Crypto Valuation Insights

Bitcoin (BTC), the ever-fluctuating digital darling of the cryptocurrency world, has recently experienced a notable dip in its price, plummeting to a seemingly paltry $35,367. Within this intriguing crypto landscape, we find ourselves amid a discussion where mining industry heavyweights, namely Marathon Digital and Riot Platforms, have found their valuation metrics under scrutiny. This analysis comes courtesy of MinerMetrics' founder and seasoned analyst, Jaran Mellerud.

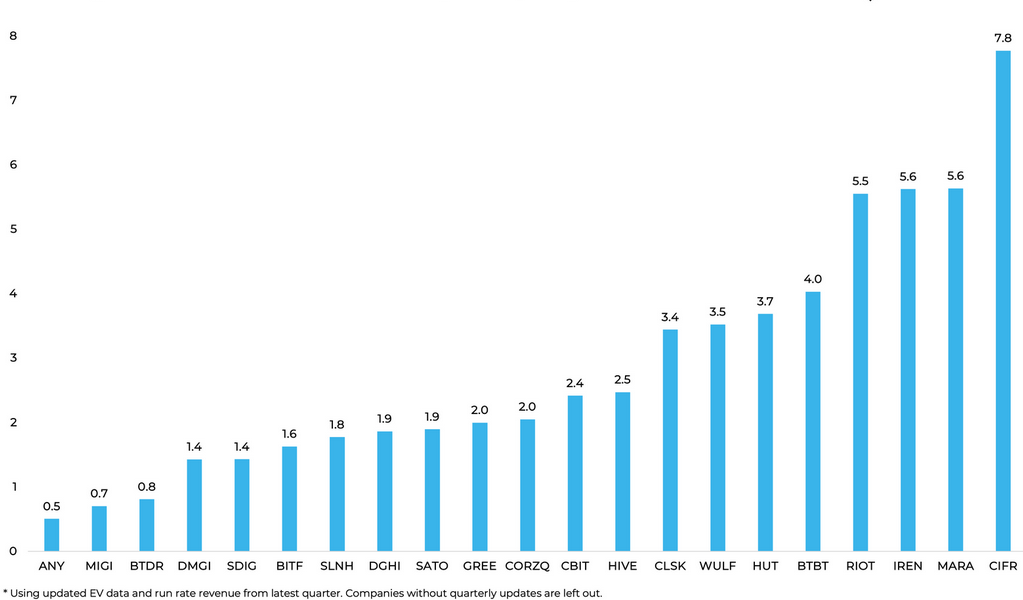

Mellerud's astute observation hinges upon a rather fascinating metric known as the enterprise value-to-sales (EV/S) ratio. This ratio provides insights into a company's worth concerning its sales revenue, with the numerical value taking center stage. The larger this figure, the more pronounced the perception of overvaluation becomes.

Delving into the specifics, we discover that companies in the crypto mining domain with the most inflated EV/S ratios include Cipher, boasting an impressive 7.8, closely followed by Marathon and Iris Energy, each commanding a respectable 5.6. Riot is not far behind, with its own EV/S ratio standing at 5.5, as divulged in a detailed report by Mellerud dated November 3.

Mining stock valuations in terms of EV-to-sales ratio. Source: MinerMetrics

Mining stock valuations in terms of EV-to-sales ratio. Source: MinerMetrics

As for the reasons behind these inflated ratios, Mellerud sheds light on the growing interest and support these mining heavyweights have garnered from institutional giants like BlackRock. This institutional favoritism has historically bestowed upon them a distinct advantage, granting them access to ample capital resources and loftier valuations, setting them apart from their industry peers.

However, Mellerud anticipates a subtle shift in investor sentiment in the months to come. This shift could potentially help rectify the existing disparities in valuation among these stocks. In light of this evolving landscape, he posits that more reasonably priced investment opportunities with lower EV/S ratios are ripe for exploration and capitalization, providing a window of opportunity for astute value investors.

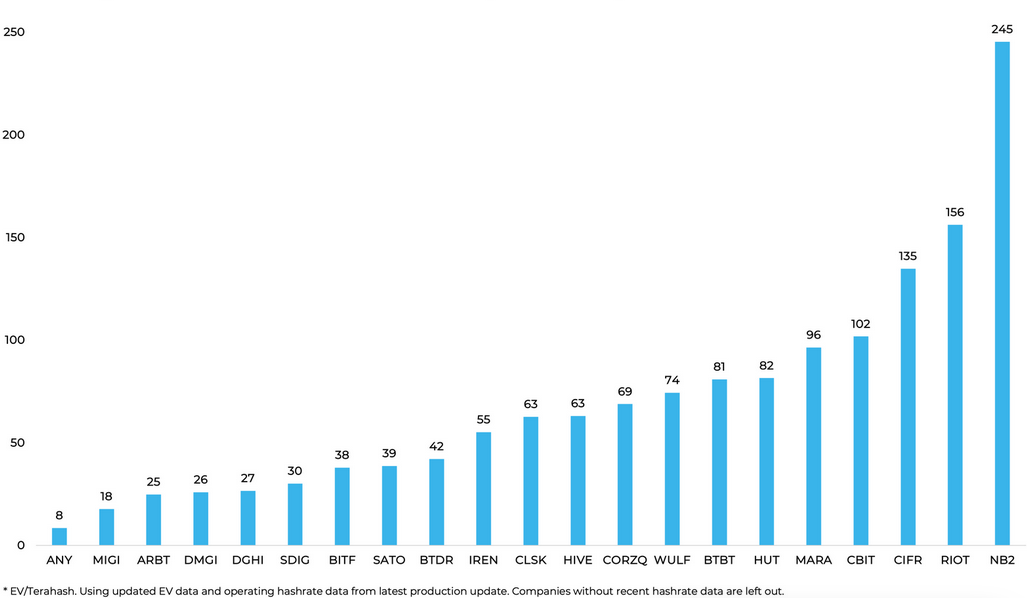

In a compelling twist, Riot's valuation is further scrutinized through the lens of its EV-to-hash rate ratio, a figure that soars to an impressive 156, according to Mellerud.

Mining stock valuations in terms of EV-to-hash rate ratio. Source: MinerMetrics

Mining stock valuations in terms of EV-to-hash rate ratio. Source: MinerMetrics

Moreover, Mellerud, drawing from his background as an analyst at Bitcoin miner Luxor Technology, underscores Riot's anticipation of significant growth. This optimism stems from the construction of its gigawatt facility and the upcoming delivery of 33,000 MicroBT machines in early 2024. Notably, Riot's multifaceted business ventures, not fully accounted for in its self-mining hash rate, underscore the importance of exercising caution when drawing valuation conclusions based on its elevated EV-to-hash rate ratio.

In the larger context of the cryptocurrency mining domain, 2023 has witnessed a robust resurgence. Leading the charge are Marathon (MARA) and Riot (RIOT), with their stock prices skyrocketing by a substantial 170% and 228%, respectively, as per data sourced from Google Finance. This remarkable performance surpasses Bitcoin's year-to-date gain of 113%.

Nevertheless, it's imperative to note that not every mining analyst shares an unwavering faith in the continued ascent of Bitcoin mining stocks. Caleb Franzen, the visionary founder of Cubic Analytics, ventures to suggest that Bitcoin may have already reached its pinnacle for the year. In stark contrast, the leading mining stocks are still clawing their way back, with prices lingering over 75% below their year-to-date peaks. Franzen provocatively questions whether Bitcoin mining companies may be compelled to double their productivity in the wake of the impending Bitcoin halving event.

"If the block rewards undergo a halving, the post-halving price of BTC would need to double for these businesses to maintain their sustainability, much as they did in the pre-halving era."

Marathon emerges as a standout player in the Bitcoin mining landscape, holding the most substantial Bitcoin reserves among mining companies. Their vault is laden with 13,726 BTC, a treasure trove valued at a staggering $486.1 million. Following in their footsteps are Hut 8, Riot, and CleanSpark, with their holdings comprising 9,366 BTC, 7,309 BTC, and 2,240 BTC, respectively, as they navigate the dynamic waters of the cryptocurrency realm.

Read more about: Resurgence Revolution: Bitwala's Reawakening and Crypto Renaissance

Trending

Press Releases

Deep Dives