BTC September Snapshot

Bitcoin, often referred to by its ticker symbol BTC, finds itself at a crossroads as it embarks on the first full week of September with its price currently standing at $25,891. The question on everyone's mind is whether it can muster the strength to reach the coveted $26,000 mark once again.

Following a relatively tranquil weekend, the tumultuous waves of the previous week in the cryptocurrency markets seem to have subsided, allowing the space to return to a semblance of "business as usual."

Bitcoin, in its characteristic fashion, maintains its position within its usual price range, yet the conspicuous absence of a discernible trend has left traders and analysts in a state of indecision concerning the cryptocurrency's future trajectory.

One cannot ignore the plethora of pessimistic forecasts surrounding Bitcoin's price, with targets such as $25,000, $24,750, and even $23,000 gaining considerable traction in recent weeks.

Conversely, the bullish contingent faces a formidable challenge in their pursuit to regain control of the market's momentum.

In light of network fundamentals poised to consolidate their recent gains and macroeconomic markets preserving their tranquility, speculations abound regarding whether September 2023 will unfold as a month marked by single-digit losses for the BTC/USD pair.

Over the weekend, Bitcoin's price fluctuations unsettled short positions in BTC

Bitcoin didn't provide many unexpected twists during weekend trading outside of regular hours, and this trend might persist as the United States stock markets are set to reopen on September 5th.

1-hour chart of BTC/USD, sourced from TradingView.

1-hour chart of BTC/USD, sourced from TradingView.

Over the weekend, Bitcoin's price movements offered few surprises, as it navigated within a narrow $200 trading corridor, as indicated by data from TradingView. However, the occasional, albeit modest, upward and downward price spikes hinted at the participation of speculative traders.

These price fluctuations were noted by prominent trader Skew, who shared order book data suggesting that the brief surges in Bitcoin's price beyond $26,000 were attributed to the failure of short positions. In a related commentary on X (formerly Twitter), it was suggested that these fluctuations were orchestrated by strategically identifying stop-loss levels, executing market buys, and subsequently executing rapid sell-offs to liquidate short positions.

$BTC

— Skew Δ (@52kskew) September 3, 2023

Positions are still getting blown out in $200 price moves on a sunday lol

this small pop was shorts getting blown out or closing at market pic.twitter.com/7ih2KpjEEq

Further analysis of the BTC spot market raised questions about whether the weekly closing price, settling around $25,970, might serve as a tactic to lull bullish traders into a deceptive sense of security.

$BTC

— Skew Δ (@52kskew) September 3, 2023

Operation save the 1W or is it operation trap the bulls into tuesday? pic.twitter.com/pP4JbeHzXC

Meanwhile, another trader and analyst, Rekt Capital, expressed apprehension, emphasizing that any price level below $26,000 could signal the formation of a potentially bearish double top pattern for 2023, potentially capping Bitcoin's price around $31,000 and opening the door to a prolonged bearish phase.

Annotated chart of BTC/USD, sourced from Rekt Capital/X

Annotated chart of BTC/USD, sourced from Rekt Capital/X

Federal Reserve speakers take center stage in the upcoming macroeconomic week

As the new macroeconomic week dawns, it offers a potential respite for risk asset traders. The upcoming U.S. schedule appears to be relatively light on significant economic data, with the focal point squarely on various senior Federal Reserve officials who are set to provide insights into the state of the economy in the lead-up to the pivotal interest rate decision scheduled for September 19. Notable figures in this regard include Atlanta Fed President Raphael Bostic and New York Fed President John Williams. The financial commentary resource, The Kobeissi Letter, underscored that the central focus remains on Fed policy, which remains shrouded in uncertainty in the run-up to the impending rates decision.

Curiously, Bitcoin has demonstrated a reduced sensitivity to Federal Reserve comments throughout the summer, with even remarks from Fed Chair Jerome Powell failing to exert significant influence on Bitcoin's price dynamics. Nonetheless, the statements made by these officials continue to have the potential to sway market expectations regarding the Federal Reserve's ongoing battle against inflation.

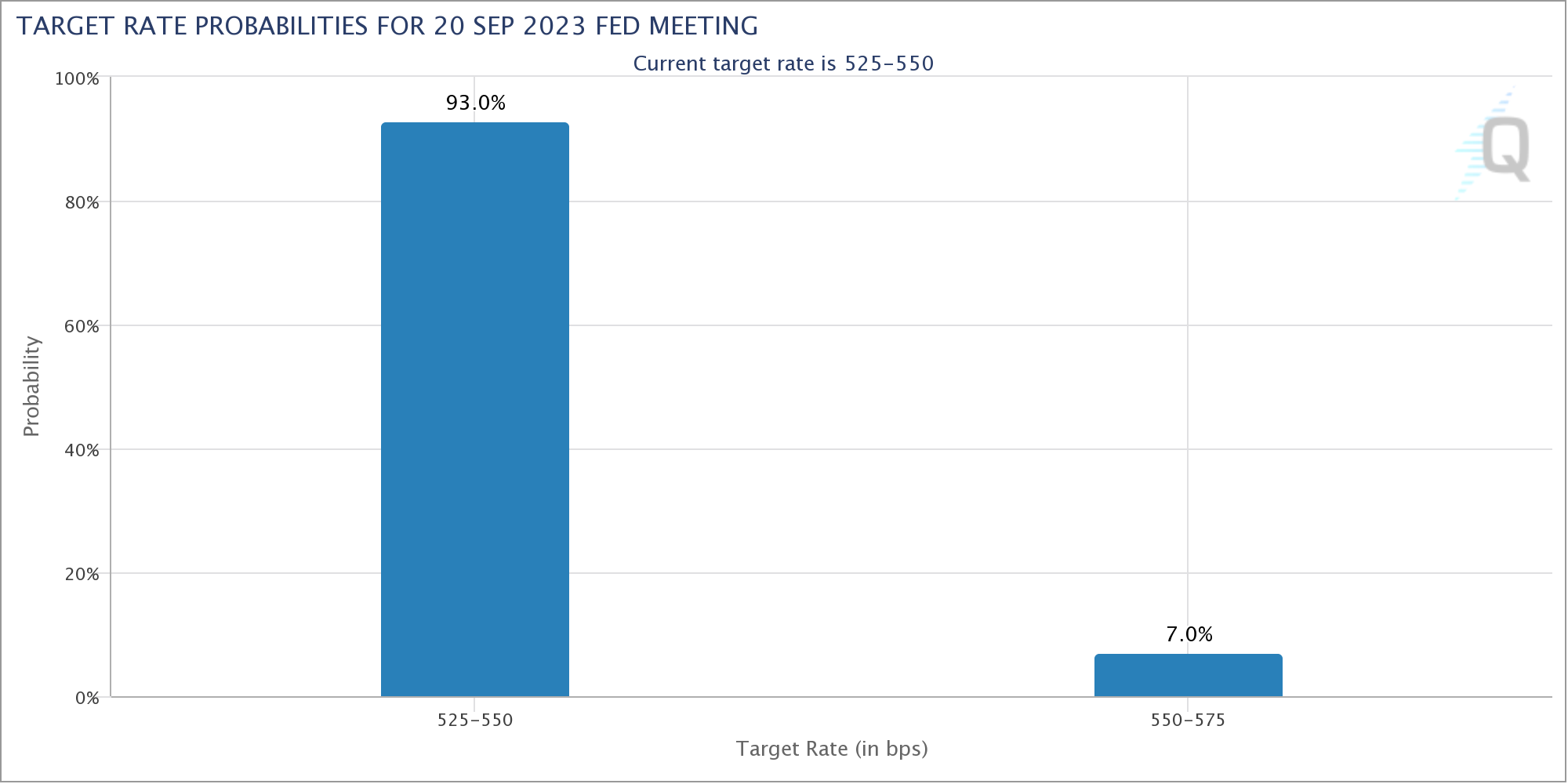

As of the time of writing, market data from CME Group's FedWatch Tool indicates a strong 93% consensus among market participants that interest rates will remain unchanged in September.

Chart depicting the probability of the Federal Reserve's target rate movements, sourced from CME Group

Chart depicting the probability of the Federal Reserve's target rate movements, sourced from CME Group

A decline in difficulty following its peak levels

After a recent surge to new all-time highs, Bitcoin's mining difficulty is now poised to undergo a modest reduction of approximately 2.4% during its upcoming automated readjustment scheduled for September 5. Such adjustments are not uncommon within the historical context, even when Bitcoin's price has exhibited opposing movements.

Overview of Bitcoin network fundamentals (screenshot), obtained from BTC.com

Overview of Bitcoin network fundamentals (screenshot), obtained from BTC.com

Analysts attribute this decline in mining difficulty to a concurrent decrease in the holdings of Bitcoin miners, particularly at F2Pool, which has witnessed a significant depletion of its Bitcoin balance. Should Bitcoin's price experience further declines, this could heighten the pressure on miners, potentially triggering additional instances of miner capitulation.

Analysts have also identified a correlation between minor price dips in Bitcoin and the movement of miners sending Bitcoin to exchanges, resulting in an increase in selling pressure.

Records being established in the accumulation of dormant BTC supply

Behind the scenes, Bitcoin's supply is gradually shifting into the hands of long-term investors. The latest data from on-chain analytics firm Glassnode reveals several new records pertaining to the percentage of the currently mined Bitcoin supply that has remained dormant for three years or more (40.538%) and for at least five years (29.637%).

Chart depicting the supply of BTC that has remained inactive for five years or more, sourced from Glassnode/X

Chart depicting the supply of BTC that has remained inactive for five years or more, sourced from Glassnode/X

This constriction of supply is viewed favorably by Bitcoin bulls, as it suggests that future demand for Bitcoin will involve heightened competition for a reduced supply.

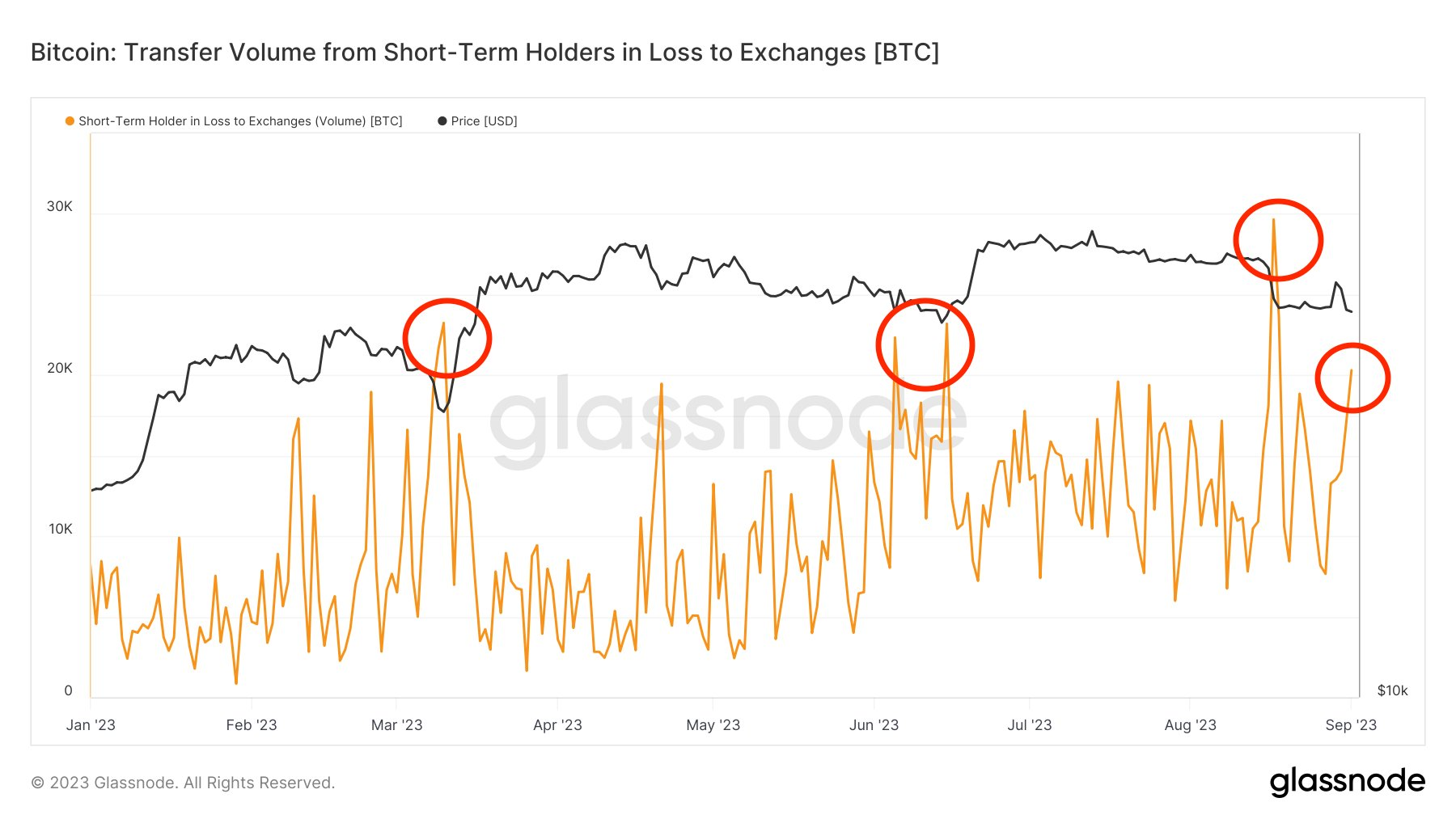

Additionally, short-term Bitcoin holders have been observed distributing their holdings into the market, further accentuating the growing disparity between the supply held by long-term and short-term holders.

Annotated chart displaying the volume of Bitcoin transfers from short-term holders incurring losses, sourced from James Straten/X

Annotated chart displaying the volume of Bitcoin transfers from short-term holders incurring losses, sourced from James Straten/X

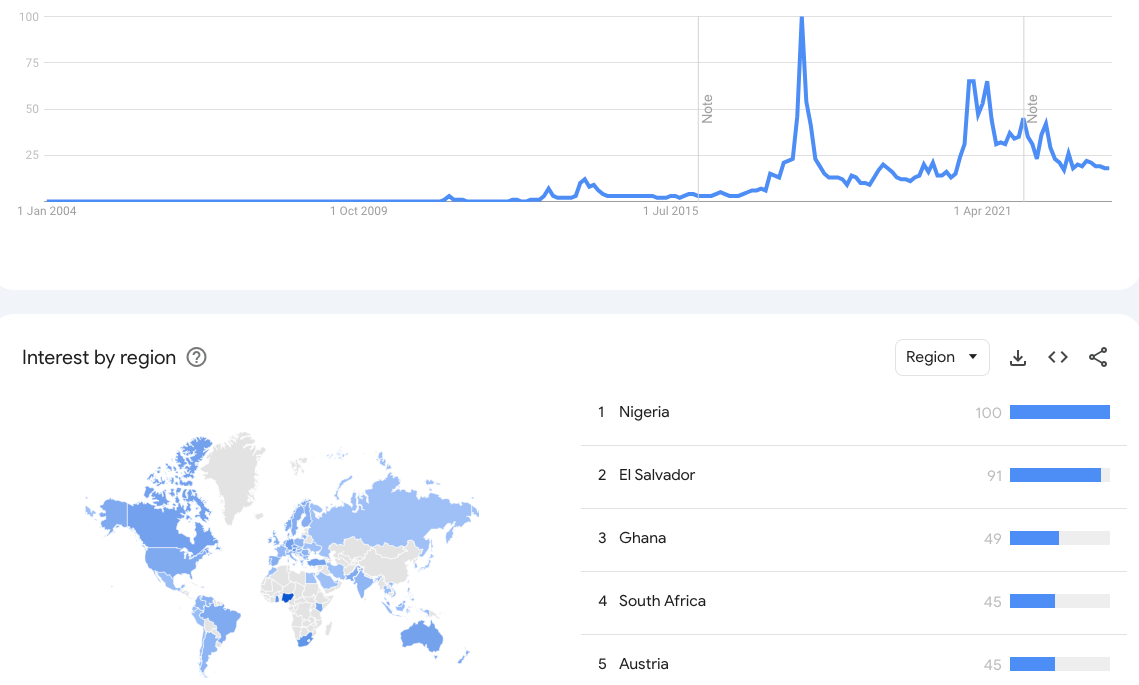

Interest regresses to the levels of 2020

Finally, Google Trends data illustrates that Bitcoin has receded from the mainstream conversations of the average non-crypto consumer in 2023. Search interest in Bitcoin has regressed to levels last observed before BTC/USD breached its previous all-time high of $20,000 in late 2020.

Screenshot depicting Google search data for "Bitcoin," sourced from Google Trends

Screenshot depicting Google search data for "Bitcoin," sourced from Google Trends

This decline in mainstream attention can likely be attributed to the absence of significant positive developments in the cryptocurrency market during the second quarter of the year. Within the crypto community, sentiment remains characterized by "fear," as indicated by the Crypto Fear & Greed Index, which has lingered around the 40/100 mark since mid-August, coinciding with a 10% decline in Bitcoin's price.

Trending

Press Releases

Deep Dives

Русский

Русский