Evaluating Bitcoin's Eggflation Resilience

Bitcoin, often referred to as BTC, has experienced a downturn, currently resting at the price point of $27,652. In a thought-provoking twist, the U.S. Federal Reserve unintentionally states that Bitcoin outperforms the United States dollar in the battle against inflation.

Within a blog post initially unveiled in the midst of June 2022 and subsequently updated, the St. Louis Fed makes an intriguing analogy, drawing parallels between BTC and dollars in the context of purchasing eggs, and the outcome is nothing short of surprising.

The phenomenon of "Eggflation" shows no significant change in the context of Bitcoin versus the U.S. dollar

This peculiar comparison, whimsically termed "Eggflation," may not encapsulate the multifaceted potential that Bitcoin holders possess for their assets. Nevertheless, it stands as a focal point in a dedicated Fed blog post that seeks to underscore the buying prowess of Bitcoin compared to the dollar.

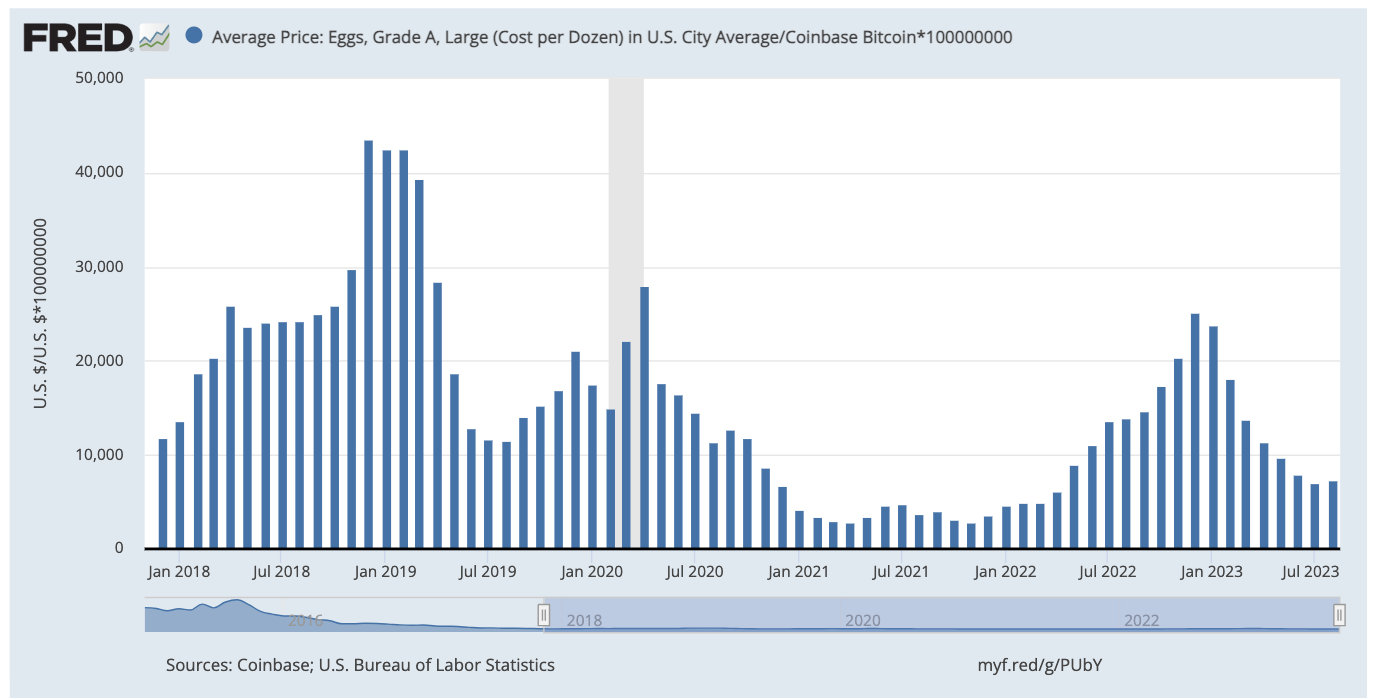

In the pursuit of elucidating this argument, an anonymous author meticulously analyzed the cost of a dozen eggs in both BTC and U.S. dollars from the onset of January 2021.

The post concludes that the price of eggs in BTC exhibits notable fluctuations, oscillating between 2829 and 6086 satoshis. This volatility surpasses the relatively stable trajectory observed in the U.S. dollar price.

Furthermore, the post accentuates the necessity to account for bitcoin transaction fees, typically hovering around $2, although sporadically surging to lofty heights of over $50. This adds an additional layer of intricacy when considering a purchase with bitcoin, suggesting a potential advantage in acquiring a larger quantity of eggs when utilizing bitcoin.

Interestingly, the accompanying charts illustrate a trend where, subsequent to reaching peaks in December 2022 in both currencies, the requisite number of satoshis to procure a dozen eggs has seen a more significant decline compared to the equivalent in U.S. dollars.

For the latest available data as of August 2023, BTC holders find themselves requiring 70% fewer satoshis for the purchase, in stark contrast to the 58% reduction in U.S. dollars required for the same purpose.

Average price of a dozen eggs in satoshis chart (screenshot). Source: St. Louis Fed

Average price of a dozen eggs in satoshis chart (screenshot). Source: St. Louis Fed

When examining the cost of eggs from the commencement of 2021, there's a notable uptick for both currencies—39% for U.S. dollars and an even more pronounced 73% increase for BTC, respectively. Nevertheless, this timeframe-specific comparison might lack substantial informative value.

During this time frame, BTC/USD traded at almost identical levels to the present, while the U.S. Consumer Price Index (CPI) year-on-year increase lingered below the Fed's targeted 2%. To fully comprehend Bitcoin's performance, a broader, long-term perspective is crucial.

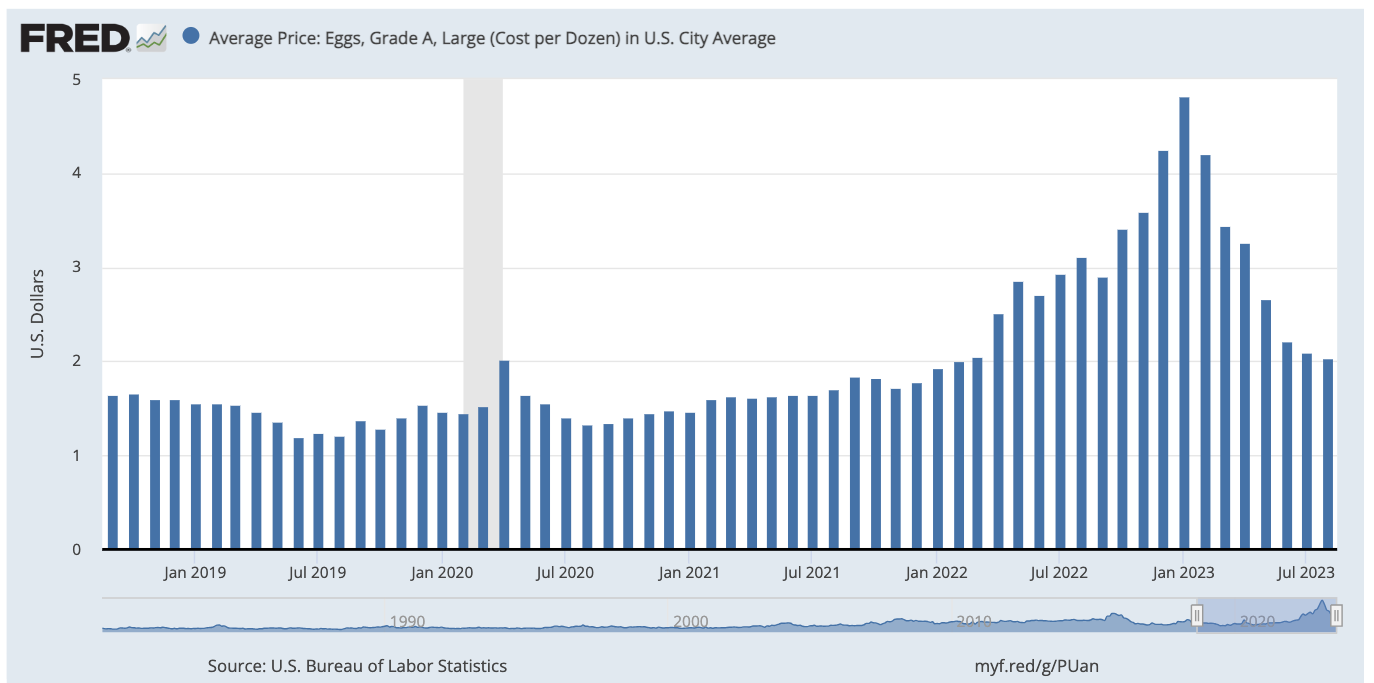

It's worth highlighting that the current price of eggs is significantly lower than what it was during Bitcoin's last pre-halving year in 2019. In this light, the "Eggflation" witnessed in 2023 appears as a minor blip on the economic landscape.

In terms of the U.S. dollar, there's been a conspicuous price surge, with the average price per dozen eggs barely exceeding $1.20 in mid-2019. This translates to a 40% increase from that period to the present.

Average price of a dozen eggs in U.S. dollars chart (screenshot). Source: St. Louis Fed

Average price of a dozen eggs in U.S. dollars chart (screenshot). Source: St. Louis Fed

A looming recession is evident

As we look ahead, attention gravitates towards the U.S. Dollar Index, which has surged to nearly one-year highs this month, signaling potential shifts in the economic landscape.

Analysts suggest that actions by foreign states may aim to redress the prevailing imbalance as their respective currencies grapple with challenges. Internally, the U.S. economy raises concern with various indicators pointing to an impending recession in 2024, a possibility underscored by the Fed's own data, placing the odds at nearly 60% in September. Concurrently, bond yields are on a rapid ascent, a phenomenon colloquially known as "bear steepening."

Read more: Kraken's European Expansion: Coin Meester Acquisition

Trending

Press Releases

Deep Dives