL Crypto (@CredibleCrypto) September 16, 2023

Meanwhile, another trader, Crypto Tony, amidst the consolidative movements, envisioned two potential scenarios. He asserted that as long as the support at $26,000 held firm, there could either be a decline to $26,100 followed by a rebound, offering a favorable long trigger, or a bullish scenario if the $26,600 highs were reclaimed.

BTC/USD chart with annotations, sourced from Crypto Tony/X

Examining exchange behavior in more detail, Skew, a trader, highlighted specific short-term trends where spot entities were engaging in selling during upward rebounds.

$BTC Aggregate CVDs & Delta

— Skew Δ (@52kskew) September 17, 2023

Pretty much just aggressive positions getting hunted into next week

Only detail here is spot selling perp driven bounces, especially squeezes https://t.co/4yZFhcsYwx pic.twitter.com/KqRyRlyUHl

Could the FOMC influence Bitcoin's price range?

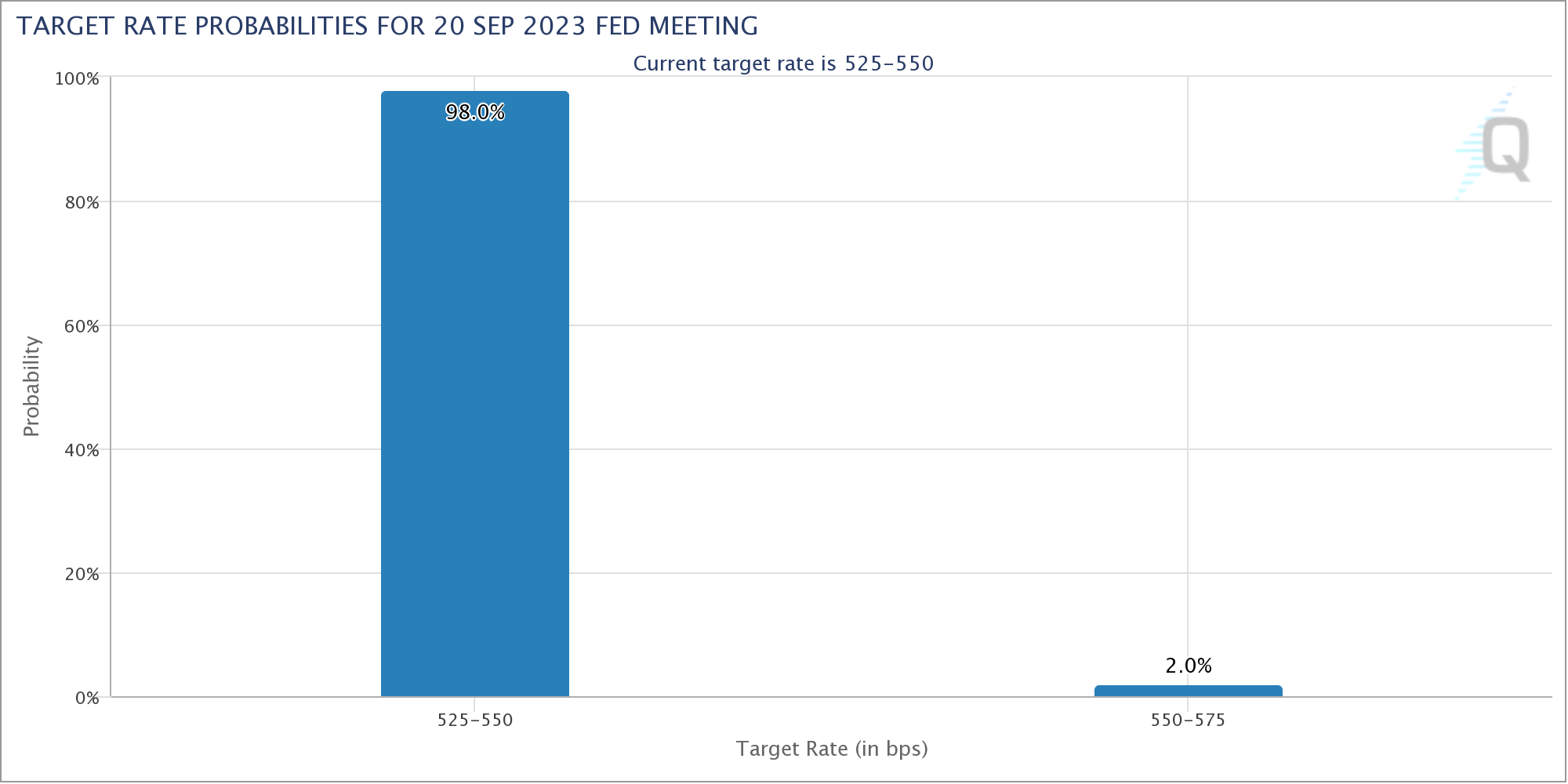

Looking ahead beyond the weekly closure, the cryptocurrency community eagerly anticipated a pivotal macroeconomic event in the coming week—the Federal Open Market Committee (FOMC) meeting scheduled for September 20. This meeting by the United States Federal Reserve would decide on benchmark interest rates, with prevailing market sentiment anticipating no changes.

According to CME Group’s FedWatch Tool, the likelihood of an unexpected scenario was minimal, at just 2%.

Chart depicting probabilities of the Federal Reserve target rate, sourced from CME Group

Chart depicting probabilities of the Federal Reserve target rate, sourced from CME Group

Recent trends showcased Bitcoin's diminished knee-jerk responses to macroeconomic data, with expectations of its continued stability even in the face of the FOMC meeting.

Popular trader Crypto Santa concluded in a recent commentary that in the short term, Bitcoin was expected to maintain its trading range between $25,000 and $27,000, with potential for increased volatility following the FOMC and interest rate decisions in the following week.

Annotated chart for BTC/USD, provided by Crypto Santa/X

Annotated chart for BTC/USD, provided by Crypto Santa/X

Trending

Press Releases

Deep Dives