Cryptocurrency Chronicles: Navigating the Tempestuous Waters of Bitcoin's Price Odyssey

In the midst of the unforeseen U.S. inflation figures, revealing a 3.2% annual uptick, the bullish surge that propelled Bitcoin (BTC) prices from $35,927 to a 31.8% 30-day gain appeared to be losing steam by November 14. The Bitcoin market, akin to a capricious tempest, seemed to be cooling off, witnessing an almost surreal $100 million in liquidations within an hour, despite the conventional markets responding with a nonchalant nod to stable month-over-month inflation.

Yet, amidst this financial theatre, not all analysts found themselves donning the cloak of concern for the contraction in Bitcoin prices. Some, akin to financial soothsayers, envisioned a trajectory toward a lofty $48,000, perhaps seeking solace in the entrails of market data.

Bitcoin price. Source: TradingView

Bitcoin price. Source: TradingView

Now, let's embark on a nautical journey into the deep, tumultuous waters of the factors influencing Bitcoin prices today.

Bitcoin long positions totaling $126 million faced liquidation

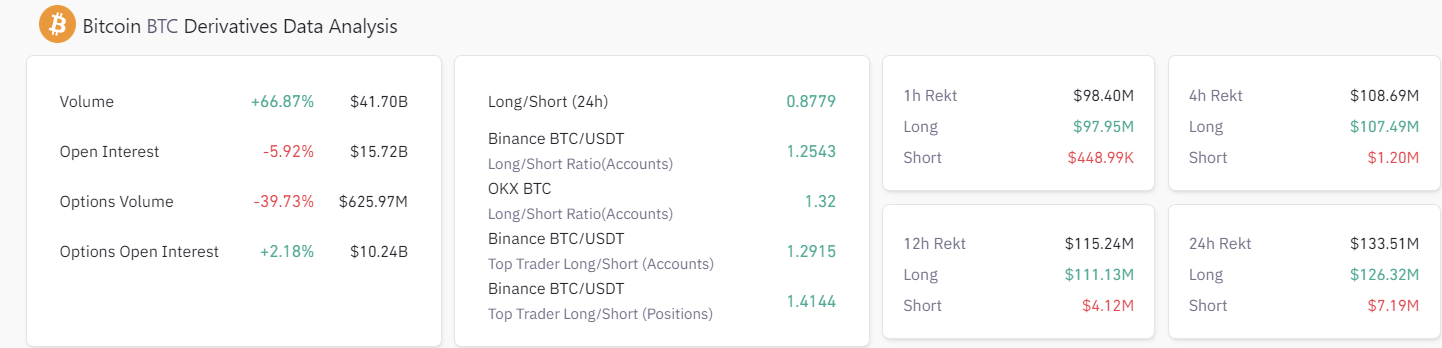

Approximately $126 million in Bitcoin long positions faced the guillotine of liquidation, an event catalyzed by a sharp and enigmatic move in the Bitcoin futures market. Within a mere hour on November 14, the seas of Bitcoin long liquidations swelled to over $97.9 million, with a grand total of $126.3 million succumbing to the liquidation whirlpool in the preceding 24 hours.

Bitcoin derivatives overview. Source: Coinglass

Bitcoin derivatives overview. Source: Coinglass

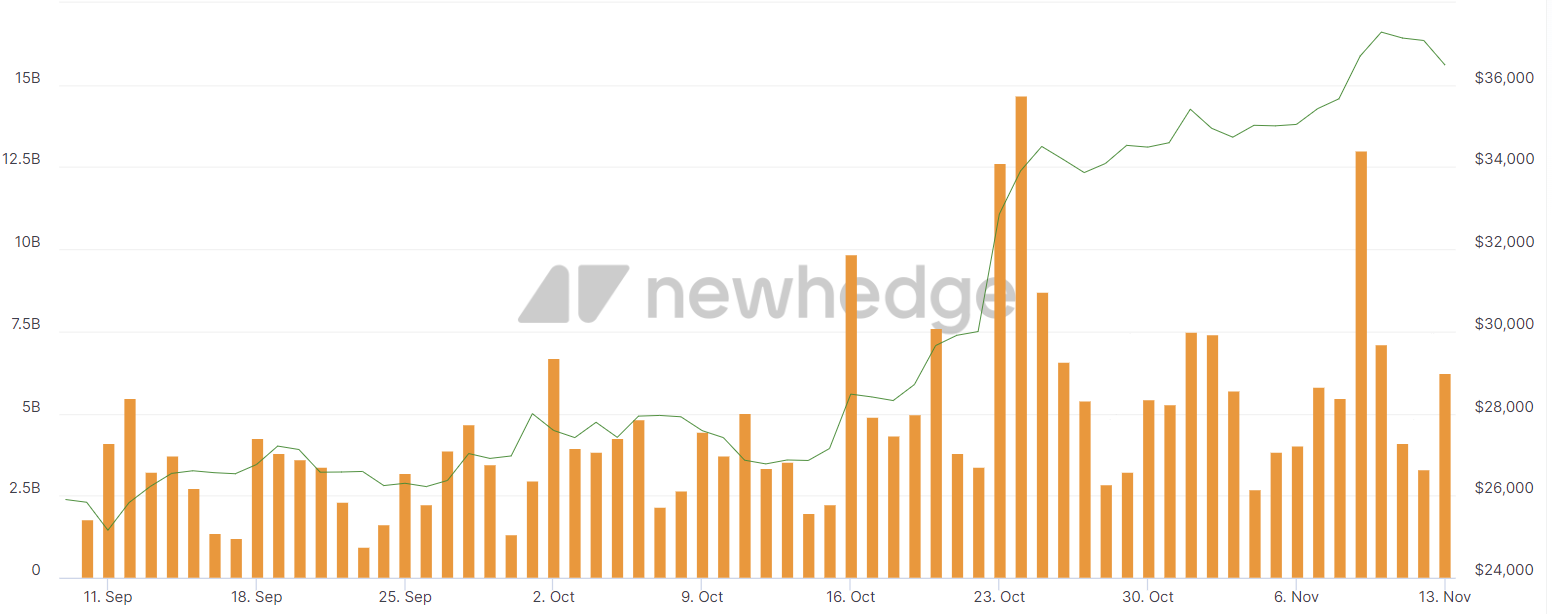

As the tides of BTC longs were mercilessly swept away, without the accompanying buoyancy of buying pressure, Bitcoin prices found themselves ensnared in a negative undertow. The once-vibrant Bitcoin trading volumes, akin to lively marine creatures, have now submerged by over $7 billion from the November peak, a peak that was ceremoniously reached on November 9, as if the Bitcoin market was paying homage to some cryptic aquatic deity with a penchant for numbers.

Bitcoin trading volume. Source: Newhedge

Bitcoin trading volume. Source: Newhedge

Yet, the tempestuous absence of consistent liquidity and trading volume has cast shadows of doubt among the discerning observers of this financial seascape. They, perched on the cliffs of analysis, question the durability of the current Bitcoin price rally, wondering if this is merely a passing squall or the herald of a more enduring storm.

$BTC 1H

— Skew Δ (@52kskew) November 14, 2023

Pretty straight forward from here I think

acceptance below $34.7K ~ seek liquidity lower

acceptance above $36.3K ~ seek liquidity higher

Orderbook levels

$34K ~ bid depth thickens

$38K ~ ask depth thickens

HTF levels

$38K

$32K pic.twitter.com/9zN2bJV8gg

A storm where, if there is an auspicious break in the clouds, Bitcoin may, like a resolute mariner, navigate its course toward a sunnier valuation.

Bitcoin long versus short ratio. Source: Coinglass

Bitcoin long versus short ratio. Source: Coinglass

An unprecedented number of Bitcoin wallets are currently experiencing profitability

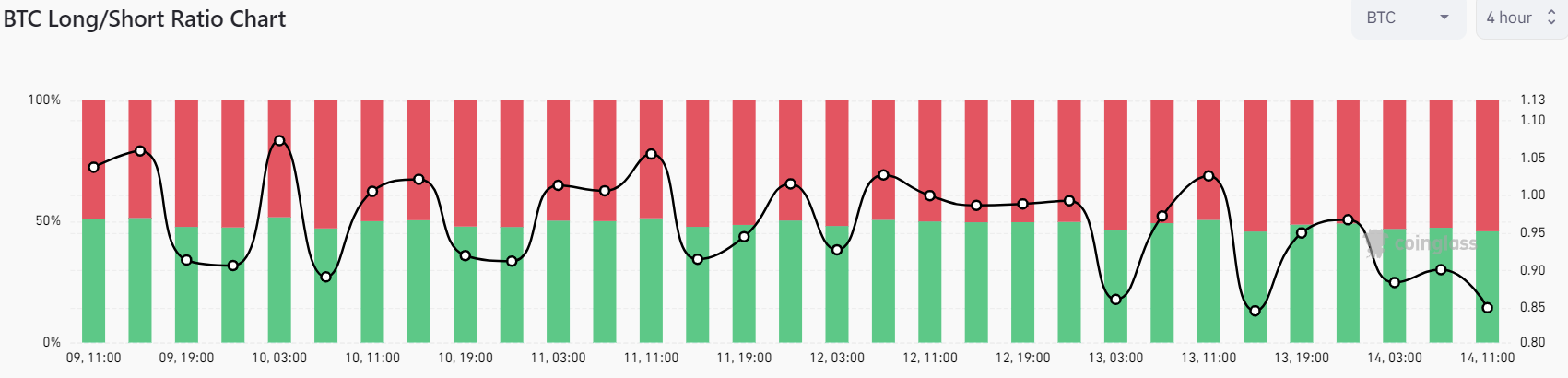

The compass of market indicators from the futures market, akin to celestial navigation, suggests that traders, akin to sailors of old, are battening down the hatches in anticipation of a pullback. Over 54% are holding fast to their short positions on Bitcoin, perhaps wary of the choppy waters ahead.

Bitcoin addresses in profit. Source: Glassnode

Bitcoin addresses in profit. Source: Glassnode

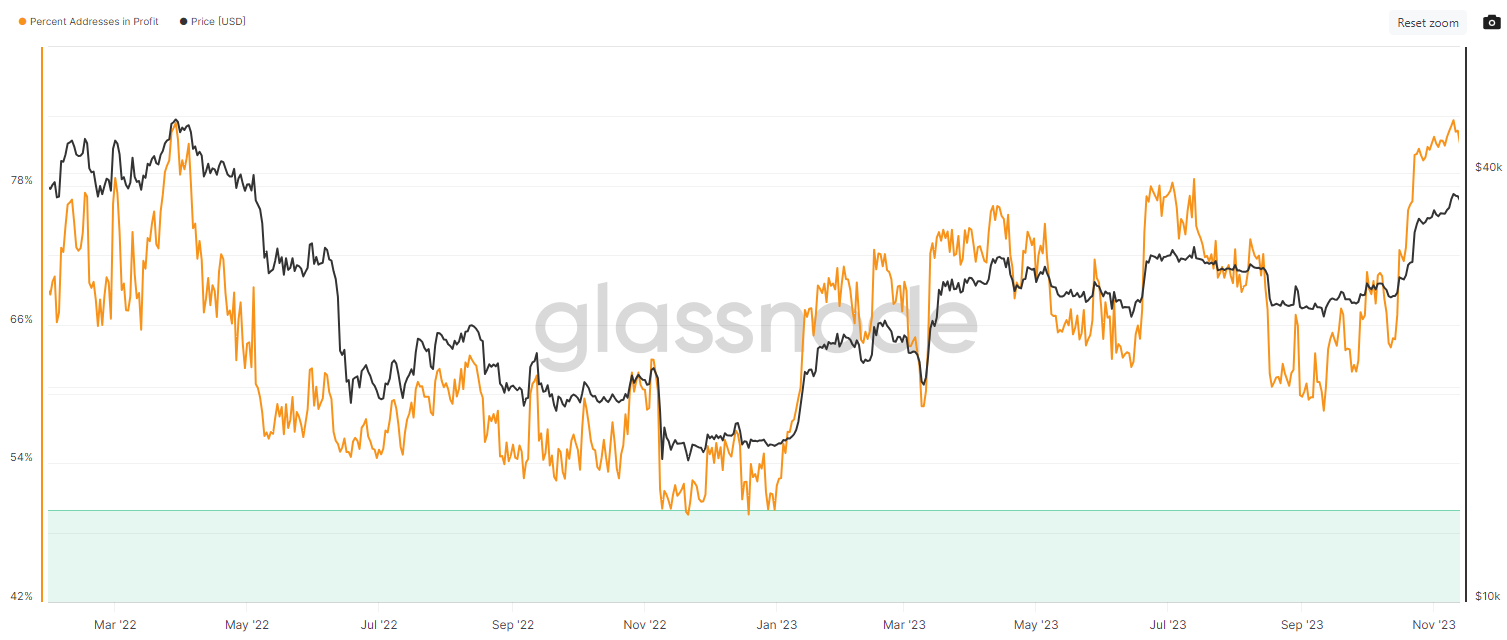

Although the Bitcoin ship faced setbacks on November 14, a record percentage of wallets, reminiscent of treasures hoarded in a mythical chest, found themselves in profit as of November 11. A striking 83% of both short-term and long-term holders reveled in the glow of profit, perhaps akin to the jubilation of sailors who have discovered an uncharted island filled with untold riches.

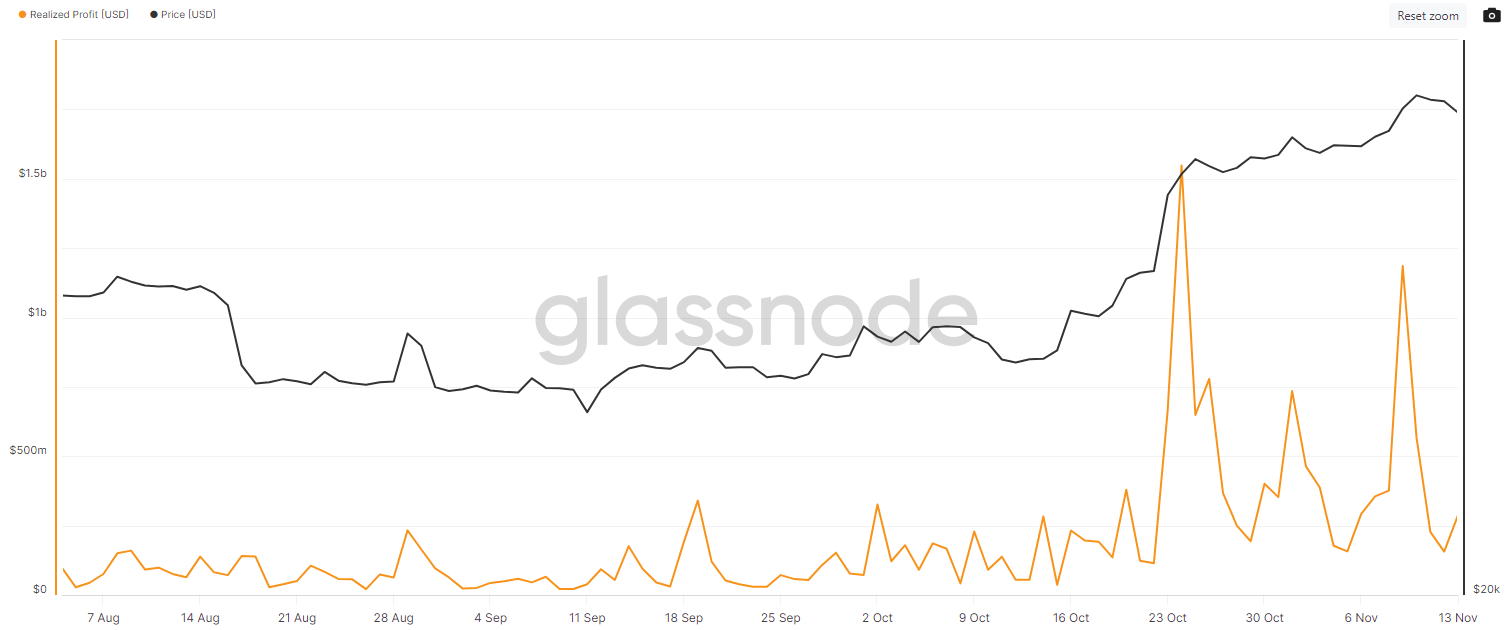

Bitcoin realized profit. Source: Glassnode

Bitcoin realized profit. Source: Glassnode

Attention is focused on the applications for spot Bitcoin ETFs

Yet, amidst this sea of profits, traders still found themselves in the shallows compared to the realized profit level observed on October 24. The shores of October witnessed a surge in profit-taking, buoyed by heightened trading volume, as if the market was a bustling port town celebrating a harvest festival. Alas, the tide has since receded, and with it, the echoes of jubilation have faded. The decline in trading volume, akin to a retreating tide, combined with the lingering scent of profits in the salty air, raises the specter of further descent if more traders decide to embark on a journey to claim their spoils.

The spotlight, akin to a lighthouse beacon, now pivots toward the applications for spot Bitcoin ETFs. The short-term uncertainties in the crypto market, reminiscent of fickle weather patterns, do not seem to have altered the long-term outlook of institutional investors. Like steadfast mariners navigating through regulatory reefs, two major institutions, BlackRock and Invesco Galaxy, have dared to set sail with ETF tickers listed on the Depository Trust and Clearing Corporation’s website.

Despite the urgency expressed by major financial firms, the Securities and Exchange Commission, a regulatory Leviathan, seems poised to persist in delaying decisions on approving Bitcoin ETFs until 2024. BlackRock, akin to a seasoned captain, recently cited USD Coin (USDC) and Tether (USDT) to the SEC, painting them as potential Krakens lurking beneath the surface, ready to stir up waves and potentially capsize the ship of Bitcoin's price.

The saga of Bitcoin prices, a tale interwoven with the currents of macroeconomic events, unfolds like an ancient maritime chart. Yet, it's also likely that the unfolding chapters will bear the imprints of further regulatory actions, ETF updates, and interest rate hikes, like annotations made by an unseen hand in the margins of this financial odyssey.

Even with Federal Reserve Chair Jerome Powell, a modern-day Neptune, pausing interest rate increases, the response of Bitcoin prices was not akin to a jubilant sea shanty. The pause in interest rates and funding ratios has led some analysts to gaze into their crystal balls, prophesying that Bitcoin prices may ascend to the lofty peak of $69,000 with the speed of a tempest-tossed ship finding safe harbor.

In the vast expanse of the long term, where the horizon meets the sea, market participants, akin to maritime visionaries, still harbor expectations of the reemergence of Bitcoin prices. This optimism is nurtured by the whispering winds of change, especially as more financial institutions, akin to seafaring vessels joining a flotilla, seem to be embracing the enigmatic allure of BTC.

Read more about: CryptoGuard Unveils Randstorm: Navigating the Turbulent Waters of a Billion-Dollar Threat in the Cryptoverse

Trending

Press Releases

Deep Dives