Deribit Reports Robust 17% Surge in Crypto Derivatives Trading Volume for August, Driven by Options

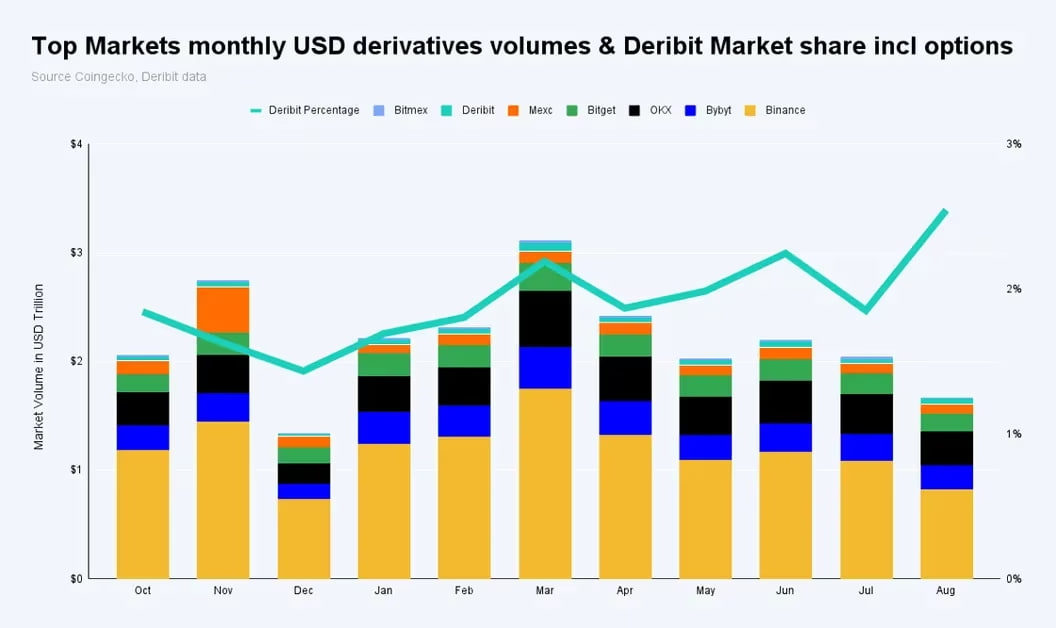

Despite a global decline of 12.1% in cryptocurrency derivatives trading activity, Deribit, a cryptocurrency exchange headquartered in Panama, witnessed a significant surge in its trading volume over the past month. Top crypto exchanges by volume trading

Top crypto exchanges by volume trading

During August, Deribit's trading volume for cryptocurrency derivatives experienced an impressive 17% increase, reaching a substantial $42 billion. This achievement is notable in the context of the prevailing global trend of decreasing derivatives trading, which contracted to around $1.6 trillion across various segments, including options, futures, and perpetual futures.

Deribit's remarkable resilience can be primarily attributed to the exceptional performance of its options trading segment. Notably, ETH options achieved their highest trading volumes since March of the same year. Additionally, Bitcoin continued to display strength, initially bolstered by its adoption as a hedge during the banking system's instability in March and further fueled by anticipation surrounding the impending ETF decision.

Options, representing derivative contracts offering the holder the right to buy or sell an underlying asset at a predetermined price on a future date, played a pivotal role in this success story. Call options provide the right to buy, while put options provide the right to sell. Deribit maintains a dominant position, commanding nearly 90% of the global crypto options market.

Bitcoin, the leading cryptocurrency by market capitalization, experienced significant price fluctuations, ranging from $25,000 to $30,000. These fluctuations triggered substantial liquidations in both futures and options on the Deribit platform, leading to an increased demand for call and put options as hedging instruments. Consequently, Deribit's Bitcoin implied volatility index (BTC DVOL) and a similar index focused on Ethereum (ETH) surged to 53% and 50%, respectively, rebounding from their historic lows. This resurgence indicates a renewed interest in options trading. The trading volume in Ethereum (ETH) reached its highest level since March. (Source: Deribit)

The trading volume in Ethereum (ETH) reached its highest level since March. (Source: Deribit)

During the previous month, over 5.6 million Ethereum (ETH) option contracts were traded, amounting to approximately $9 billion based on ETH's current market price of $1,624. This figure marks the highest monthly trading volume since March. Additionally, approximately 0.7 million Bitcoin (BTC) option contracts changed hands on Deribit. It's worth noting that on Deribit, each options contract corresponds to 1 ETH or 1 BTC.

Trending

Press Releases

Deep Dives